For the first time since April, the euro-dollar pair has been testing the 13th figure, thereby indicating new price horizons. True, the attack ended in failure - the price quickly moved away from two-month highs, returning first to the opening level, and then completely updating the low of the day. Nevertheless, the euro still looks more attractive than the dollar, which, in turn, cannot recover from the dovish intentions of the Fed. Tomorrow the euro is to be tested by the June meeting of the ECB, and if the European regulator maintains the status quo in its rhetoric, the eur/usd bears will be left alone with a weakening greenback. However, first things first.

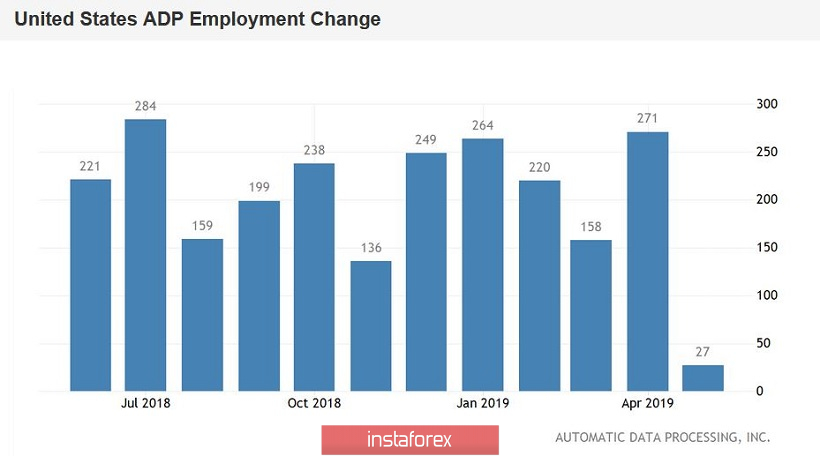

Today, the pair's impulsive growth was due to the extremely weak report on the US labor market from the analytical agency ADP. According to them, the number of jobs in private American companies grew by only 27 thousand in May (with a growth forecast of 180 thousand). This is a very weak result (the worst in the last 9 years), which is a disturbing harbinger of weak Nonfarms. For comparison: last month, the ADP report showed an increase in the number of employed in 270 thousand, while Nonfarms came out at the level of 263 thousand. Given the high level of correlation of these indicators, traders are worried about the fate of the Friday release: if the official data disappoint in the same way, the dollar will again fall under the wave of sales.

The fact is that the labor market has always been a reliable support for the US currency: the unemployment rate is consistently kept at record-low values, and Nonfarms are in the range of 180-300 thousand (with the exception of February 2019, but in this case the statistics were distorted). The "hawks" of the Fed, arguing their position, as a rule, referred to the dynamics of the labor market, noting positive trends and steady growth of key indicators. Even the level of average hourly wages, which varies in the range of 0.1-0.3%, provided indirect support to the US currency. And if now the US economy will lose support from this side, the fate of the interest rate of the Fed will be predetermined.

Such a warning has once again made traders nervous: the yield on 10-year-old treasuries again updated its local low (2.088), putting pressure on the dollar index, which tested the 96th figure. The situation was somewhat smoothed out by the ISM composite index for the non-production sphere (it unexpectedly rose to 56.9 points), but on the whole the market's mood remains depressed. If Nonfarms fail on Friday synchronously with ADP, the "hawks" and centrists of the Federal Reserve will find it harder to defend their position. In particular, the head of the Federal Reserve Bank of Chicago, Charles Evans, said today that he is concerned about the prolonged period of low inflation. According to his estimates, the US trade conflict with China will only slow down the inflation process, so the regulator may have to respond to the situation.

His colleague - Robert Kaplan - was more optimistic in his assessments. In his opinion, the Fed must first make sure that the US economy has slowed down its growth, and only then decide to lower the rate. As we see, many Fed members are now talking about the probability of monetary policy easing. In one way or another, they allow the implementation of such a scenario, whereas previously most of them categorically rejected such an idea.

But the single currency could not take advantage of the dollar's weakness today. The euro has lost all the points it won amid fears about the June meeting of the ECB, which will take place on Thursday. Investors rightly fear that the regulator may demonstrate a "dovish" attitude regarding the prospects for monetary policy. Much will depend on how members of the ECB interpret the latest data on the growth of European inflation.

I recall that after the April growth to 1.7% y/y and 1.2% m/m, the consumer price index slowed down in May to 1.2% and 0.8%, respectively. Core inflation also disappointed - in April, this indicator jumped to 1.3%, and in May, analysts predicted a decline to one percent. But the core index was weaker than expectations, returning to the level of March, that is, to the mark of 0.8%. According to some experts, the fact that European inflation accelerrated in April was temporary and was due to seasonal fluctuations - Easter holidays and long weekends contributed to the growth of inflation indicators. In May, the situation stabilized, and inflation indicators returned to their normal course. If ECB members follow the same logic, then the European currency will be supported. But if Mario Draghi allows a return of QE, then the euro will not be able to resist the dollar, even despite the weakness of the latter.

Experts estimate the likelihood of such a step differently. According to some analysts, the head of the ECB should at least hint at the announcement of new incentives, given the weak dynamics of European inflation. According to other currency strategists, the market is expecting too much from Draghi - hints of rate cuts, hints of a renewal of QE, a negative outlook for the eurozone, and details about the next round of bank loans under the TLTRO program. According to them, though Draghi has a different "dovish" character, this time the bears may disappoint EUR/USD. In particular, TLTRO-3 conditions may be less attractive compared to TLTRO-3. In general, Draghi can take the same position as in previous meetings, which will provoke a demand for the European currency.

But for now, these are all assumptions, so the single currency is under pressure from uncertainty. On Thursday, the single currency will have to undergo a rather difficult test, but if the results of the ECB meeting are in favor of the euro, the eur/usd pair will soon be able to consolidate not only within the 13th figure, but also come to the next resistance level of 1.1420 (the top line of the Bollinger Bands indicator on the weekly chart).