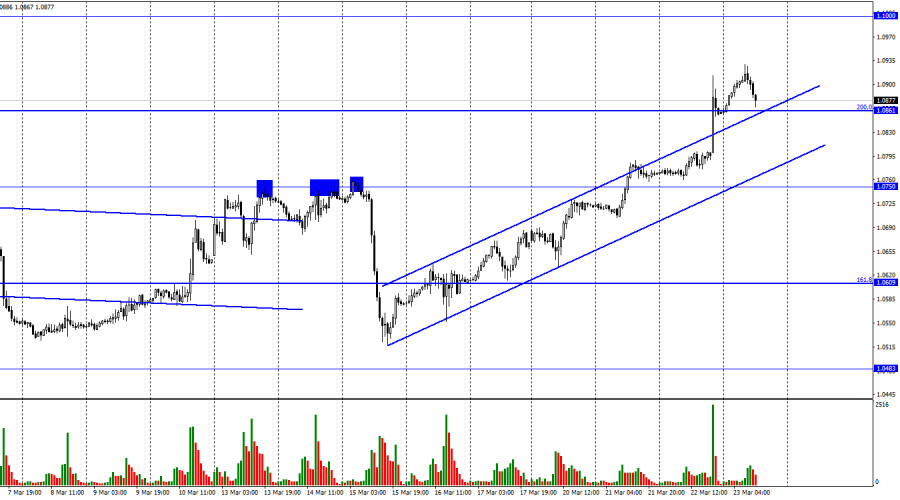

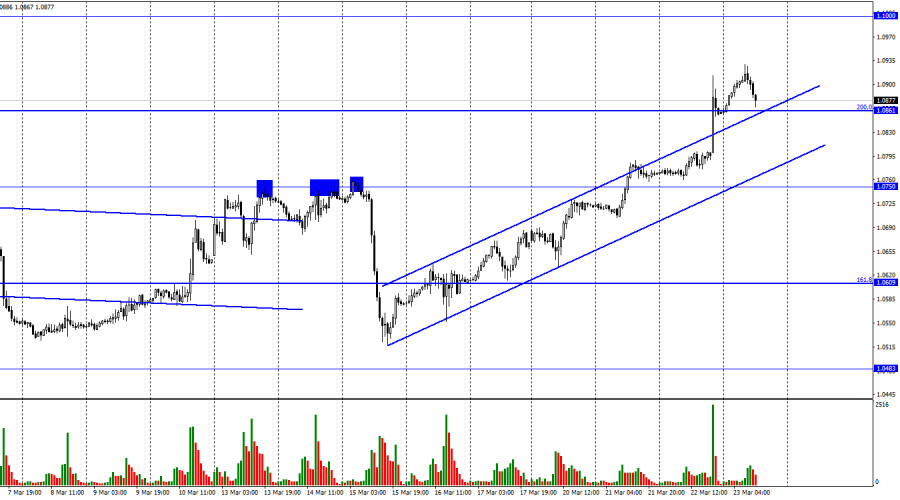

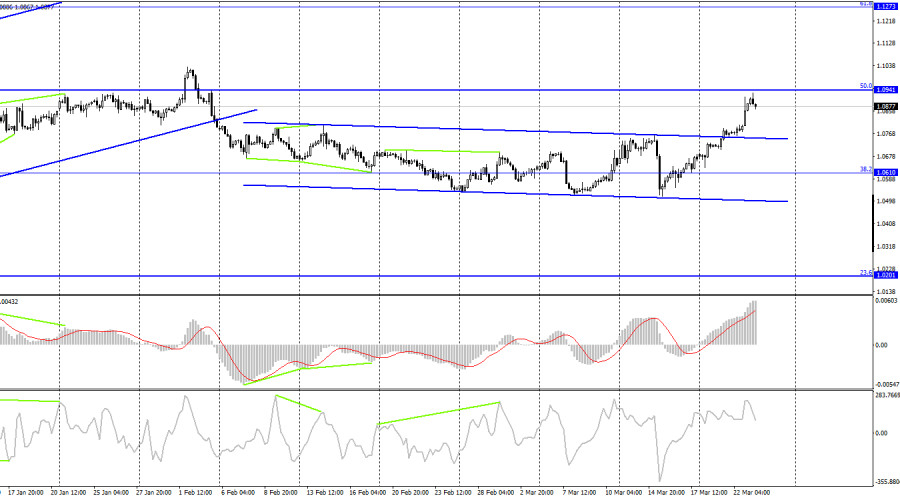

On Wednesday, the EUR/USD pair kept on rising and managed to remain above the corrective level of 200.0% (1.0861), moving above the trend channel. The growth can now be carried on to the following level of 1.1000. The US dollar will benefit if the rate of the pair closes below the level of 1.0861, and some of the prices will fall in the direction of the lower line of the corridor, indicating that traders are in a "bullish" mood.

Last night, the outcomes of the FOMC meeting were made public. Before this event, traders were quite anxious since they were unsure if the regulator would follow its plan and raise the rate by 0.25%. However, the FOMC did make such a decision, and even the traders were unprepared for it. After a five-day decline, the US currency fell even further and has only now begun to recover modestly. Six days of pair growth is too much. Given that I don't believe the outcomes of the FOMC meeting can be characterized as "dovish," I anticipate a decline in quotes in the near future. You must also consider the fact that the dollar had been declining for five days prior.

