The EUR/USD currency pair continued to trade as if reluctantly. Naturally, until July's consumer price index became known in the States. Looking ahead a little, we note that after several weeks spent in the side channel, the pair now has a real opportunity to resume the trend movement. And not at all in the direction we were waiting for. Simply put, the pair has broken through the upper boundary of the side channel. Unless the current growth ends as abruptly as it began, the euro currency can finally count on more or less significant strengthening. We will briefly discuss the inflation report and possible scenarios for the Fed's monetary policy.

Here I would like to note that the fall of the US currency is quite natural since the slowdown in inflation means that a moderate one may replace an aggressive one. However, we would not open champagne on this occasion to celebrate the end of a long-term downward trend. We believe that in several days or weeks, the euro will have received significant support since the market will expect a rate increase of only 0.5% in September. But at the same time, it should be remembered that the ECB's monetary approach also matters to traders and affects the movement of the euro/dollar pair. And it is still very difficult to expect aggressive, tough actions from the European Central Bank. Moreover, if the Bank of England and the Fed have openly declared the fight against high inflation their main task and hinted that they are ready to neglect the reduction in economic growth, then the ECB takes the opposite position. So far, we are talking about a maximum of one more rate increase in 2022. Is this enough for the European currency to grow, given that the Fed is likely to continue to raise the rate to at least 4%? We believe that despite the strong dollar fall, the US currency still retains high chances of growth in 2022.

Inflation slowed to 8.5%.

So, the consumer price index decreased by the end of July to 8.5%. Immediately, I would like to note that for all those who believe that core inflation is more important, look at the market's reaction and then at the core inflation rate, which by the end of July has not changed at all compared to June. If the market and the Fed look more at the baseline, what did traders react to yesterday? There were no changes. Thus, we continue to believe that the main indicator of inflation is the main one for everyone and everything. Yesterday it was revealed that inflation has dropped to 8.5%, which means a lot for the foreign exchange market, the Fed, and the American economy. First, this decrease can be called "significant." Second, such a strong decline may mean that we have already seen and passed the inflation peak. Third, since inflation has already begun to slow down, the Fed no longer needs to raise the rate at a cruising pace to slow it down. If the September report does not spoil the whole picture, we would say that the worst is now over. Fourth, if inflation has started to decline, it means that the pressure on the economy through the Fed will weaken, which means the American economy will be able to avoid a recession!

For the dollar, however, all of the above is bad news. Recall that the dollar, which has grown significantly in recent months and even years, requires stronger reasons for further growth. And such grounds could be either new geopolitical conflicts (or an escalation of old ones) or an increased Fed rate at an increasingly rapid pace. But, as we can see, neither the first nor the second has been observed, so the market has taken the inflation report positively and now has less and less reason for new powerful dollar purchases. Thus, the general situation is now twofold. If you look at the general fundamental and geopolitical background, the dollar still looks more attractive for investment. If you look at how the fundamental background is changing, then the situation for the European currency is slowly starting to improve. It may not be immediately, but in the future, in the next 3-6 months, it will be possible to count on the formation of a new upward trend.

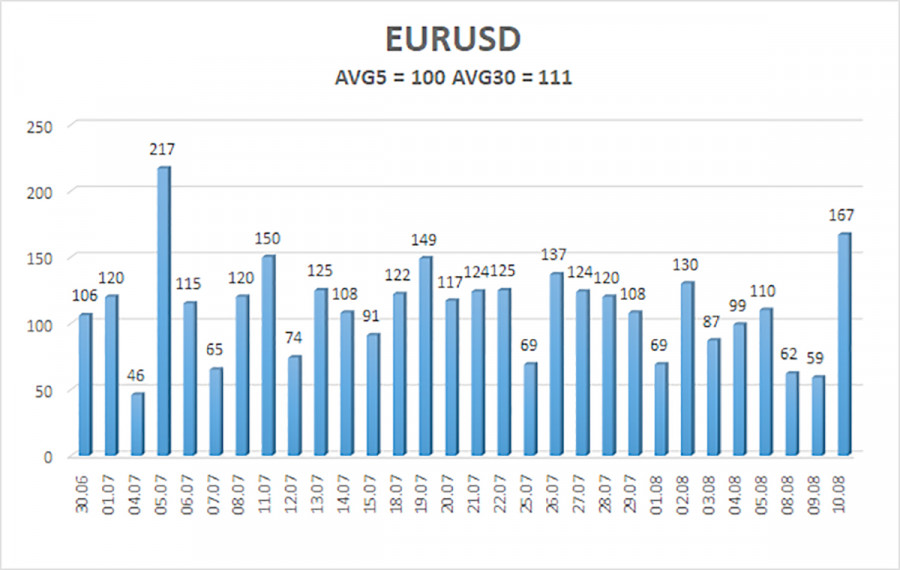

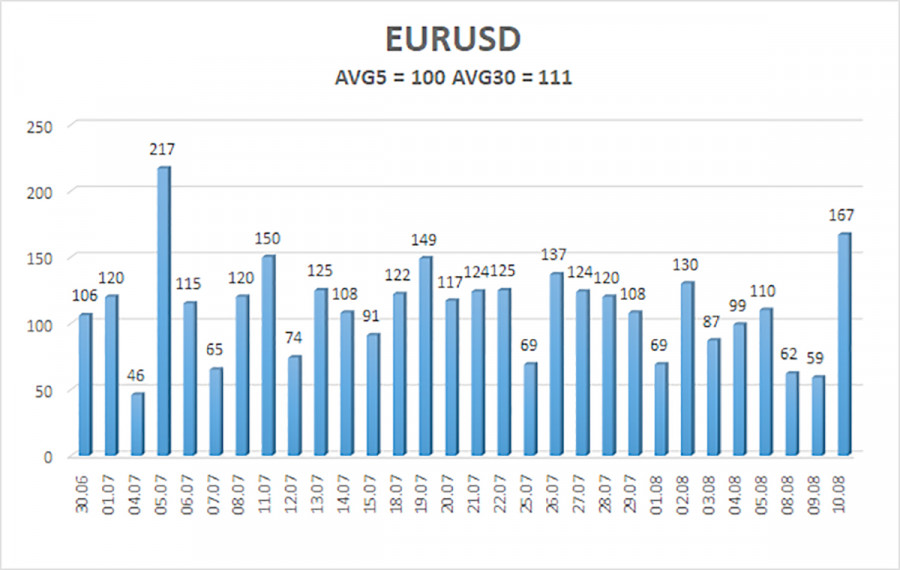

The average volatility of the euro/dollar currency pair over the last 5 trading days as of August 11 was 100 points, which is characterized as "high." Thus, we expect the pair to move today between 1.0220 and 1.0420. The reversal of the Heiken Ashi indicator downwards signals a round of downward movement.

Nearest support levels:

S1 – 1.0315

S2 – 1.0254

S3 – 1.0193

Nearest resistance levels:

R1 – 1.0376

R2 – 1.0437

R3 – 1.0498

Trading recommendations:

The EUR/USD pair is now trying to resume the upward trend. Thus, it is now possible to stay in long positions with targets of 1.0376 and 1.0420 until the Heiken Ashi indicator turns down. It will be possible to consider short positions again after fixing the price below the moving average with targets of 1.0132 and 1.0071.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which you should trade now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.