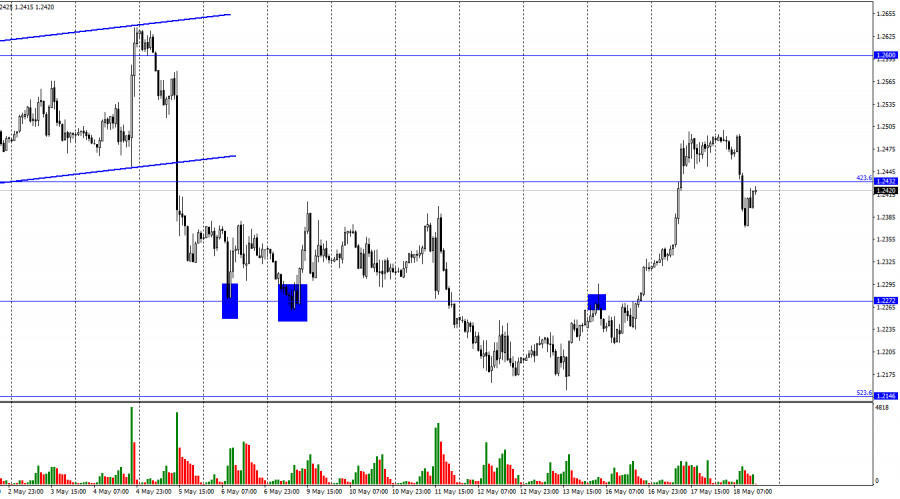

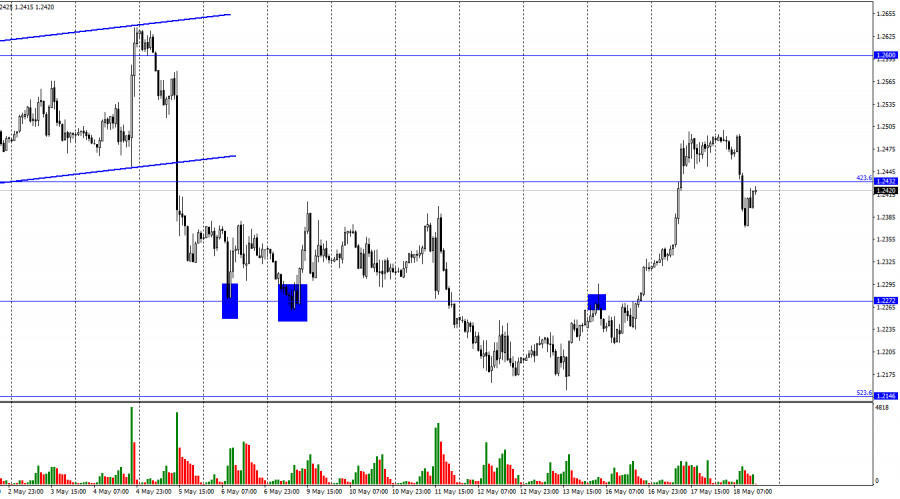

According to the hourly chart, the GBP/USD pair performed a reversal in favor of the US currency on Tuesday and has already begun the process of falling with consolidation under the Fibo level of 423.6% (1.2432). Thus, the fall of the British dollar's quotes can be continued in the direction of the next level of 1.2272. The pound quickly soared up, but now it can also land quickly. Today, the pair can only blame the UK inflation report for the 120-point drop. In April, inflation was 9.0% y/y, which is slightly lower than traders' expectations. However, a month earlier, the indicator was 7.0% y/y. In just one month, price growth accelerated by 2%, and now inflation in Britain is even higher than in the US or the EU. Let me remind you that the Bank of England has raised its rate to 1%, as well as the American central bank. However, the British pound failed to take advantage of this, and now, as we can see, it has not had any positive impact on price growth. Based on this, I would assume that the Bank of England will continue to raise the interest rate, but in the last few weeks rumors have been actively circulating that the British regulator is just planning to take a break for several months and not rush to tighten monetary policy.

Thus, there may be an interesting situation in the UK in which the central bank raised the rate four times, which did not affect inflation, but may have an impact on the growth rate of the economy. If GDP continues to slow down first in the first quarter and then in the second, we can say that the decision to raise the rate only allowed us to avoid even higher levels of inflation. All this can hardly help the British gain confidence and continue yesterday's growth. Economic statistics now promise to deteriorate greatly. And in America yesterday, Jerome Powell confirmed that the Fed will follow the planned path of tightening monetary policy. That is, in June and July, the interest rate may rise to 2%. And the dollar may resume its growth after that.