During the press conference, Jerome Powell avoided being confrontational but did confirm that the US banking crisis won't cause the Fed to stray from its course of battling high inflation. He stated that although all would rely on the incoming inflation numbers, the rate might increase further. It will also be important to consider the labor market and unemployment rates. I believe that the Fed is free to increase the rate by 0.25% two or three more times. It's still unclear if this will be sufficient to bring down consumer prices to 2%, but the Fed is not at risk. The labor market is still strong, unemployment is not distant from its 50-year lows, and the GDP grows nearly every quarter. The dollar, however, has not yet benefited from this.

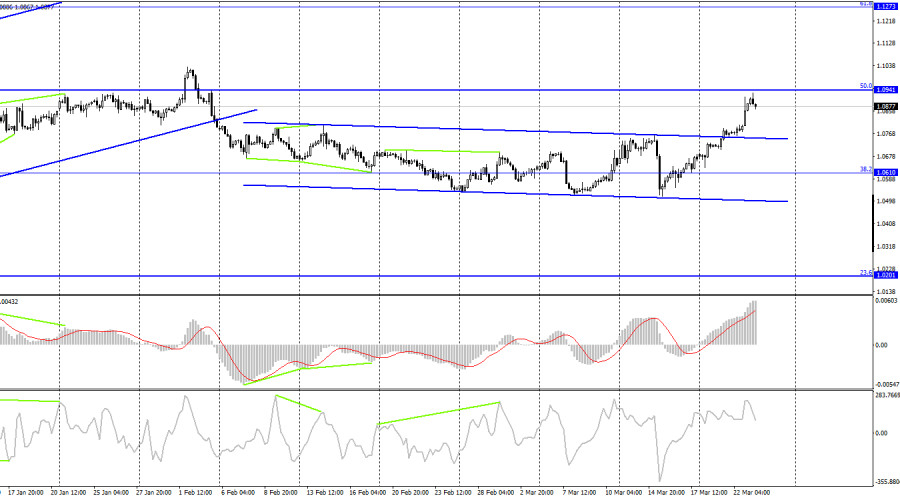

On the 4-hour chart, the pair managed to hold above the corridor of the descending trend yesterday, allowing us to anticipate continued growth in the direction of the following corrective level of 50.0% (1.0941). Emerging divergences are currently undetectable in any indication. The rebound of quotes from the 1.0540 level will favor the start of a fall in the direction of the Fibo level of 38.2% (1.0610) while fixing above it will improve the chance of sustained growth in the direction of the next corrective level of 61.8% (1.1273).

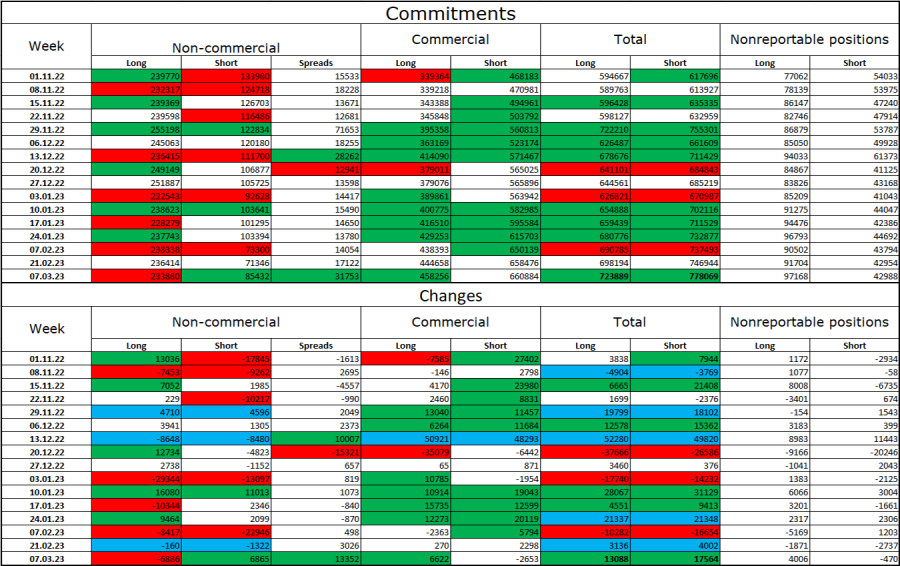

Report on Commitments of Traders (COT):

Speculators closed 6,886 long contracts and opened 6,865 short contracts during the most recent reporting week. Major traders' overall attitude is still "bullish" and getting better. Please be aware that the most recent report is from March 7. A few weeks separate us from real-time. Speculators now have 234 thousand long contracts, while just 85,000 short futures are concentrated in their hands. While the value of the euro has been declining for some weeks, we are currently without new COT data. The likelihood of the euro currency's growth has been steadily increasing over the past few months, much like the euro itself, but the information background hasn't always backed it up. After a protracted "black period," the situation is still in the euro's favor, and its prospects are strong. Until the ECB gradually raises the interest rate by increments of 0.50%, at least.

Calendar of events for the United States and the European Union:

US – number of construction permits issued (12:00 UTC).

US – number of initial applications for unemployment benefits (12:30 UTC).

On March 23, there are no economic events scheduled in the European Union, and there are only a few brief reports. The information background may have little to no impact on traders' attitudes.

Forecast for EUR/USD and trading advice:

When the price of the pair is anchored below the level of 1.0861 on the hourly chart, or when it reverses from 1.0941 with a target of 1.0750, new sales of the pair can be initiated. On the hourly chart, new purchases may be made if the price rises over the 1.0861 level with a target of 1.1000.