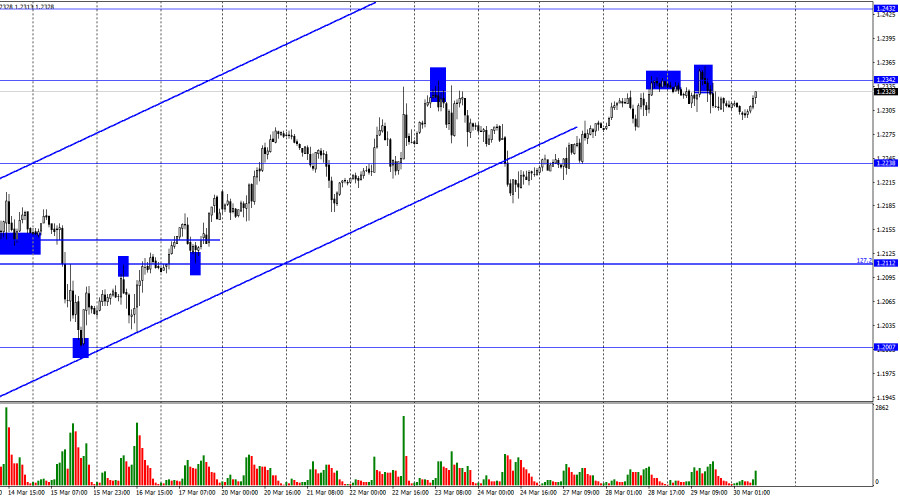

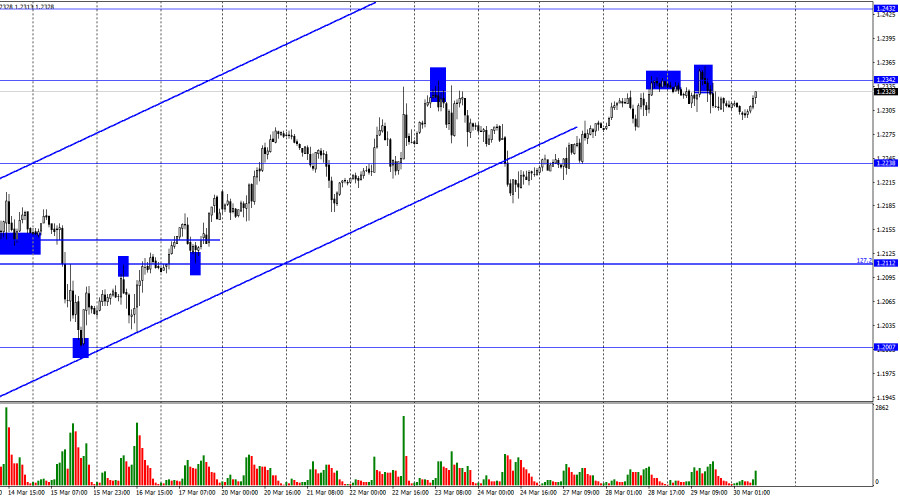

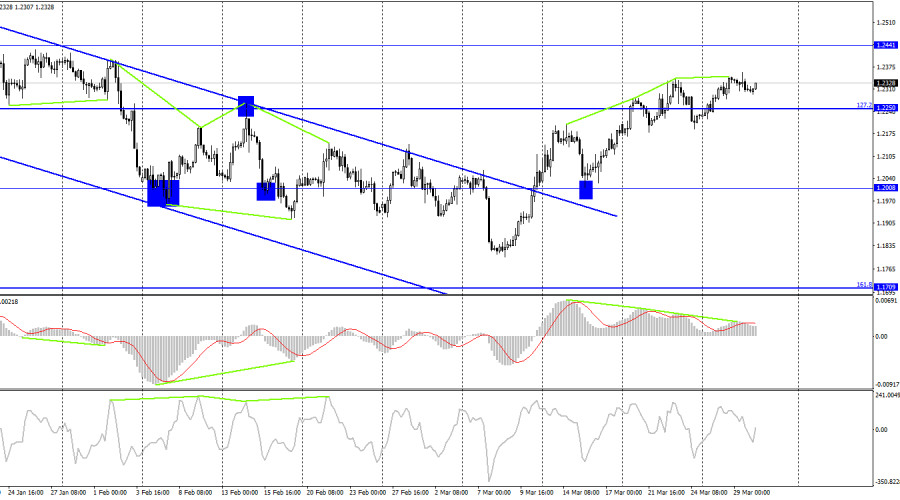

The GBP/USD pair did another rebound from the level of 1.2342 on Wednesday and a slight decline, according to the hourly chart. A return to the level of 1.2342 has been achieved as of right now. Traders will once more be able to anticipate a reversal in favor of the US currency and a small decline in the direction of 1.2238 if this level experiences another rebound. The likelihood of continued growth toward the following level of 1.2432 will increase if the pair's rate is fixed above 1.2342 (which is more probable).

This week, there is no background information available for the pound/dollar pair. There was one speech by Bank of England Governor Bailey on Monday and Tuesday, but the market responded to his remarks about continuing the PEPP's tightening process modestly. Because the British regulator cannot act differently given the inflation rate, there is no surprise in this. Even though Mr. Bailey stated that the rate of an interest rate increase should not go above that of 2008, I would argue that he must keep the current rate. Since it shouldn't go above the present value of 4.25%, we can anticipate a 0.25% increase at the next meetings, but no more.

