US inflation is breaking records again. All components of the macroeconomic report were released today either in the green zone or in accordance with the forecast. The market, in turn, reacted in a rather peculiar way to the release by organizing a sale of the dollar. And yet today's report plays a crucial role in determining the future prospects of the greenback. Inflation in the United States is still at a record high level, and this fact suggests that the Federal Reserve will decide on the first increase in the interest rate already at the March meeting. In addition, now we can say that the central bank will take a tougher position on this issue in the context of future prospects. At the moment, we can say that the Fed will probably raise the rate three times before the end of 2022, and will also start reducing its balance sheet approximately in July-September. Such a fundamental background, to put it mildly, is not conducive to a reversal of the EUR/USD trend. Therefore, at the moment we are dealing with a fairly large-scale correction, which a priori is temporary.

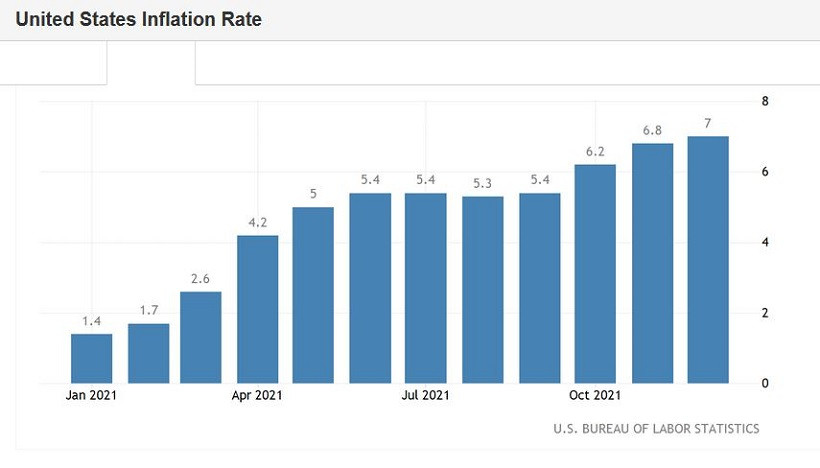

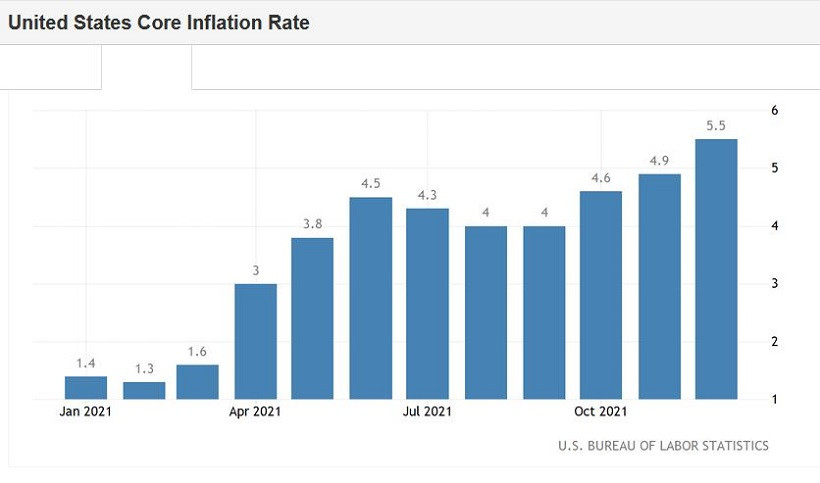

But back to today's report. It really exceeded the expectations of most experts in almost all respects. The consumer price index remains at the level of multi-year highs. Thus, according to published data, the overall CPI accelerated to 7.0% y/y in December. This is the highest value of the indicator for the last 40 years. The last time this indicator was at this level was in 1982. On a monthly basis, the index also showed positive dynamics, rising to 0.5% (with a slight decline forecast to 0.3%). The core consumer price index, excluding volatile food and energy prices, similarly remained at a high level. In monthly terms, an increase of up to 0.6% was recorded, in annual terms - up to 5.5%. And here again is a long-term record: the index last "gave out" such results in annual terms in February 1991.

