The S&P 500 has remained largely unchanged, however, the situation in the Middle East has caused oil prices to rise. The US dollar strengthened after the publication of data on unemployment benefit claims, while the Japanese yen weakened following Japan's statement of no intention to raise interest rates.

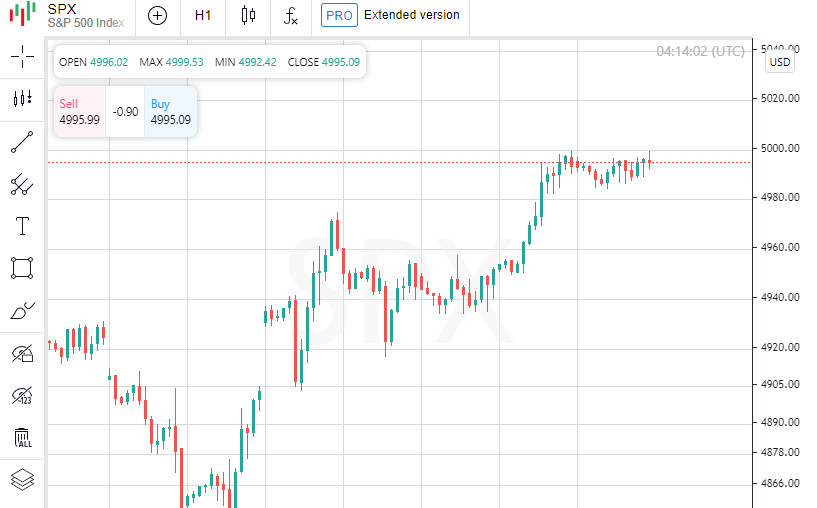

On Thursday, Wall Street saw a rise in major indices, with the S&P 500 index fluctuating around the significant mark of 5000 points. The market reacted to fresh reports on company profits and employment data in the US, which also contributed to the rise in the US dollar rate.

At the same time, European stocks showed a decline, and the yield on US Treasury bonds increased after an auction of 30-year bonds. Oil prices jumped amid fears of an escalation of conflict in the Middle East, while the number of unemployment benefit claims in the US fell to 218,000 for the week ending February 3, which was below economists' forecast of 220,000.

Representatives of the Federal Reserve System of the USA, the European Central Bank, and leading emerging markets demonstrate resilience to assumptions about an imminent decrease in interest rates, assessing the effectiveness of current measures to control inflation. According to the analysis of the FedWatch tool by CME Group, the probability of a Federal Reserve rate cut in March decreased by 2.5 percentage points compared to the previous day, standing at 16.5%. A week earlier, this probability was estimated at 36.5%.

The US dollar index slightly increased, reaching 104.13, while the euro rose by 0.05%, to 1.0776. The Dow Jones Industrial Average gained 48.97 points (0.13%), reaching 38726.33, the S&P 500 index increased by 2.85 points (0.06%), to 4997.91, and the Nasdaq Composite index rose by 37.07 points (0.24%), to 15793.72.

Shares of Walt Disney rose by 11.5% after its profit exceeded Wall Street analysts' forecasts. The company also announced plans for a $3 billion share buyback, a 50% dividend increase, investments in game development, and the launch of the ESPN streaming service in 2025.

Spirit Airlines shares went up by 3.3% following statements about the prospect of positive cash flow in the second quarter. PayPal shares fell by 11.2% amid forecasts of stagnation in adjusted earnings for the current year, affecting the overall decline in the S&P 500 financial sector.

Ralph Lauren shares jumped 16.8% due to an increase in revenue in the third quarter, while Under Armour shares closed up 0.1% after raising the annual profit forecast.

The Russell 2000 index, reflecting the dynamics of small-cap companies, showed the best performance of the day, increasing by 1.5%. The Philadelphia semiconductor index rose by 1.6%, reflecting growing interest in the sector due to the development of artificial intelligence technologies.

Among the 11 key sectors of the S&P 500 index, the energy sector demonstrated the highest growth, rising by 1.1% amid rising oil prices.

According to LSEG, more than half of the companies in the S&P 500 have reported quarterly earnings, with 80.6% of them exceeding analysts' expectations, which is above the long-term average of 67%.

The global MSCI stock index, tracking the dynamics of stocks in 49 countries, decreased by 0.02%. The pan-European STOXX 600 index closed down 0.1%. Losses in the healthcare sector were offset by gains in consumer sector companies, such as Unilever and Kering.

The yield on 10-year US Treasury bonds rose by 5.6 basis points to 4.154%, and the yield on 30-year bonds increased by 4.5 basis points to 4.3541%.

In the commodities market, futures for crude oil in the US jumped by 3.05%, to $76.11 per barrel, while Brent crude rose to $81.48 per barrel. The spot price of gold decreased by 0.04%, to $2033.39 per ounce, and futures for American gold fell by 0.2%, to $2047.90.

In Asia, the Japanese Nikkei index rose by 2.1% and closed at the highest level in the last 34 years, thanks to moderate statements from the Bank of Japan. The Shanghai Composite Index and the CSI blue chip index reported significant weekly growth, resulting from the market's positive reception to the change in leadership of the Chinese market regulator.

The Consumer Price Index in China in January showed the biggest annual drop since 2009, despite a monthly increase of 0.3%, which exceeded the figures of the previous month.