The EUR/USD currency pair even managed to grow a little on Tuesday. We say "even" because there was no reason for the euro to grow, except for technical reasons. Of course, the technical factor is also very strong and may even completely overlap the fundamental and geopolitical. But, if you remember, we said in our recent articles that the current week will be in some way a catalyst for the mood of most traders in the market. Recall that an extremely small number of important events are planned for this week. And those that are still available are quite formal, such for example, two speeches in the US Congress by Jerome Powell. Thus, the market can show "its true face", since against the background of an empty calendar of events it has an excellent opportunity to adjust the pair up. And if this correction itself does not happen, or it will again be formal, then we will conclude that the global downward trend continues. Consequently, in the coming weeks, it will be quite possible to expect an update of the 20-year lows of the value of the European currency in US dollars.

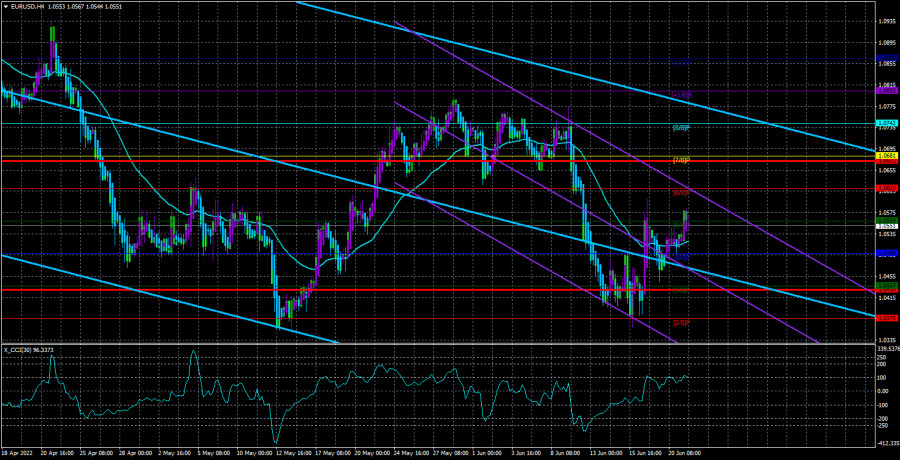

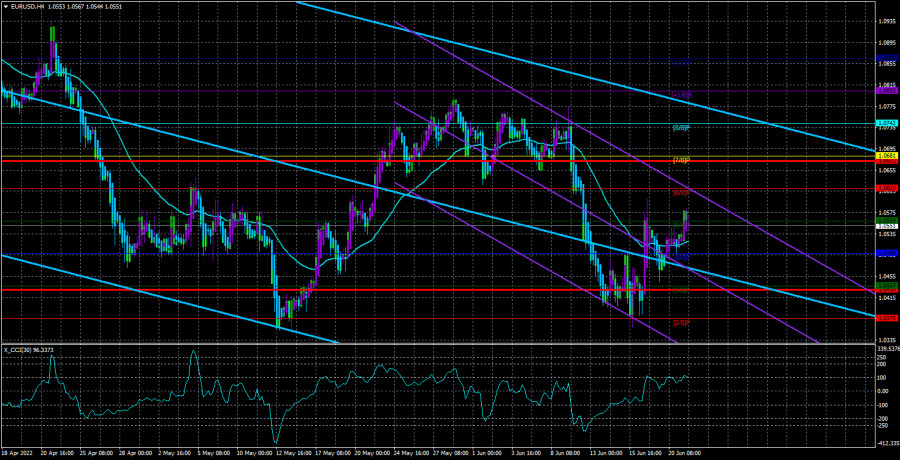

And at the moment, we can make a preliminary conclusion that the downward trend persists. Although the week began with the growth of the euro, in two trading days, this currency managed to add only 50-60 points, which is very little. On the 24-hour TF, the pair is still located below the Ichimoku cloud, below the critical line. We believe that even if the price rises to the Senkou Span B line and its previous local maximum, which now almost coincides and passes at 1.0766, it still will not change the "bearish" mood of the market. Geopolitics and the foundation continue to destroy any desire of traders to buy euros.

Christine Lagarde makes excuses for high inflation.

As we have said more than once, the problem of high inflation is widespread in 2022. However, if the Bank of England and the Fed are at least trying to work with this issue, then the ECB takes the position of Wang. That is, there is a feeling that ECB officials can look into the future, see 2% inflation there, and therefore do not even make any moves in the direction of somehow lowering the current rate of price growth. Recall that only under the pressure of some central banks of the European Union, the ECB finally changed its rhetoric about a month ago and allowed that the rate would be raised once or twice in 2022. However, these one or two times make almost no sense, unless Vanga or Nostradamus works at the ECB. As we can already see, the Bank of England has raised the rate five times, and inflation has been growing and continues to grow. By the way, it is today that we will be able to verify this since the publication of the report for May is scheduled in Britain today.