The structure of the release suggests that the CPI increased in December primarily due to the rise in prices of housing, used cars and trucks. Thus, housing costs, which account for about one-third of the total amount, jumped by 4.1% year-on-year. This is the fastest pace in almost 15 years (since February 2007). Prices for used cars, which became the main component of inflationary growth during the coronavirus crisis (due to problems with supply chains), increased in December by another 3.5% in December: as a result, the overall increase compared to last year was 37% (!).

Here again, it is necessary to recall that at the very end of last year, an indicator of the price pressure of consumer spending was published, which is the "most preferred" for Fed members in the context of the analysis of inflationary processes. This indicator also showed record growth. The core PCE index for November, which does not take into account volatile food and energy prices, jumped to 4.7% in annual terms. This is the strongest growth rate in the last 32 years.

Against the background of such trends, Fed Chairman Jerome Powell yesterday made it clear that the Fed will begin tightening monetary policy in the near future. His colleagues - Barkin, Mester, George - actually announced the first rate hike in March. Another representative of the hawk wing (Rafael Bostic) said that the central bank could raise the rate three or four times by the end of the year. At the same time, none of the Fed members who spoke focused their attention on the relatively weak increase in the number of people employed in the non-agricultural sector. On the contrary, the unemployment rate (which fell to 3.9% in December) and the average hourly wage (+4.7% in December) came to the fore.

In other words, almost all fundamental factors play in favor of the greenback. However, contrary to this fact and common sense, the dollar came under a wave of sales - both yesterday (after Powell's speech in the Senate) and today (immediately after the inflation release). This is an atypical, but far from unique situation.

It is worth noting that there is no consensus on the market about the reasons for this behavior of the greenback. According to some analysts, in this case, the rule "buy on rumors, sell on facts" applies. On the eve of Powell's speech, the pair declined to the lower limit of the established 6-week price range of 1.1260-1.1360. However, as soon as the head of the Fed confirmed the assumptions of most traders, the dollar ceased to be in high demand. According to other analysts, the market was disappointed by Powell's speech, which was not "decisive enough." On the one hand, he "gave the go-ahead" to tighten monetary policy this year. But at the same time, Powell refused to give any specifics. Answering the senators' questions, the head of the Fed said that if inflation rates continue to grow at the current pace ("for a longer period than expected"), the Fed "will have to raise the rate even higher over time." According to some experts, such "cautious verbal maneuvers" put pressure on the greenback.

In addition, over the past two days, the yield of treasuries – in particular, 10-year securities - has been declining. This factor also puts pressure on the US currency.

However, if we ignore the reasons for the illogical behavior of EUR/USD (and other dollar pairs), we can say with some confidence that we are dealing with a correction. The European currency does not have any weighty arguments for breaking the trend, whereas the US currency has not only key macroeconomic reports in its "allies", but also the Fed. Therefore, in my opinion, the current price increase is temporary.

From a technical point of view, the situation for the EUR/USD pair is as follows. On the weekly chart, the pair continues to be between the middle and lower lines of the Bollinger Bands indicator, under the Kumo cloud, but on the Tenkan-sen line. To talk about a trend reversal, the pair's bulls need to break the middle line of the Bollinger Bands - that is, to settle above the 1.1500 mark. Up to this point, the current price growth can be viewed through the prism of a "forced" corrective pullback. The correction can be of a larger scale (up to the 15th figure), but it is still a correction, not a trend reversal. The resumption of the downward trend will be evidenced by a decline below 1.1360 (Tenkan-sen line). In this case, the Ichimoku indicator will form a bearish "Parade of Lines" signal, which will declare the priority of selling. At the moment, it is advisable to take a wait-and-see attitude for the pair. As soon as the upward corrective momentum begins to fade (especially if it happens near the boundaries of the 15th figure), the short positions will be "in trend" again. In my opinion, the EUR/USD bears will seize the initiative on the pair by the end of this week.