US stock index futures rose in the premarket on Thursday after retreating from their historical highs a day earlier. Profit-taking was not something surprising - especially considering that several important fundamental data on the American economy is coming out this afternoon. Futures on the Dow rose by 84 points, futures on the S&P 500 and Nasdaq 100 were trading almost unchanged with a slight plus.

Back on Wednesday, the S&P 500 index fell 0.5% as the rally seen at the beginning of the reporting season began to weaken. The Dow blue chips fell by more than 250 points, for the first time in four days. According to CNBC calculations, about 40% of S&P 500 companies reported earnings, and more than 80% of them exceeded Wall Street expectations. Reports from tech giants Amazon and Apple are expected after the close today – this will be a good shake-up for the market.

Many leading economic agencies, after the recent record growth in energy prices, are revising forecasts for raw materials companies. Goldman Sachs expects that the total return on shares of energy companies may exceed 20%. I recommend taking a look separately at companies in this sector after the reporting season.

As noted above, today many traders will focus on the third-quarter gross domestic product data from the US Department of Commerce. Economists expect growth of just 2.8%, after a jump of more than 6.5% in the second quarter. The decline is directly related to problems in supply disruptions, which continue to be observed even now. Difficulties with finding qualified personnel remain in the labor market. At the same time, consumers are struggling with high prices for several retail goods, which affects the total volume of retail sales - in fact, everything you need to know about the problems in the US economy in the 3rd quarter of this year.

Let's run through the premarket and see who did the main movements on it

Ford shares jumped more than 9% amid the automaker's claims that the increased availability of semiconductors during the third quarter of this year allowed it to rock production. The company also reported earnings of 51 cents per share, well above the consensus forecast of 27 cents. Ford also increased its annual revenue forecast amid strong demand.

Caterpillar's securities in the premarket rose 2.5% after the equipment manufacturer, despite a small revenue deficit, reported an increase in net profit in the third quarter, which exceeded economists' forecasts. Adjusted earnings were $ 2.66 per share compared to the consensus forecast of $ 2.20 amid increased demand in the construction industry.

As for the pharmaceutical sector, Merck, the drugmaker, exceeded economists' estimates by 20 cents and announced an adjusted quarterly profit of $ 1.75 per share, while revenue also exceeded expectations. Merck shares rose 2.2% in the premarket.

Among the leaders of the fall were the securities of Twilio, which fell by about 13% during the premarket due to a reduction in profit and revenue in the third quarter of this year.

eBay securities also fell by about 5% due to weak revenue forecasts for the fourth quarter. The company beat economists' estimates by just 1 cent with a profit of 90 cents per share. The revenue of the online market operator also exceeded forecasts.

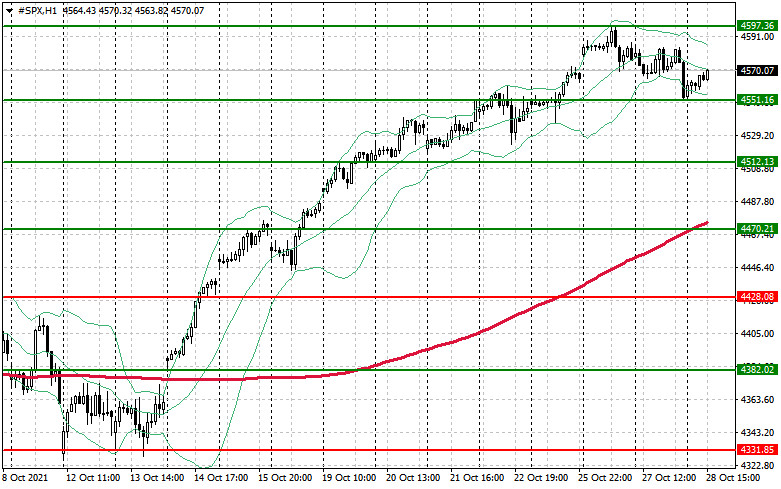

As for the technical picture of the S&P 500 index

The correction to the large support of $ 4,551 was quite expected. It is not surprising that against the background of the update of historical highs, many investors rushed to record profits before the important statistics on US GDP for the third quarter of this year. If the $ 4,551 level holds, then you can count on a repeat return to $ 4,597 and a breakout of this range, followed by an exit to $ 4,620 and $ 4,670. It will be possible to talk about the correction of the trading instrument after the breakout of $ 4,551 to the area of $ 4,512, where new buyers will revive in the market again.