Returning to Lagarde's speech. She noted on Monday that an internal investigation was conducted inside the ECB to identify those responsible for high inflation in the European Union. According to Lagarde, the ECB became the first bank in the world to conduct such an investigation. From our point of view, this is an attempt to make a good face at a bad game. This investigation makes almost no sense since you can't rewind inflation. Yes, perhaps the guilty analysts and economists will be found. They may even be punished or fired, but how will this help solve the problem? How will this affect the current actions of ECB officials, who continue to show the most passive attitude? We understand that the European economy is once again going through hard times. Because of the geopolitical conflict in Eastern Europe, because of sanctions against Russia, which Europe itself has imposed, and a possible food crisis, because of the rising price of hydrocarbons. But the problem with inflation still needs to be solved somehow. Or at least publicly declare that there are no tools at the disposal of the regulator that could now lower the consumer price index and at the same time not drive the economy into recession. Because we believe that this is exactly the case. The European economy is too dependent on Russian energy resources, much more than the UK or the EU. Therefore, most likely, Europe is waiting for the next problem. And if Europe is waiting for a problem, then the euro currency is waiting for problems.

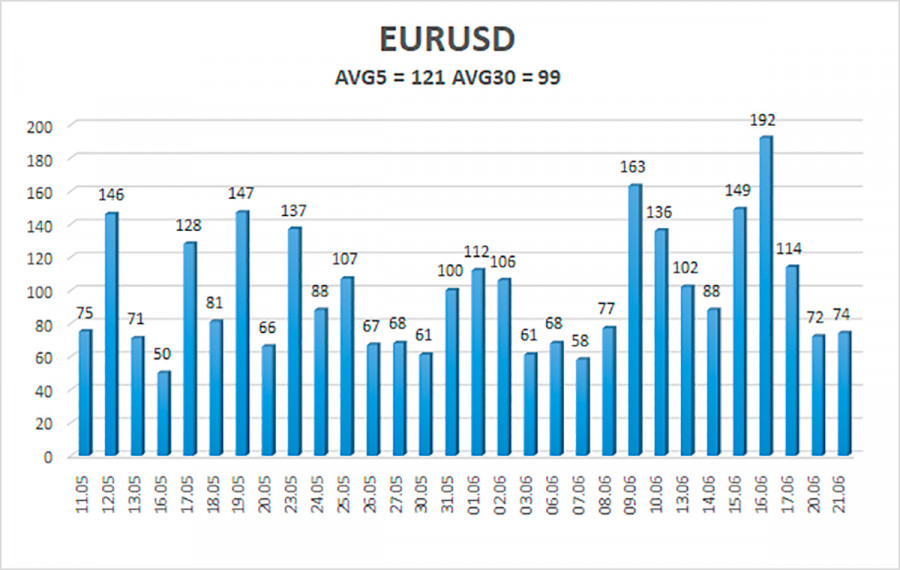

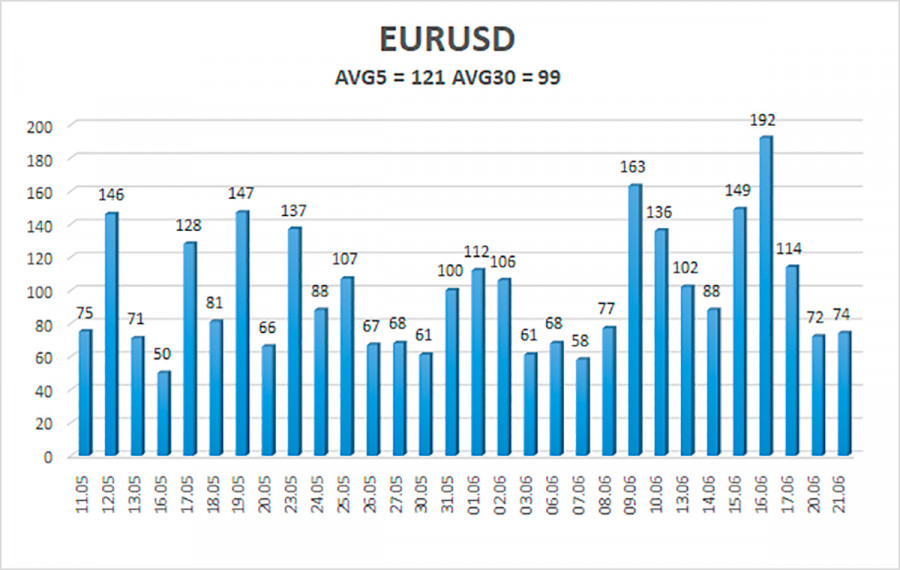

The average volatility of the euro/dollar currency pair over the last 5 trading days as of June 22 is 121 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.0430 and 1.0672. A reversal of the Heiken Ashi indicator back down will signal a new round of downward movement.

Nearest support levels:

S1 – 1.0498

S2 – 1.0437

S3 – 1.0376

Nearest resistance levels:

R1 – 1.0559

R2 – 1.0620

R3 – 1.0681

Trading recommendations:

The EUR/USD pair has started to grow quickly and cannot continue it yet. Thus, now it is necessary to trade on the reversals of the Heiken Ashi indicator since there is no clear trend. There is a fairly high probability of a "swing".

Explanations of the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.