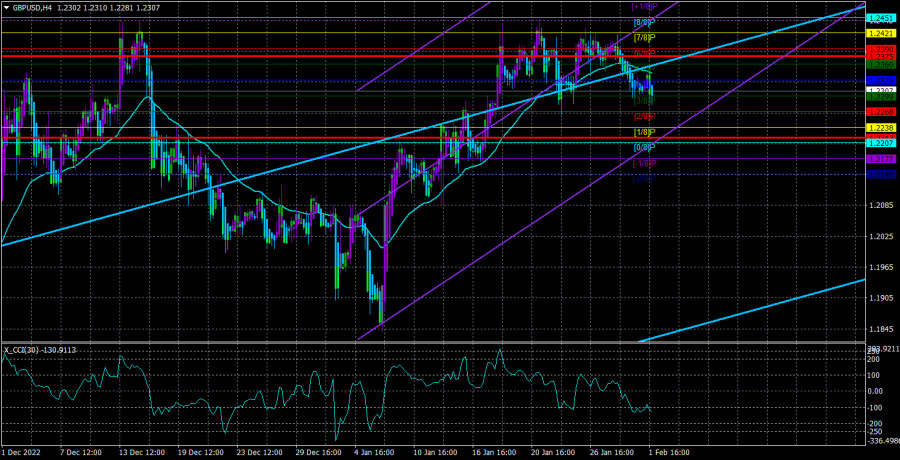

Yesterday, the GBP/USD currency pair continued to trade below the moving average line. As a result, the "feat of the euro" was not repeated, but the British pound was also not supported by an inflation report. It stands to reason that the pair is moving more slowly. We don't take into account evening and nighttime moves since we need to wait for the market as a whole to completely digest the Fed meeting's outcomes. The British pound generally stays inside the side channel. The meaning is the same, if perhaps not quite as clear-cut as with the euro. Also keep in mind that the formation of the "double top" pattern, which is clearly shown in the above illustration, is now very likely. We have serious doubts about such formations since they can only be understood to exist when the pair moves sufficiently far away from the second maximum. Despite this, the pattern is solid, and the pound is demanding to fall because it has been overbought for a while.

The Bank of England meeting outcomes will also be summarized today in the UK; therefore, the market's response to those results will overlap with that of the Fed meeting results rather than the BA meeting results. The ECB will also announce its conclusions at that time, and occasionally the euro tends to drag the pound along with it. In general, it will be quite challenging to comprehend precisely what the market is reacting to and how it interprets specific developments, even if today is not a day of extreme volatility. We think it is preferable to wait until all three sessions are finished, then wait 12 to 24 hours before making any decisions or formulating a plan. We still think that all three central banks' outcomes have already been figured out, but the Bank of England might throw us a surprise. And the rhetoric used by the heads of central banks is no longer immediately apparent.

The Fed's decision to stop raising the rate is absurd.

Recently, discussions have focused on increasing the rate in March rather than during the February meeting. According to some experts, the Fed may decide against tightening monetary policy in March while simultaneously announcing a decrease in the target rate. We think that such a move is absurd because inflation is still steadily falling, and no one can predict when it will stop falling altogether. Monthly inflation figures are published, and the Fed meets once every month and a half. The Fed only needs to review each inflation report and take appropriate action. We think that when inflation falls to 4-5%, tightening should be stopped. In the best-case scenario, it may take many months to achieve this amount, which is still far away. As a result, we think the Fed will opt to implement another two or three increases of 0.25%.

Additionally, the Bank of England has been discussed frequently. Even the amount by which the rate will increase today is unknown. It can expand by 0.25% even though it should logically increase by 0.5%. The market may have already chosen one of these possibilities, but this is unknown. It is unclear how BA will increase the rate in the future. We seriously doubt that this alternative is relevant given the highest level of inflation in the UK, which is in no rush to drop. The British regulator needs to increase the rate by 0.5% three to four more times. The British economy will undoubtedly experience a recession, and the higher the rate, the more severe the decline. Thus, in any event, we are beginning with the possibility of a decline in the pound, but the Bank of England and Andrew Bailey's rhetoric can today make their adjustments. But even with this possibility, we think the pair should move down at least 500–600 points. Then it will be seen. The British pound has no significant growth prospects as of now for 2023.

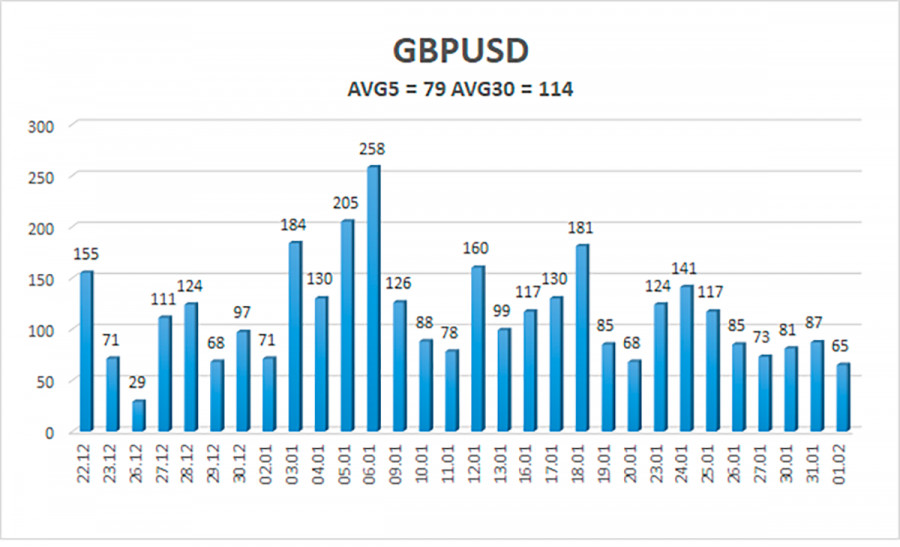

Over the previous five trading days, the GBP/USD pair has had an average volatility of 79 points. This number is the "average" for the dollar/pound exchange rate. Thus, we anticipate movement inside the channel on Thursday, February 2, limited by levels of 1.2217 and 1.2375. A new attempt to continue the upward trend is indicated by the Heiken Ashi indicator's upward reversal.

Nearest levels of support

S1 – 1.2299

S2 – 1.2268

S3 – 1.2238

Nearest levels of resistance

R1 – 1.2329

R2 – 1.2360

R3 – 1.2390

Trading Suggestions:

In the 4-hour timeframe, the GBP/USD pair is located below the moving average. As a result, it is now possible to hold short positions with 1.2268 and 1.2217 as the targets. If the price is fixed above the moving average line, you can start trading long with targets of 1.2408 and 1.2451. Additionally, the pair has remained flat in recent weeks.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.