Analysis of previous deals:

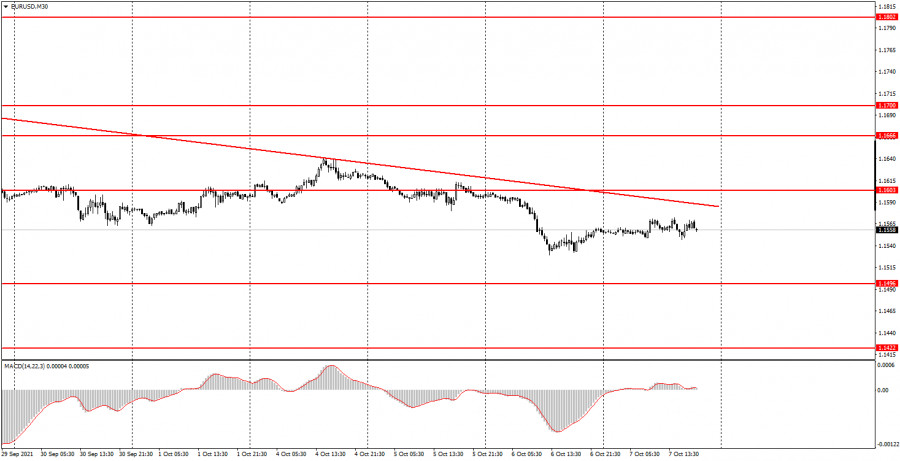

30M chart of the EUR/USD pair

The EUR/USD pair continued the correction on Thursday, which began the night before. However, judging by the strength of the movement, it can hardly be called a correction. Maximum rollback. During the day, the EUR/USD pair was on the absolute anti-record of volatility, passing only 25 points in a day. Thus, the price has not approached the downtrend line today, it is the trend line that has fallen towards the price. What can you say about today's technical picture? It hasn't changed, it's obvious. The price is already very close to the trend line, and consolidation above it can trigger the beginning of a new upward trend. The fundamental and macroeconomic backgrounds are now very ambiguous, so we cannot say that they support this or that currency. Let's remember that the US dollar has been growing non-stop for more than a month, but managed to add only 360 points during this time. That is, the dollar is adding about 20-25 points a day. No matter what angle you look at, the volatility is very weak, so signals from the MACD indicator are still not recommended to be considered.

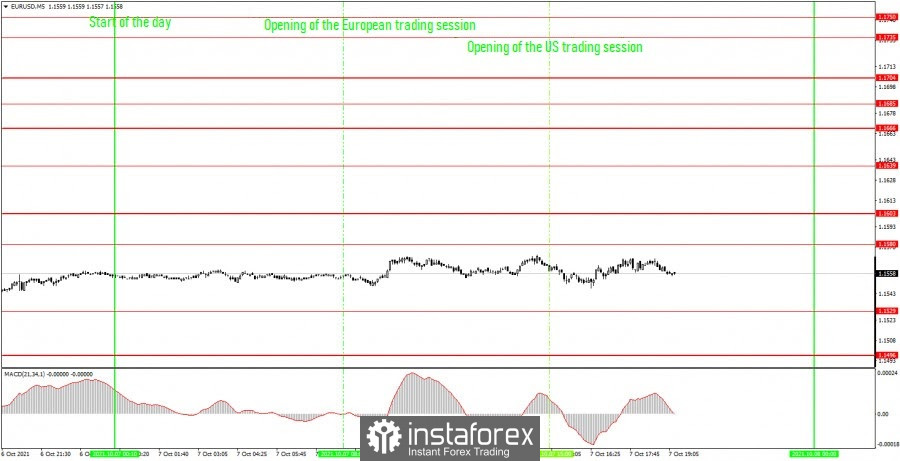

5M chart of the EUR/USD pair

The technical picture on the 5-minute timeframe needs no comment on Thursday. The price could not even approach any of the nearest levels the entire day, the distance between which was equal to 51 points. This can be clearly seen in the chart above. As we already said, the volatility was 25 points, so it is very good that the price could not even reach a single level. Otherwise, false trading signals could have been scattered. Therefore, novice traders did not have to open a single position today. There was also no noteworthy report or other event. The most empty day.

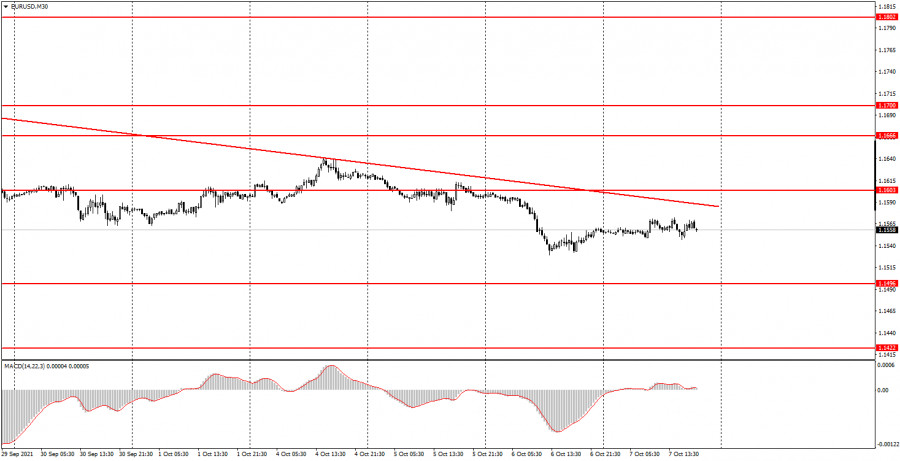

How to trade on Friday:

The EUR/USD pair is still in a downward trend on the 30-minute timeframe. Therefore, at this time, selling is still more relevant than buying. However, in most cases, the total volatility of the day does not exceed 40-50. Thus, it is still very inconvenient to trade on the 30-minute TF, and we still do not recommend tracking signals from the MACD indicator. The key levels on the 5-minute timeframe for October 8 are 1.1496, 1.1529, 1.1580, 1.1603, 1.1639, 1.1666. Take Profit, as before, is set at a distance of 30-40 points. Stop Loss - to breakeven when the price passes in the right direction by 15 points. At the 5M TF, the target can be the nearest level if it is not too close or too far away. If it is, then you should act according to the situation or work according to Take Profit. On Friday, volatility should rise very seriously against Thursday's value of 25 points. In principle, one report on NonFarm Payrolls should be enough for the markets to start trading the pair, and not just pretend. Recall that the Nonfarm report is currently the most important report for the American economy, markets and the Federal Reserve. If its actual value for September turns out to be lower than the forecast (+490,000), then the dollar may start falling (= growth of the euro/dollar pair). And vice versa.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.