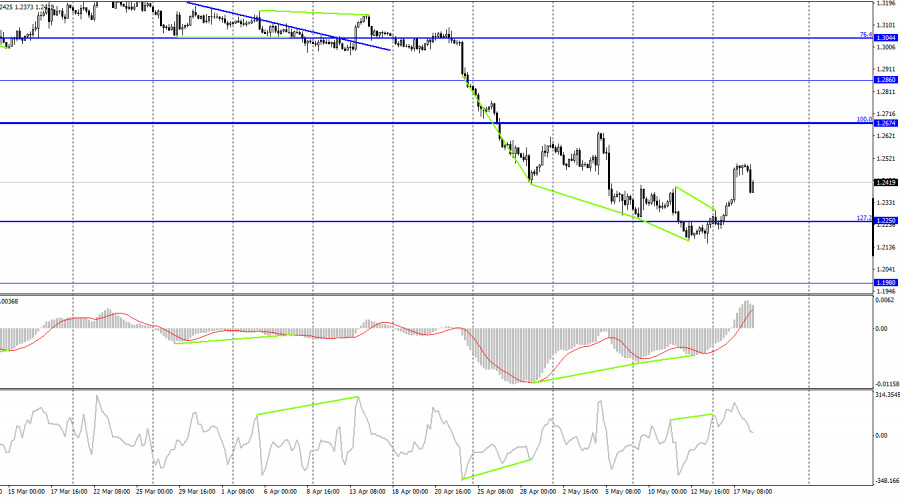

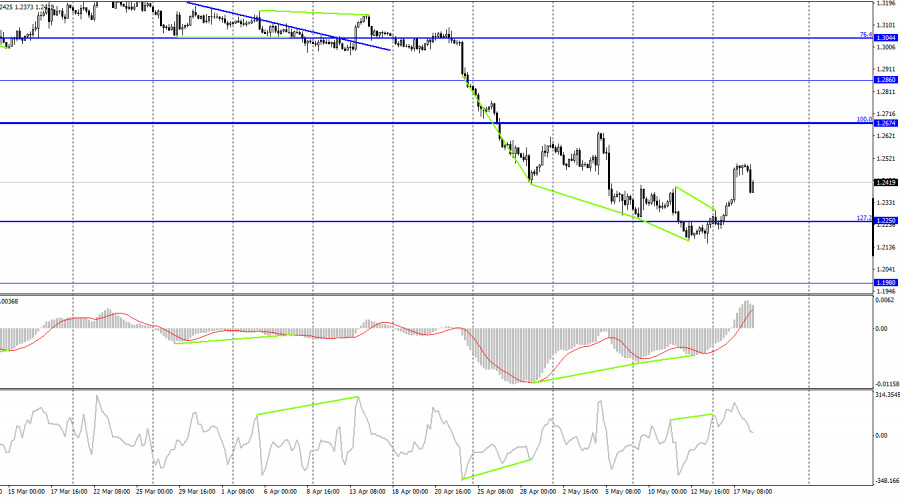

On the 4-hour chart, the pair secured above the corrective level of 127.2% (1.2250), which allows it to continue the growth process towards the next Fibo level of 100.0% (1.2674). At the moment, a "bearish" divergence is brewing in the MACD indicator, and the information background casts great doubt on the ability of the British to continue growing. I wouldn't be surprised if the pair's price drop resumes in the coming days.

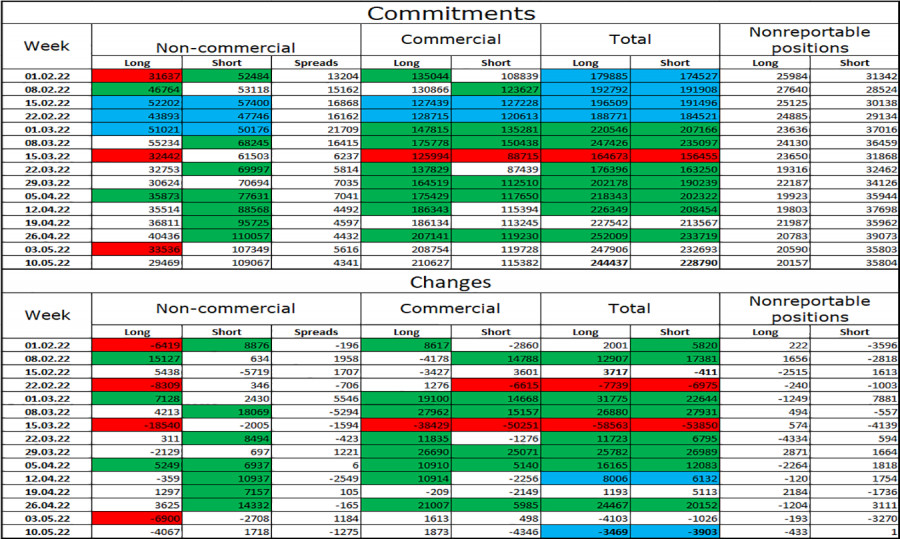

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has not changed too much over the past week. The number of long contracts in the hands of speculators decreased by 4,067 units, and the number of short contracts increased by 1,718. Thus, the general mood of the major players has become even more "bearish". The ratio between the number of long and short contracts for speculators still corresponds to the real picture on the market - longs are 4 times more than shorts (109,067-29,469). The big players continue to get rid of the pound. Thus, I expect that the pound may continue its decline over the coming weeks. But also such a strong gap between the number of longs and shorts may indicate an imminent change of trend in the market. I do not rule out that the British will end its long fall in the near future.

News calendar for the USA and the UK:

UK - consumer price index (06:00 UTC).

On Wednesday, an inflation report was already released in the UK, which collapsed the pound, and in the US, the calendar of economic events is empty today. For the rest of the day, there will be no influence of the information background on the mood of traders.

GBP/USD forecast and recommendations to traders:

I don't recommend selling the pound right now - the pair's growth is too strong. I recommended that the purchases of the British either be closed or held with a target of 1.2600 and a Stop Loss level below 1.2432. Today, this deal should have been withdrawn because of an important report on British inflation.