The newest rate hike by the Fed has been called "dovish" by some experts. If the PEPP's tightening can be described as "dovish," then the Bank of England is also getting near a similarly "dovish" increase. In other words, the latter. The pound, which is still growing, may soon cease as a result. Of course, there is still plenty of time, and the pound might have time to increase considerably before the next Bank of England meeting. But generally speaking, sell signals are beginning to show up on both charts. The fourth quarter GDP will be this week's lone update from the UK. And only tomorrow will it be made available. Trader activity may remain low through the conclusion of the week.

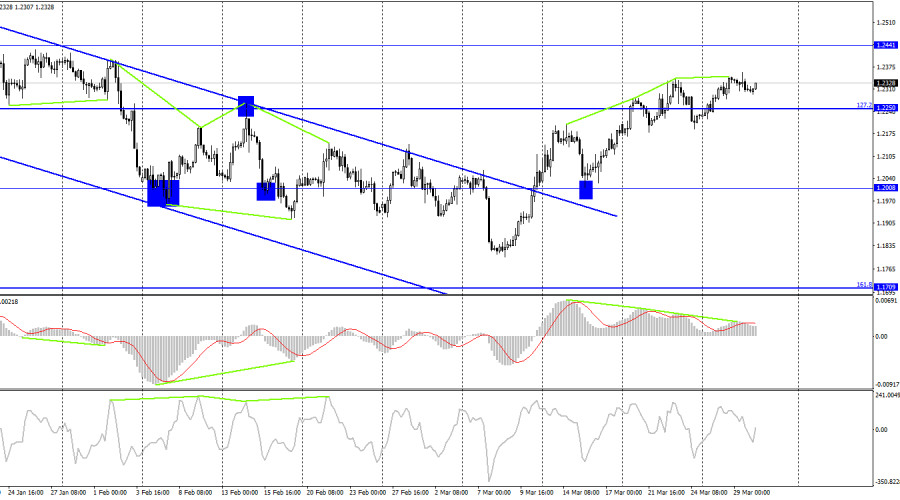

The pair reversed direction in favor of the British pound on the 4-hour chart and started to rise again toward the level of 1.2441. The MACD indicator has established its third consecutive bearish divergence, which once again gives us reason to expect a turn in favor of the US currency and a slight decline in prices. Two strong sell signals can be obtained along with the hourly chart's potential rebound from 1.2342.

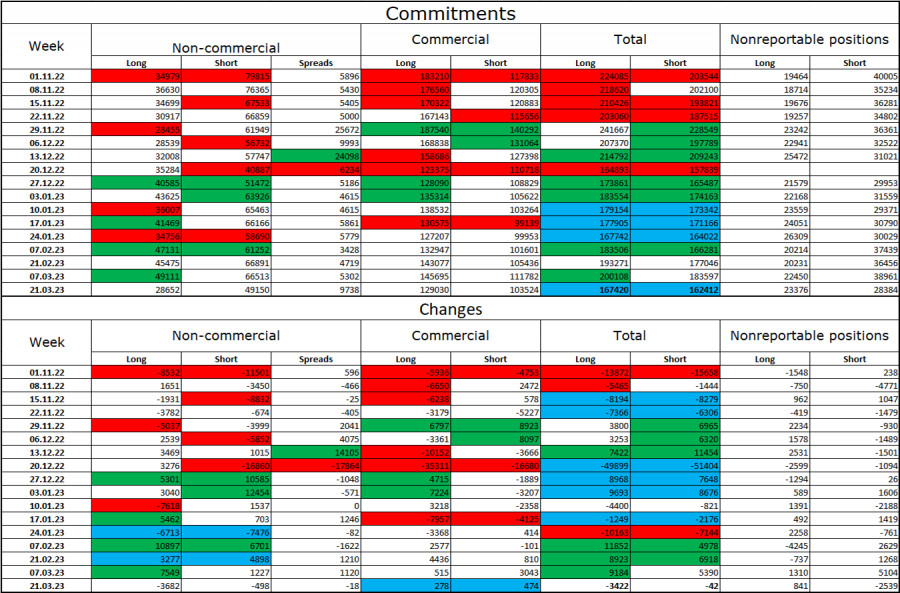

Report on Commitments of Traders (COT):

Over the past reporting week, the attitude of traders in the "non-commercial" category has hardly changed. The number of long contracts held by investors dropped by 3682 units, while the number of short contracts dropped by 498. The major players' overall outlook is still "bearish," and there are still more short-term contracts than long-term contracts. Although things have been steadily shifting in favor of the British pound over the past few months, there are still a lot more speculators holding long positions than short ones. As a result, the pound's future is looking better, yet the British pound hasn't changed much over the past six months. There was a break outside the downward corridor on the 4-hour chart, and the pound is currently supported. I do observe that several current factors are at odds with one another, and the information background does not offer the pound much support.

News calendar for the USA and the UK:

US – GDP for the fourth quarter (12:30 UTC).

US – number of initial applications for unemployment benefits (12:30 UTC).

On Thursday, the calendars of economic events in the UK and the US feature only a couple of minor entries. The prior information's impact on today's traders' attitudes will be minimal.

Forecast for GBP/USD and trading advice:

When the British pound rises above 1.2342 with a target of 1.2238, sales of the currency are probable. I don't think it makes sense to buy the pair at this point because the hourly chart's closing was made under an ascending trend corridor. However, if the price closes above 1.2342, you might want to think about purchasing small lots with a 1.2432 target.