On Friday, the EUR/USD currency pair continued to move more sideways than upwards, but overall the rising trend is still in place, and the European currency soared with renewed force tonight and in the morning. The pair simply took a little break last week before a new "take-off," in theory. We are not the only ones puzzled by this; a sizable number of specialists are also questioning what is motivating the market, which keeps buying the euro currency. Nothing significant occurred on Monday night that could have caused the euro to increase significantly. As a result, the overall situation is unchanged: the pair frequently exhibits growth for no apparent reason.

We've already mentioned that the euro may now be supported by one or two factors. The first is the highly likely narrowing of the ECB-Fed rate differential in the coming months. The second is a technical upward trend correction following a slump of approximately two years. However, it should also be acknowledged that the euro is expanding too quickly and in excess. The outcomes of the Fed and ECB meetings, which will be held in a week and a half, are in reality already known to the market. We think that these occurrences may cause the market's sentiment to shift. However, we must reiterate that the market will act regardless of the underlying and macroeconomic context if it chooses to purchase the euro and sell the dollar. Just that there are times when the macroeconomics and "foundation" don't correspond with the direction of movement. So, all you need to do is pay closer attention to technical analysis, which depicts market activity flawlessly.

What will this week's trading bring?

In terms of macroeconomics or "foundation," this week won't be the most interesting. There won't be many truly significant stories or happenings. We should begin by listening to a few more remarks from Christine Lagarde. Last Thursday and Friday, the ECB's president spoke, although she offered no essentially novel information. Monetary policy, it should be understood, is like the Titanic in the Atlantic. If Lagarde speaks five times in two weeks, she simply cannot surprise market participants every time because she shifts the direction of her movement extremely slowly. Therefore, just one performance out of five or ten can cause a market shift. But it's also impossible to dismiss the ECB president's statement as "unimportant."

Lagarde will present this week on Monday, Tuesday, and Friday. Tomorrow will also see the release of business activity indices for the EU services and industrial sectors in addition to Lagarde's speeches. Serious changes in their values shouldn't be anticipated based on the forecasts. All three indicators are predicted by experts to remain below the "waterline" of 50.0, therefore a big response to these findings is not anticipated absent significant departures from expectations.

All of the events scheduled for this week, following the European Union, are listed above. It turns out that traders can, in theory, focus only on the "method" for the next five days. And all that is saying at this point is that neither a sell signal nor a condition for the pair to decline exists. On the 4-hour TF, all indications are pointing upwards, and on the 24-hour TF, the price is above all of the Ichimoku indicator's lines. Such a movement might theoretically continue for as long as you like. Although we are not opposed to the euro's expansion, we think there should also be corrections.

It should be remembered that nearly all of the Fed's monetary policy committee members indicated last week that they were prepared to continue tightening monetary policy. Although it appears to be a "hawkish" aspect, the dollar showed little sign of reaction. It is therefore far from certain that the dollar will appreciate, even if supportive elements for the US currency emerge this week.

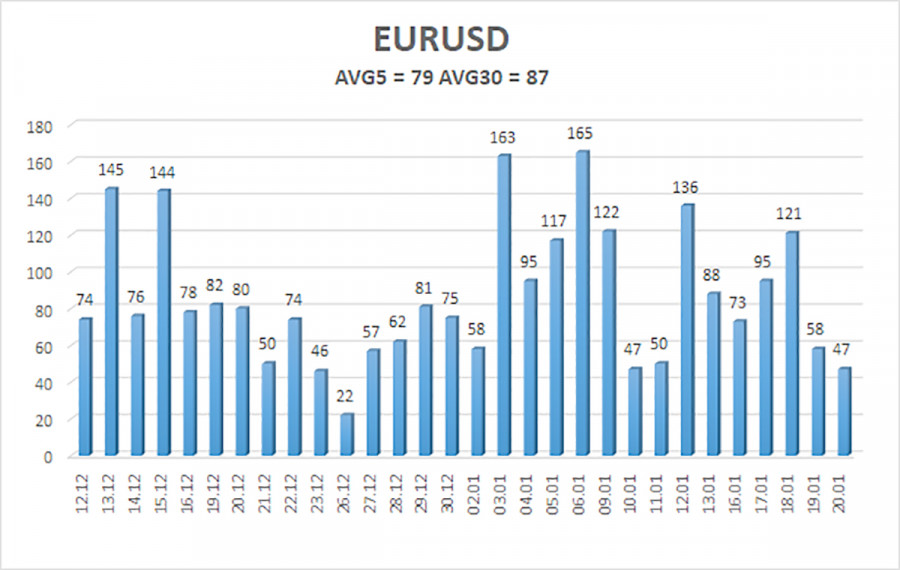

As of January 23, the euro/dollar currency pair's average volatility over the previous five trading days was 79 points, which is considered "normal." So, on Monday, we anticipate the pair to fluctuate between 1.0813 and 1.0971. The Heiken Ashi indicator's downward reversion will signal the beginning of a new phase of corrective activity.

Nearest levels of support

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

Nearest levels of resistance

R1 – 1.0986

Trading Suggestions:

The EUR/USD pair is attempting to move north once more. Until the Heiken Ashi indicator turns down, you can continue holding long positions with goals of 1.0971 and 1.0986. After putting the price below the moving average line and setting a target price of 1.0742, you may start opening short positions.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.