Apparently, the currency market is beginning to enter a state of suspended animation again in anticipation of the Fed's monetary policy meeting in November, as well as the upcoming election of a new head of the regulator for the next term.

It is worth noting that there are only less than two weeks left before the November meeting of the Fed on monetary policy. It is assumed that the bank will announce the parameters for reducing the volume of redemption of assets – government bonds and secured mortgage securities. This topic has now somewhat receded into the background, giving way to full influence on the markets of the season of corporate reporting of companies, but it will undoubtedly reappear and will have a noticeable impact on investor sentiment. In the meantime, we expect the situation on the markets to remain the same, where the focus will be on the impact of the coronavirus pandemic, high inflation in the world in general and in America in particular, as well as the expectation of the start of an increase in the Fed's interest rates, possibly as early as next year.

In addition, there is no doubt that an important factor that will influence the markets will be the likely reappointment for a new term of J. Powell as the Fed Chairman or the election of a new head of the Central Bank. So far, there is talk that Lael Brainard, a member of the Board of Governors of the US Federal Reserve (FRS), maybe his likely successor.

Therefore, observing everything that happens and given the listed factors of the current real influence, as well as those that will operate in the future, we expect that a long period of consolidation may begin in the markets amid high volatility with likely local spikes in both asset value growth and their decline. Of the next influential factors, we will highlight the publication in early November of employment data in America, then the Fed's decision on measures to reduce asset purchases (QE), which will undoubtedly affect the public debt market in the United States, and through it in other stock markets, currency and commodity markets.

What can be expected next week?

We believe that the focus will remain on the publication of companies' reports for the 3rd quarter. This is an important event that will show how businesses in economically strong countries manage to grow in the face of various challenges – the COVID-19 pandemic, and a clear slowdown in the growth of the global economy in conditions of high inflation.

At the same time, if the market does not receive negative news, it will be possible to expect the continuation of local demand for shares and commodity assets. In this case, the US dollar will remain under pressure in the currency market, traditionally responding with a decline to an increase in demand for risky assets.

From the economic statistics data next week, attention should be paid to the publication of the GDP values of the United States, Germany, Canada, consumer inflation in the euro area, and inflation components in America – figures on income and expenses of Americans, as well as statistics on the price index of personal consumption expenditures. These data with their values can have a noticeable local impact on the markets in general and on the dynamics of the dollar exchange rate in particular.

Forecast of the day:

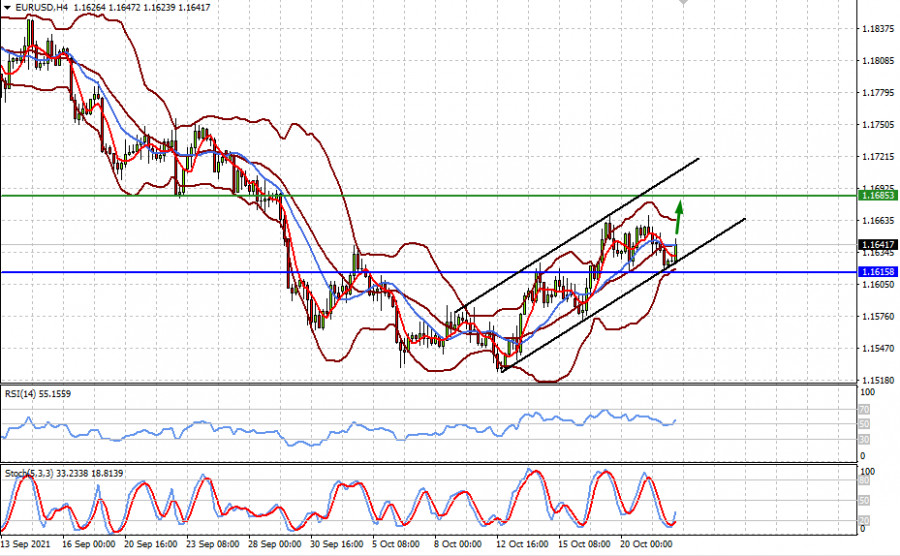

The EUR/USD pair declined to the level of 1.1615. If positive sentiment prevails on the market today, it may rise to the level of 1.1685.

Spot gold is recovering after a local downward correction in the range of 1721.70-1830.00 amid the emerging topic of US government debt, the election of a new head of the Federal Reserve, and a number of other events and factors cited in the article. A price rise above the level of 1800.00 may lead to further growth to 1830.00.