Overview of trading and tips on EUR/USD

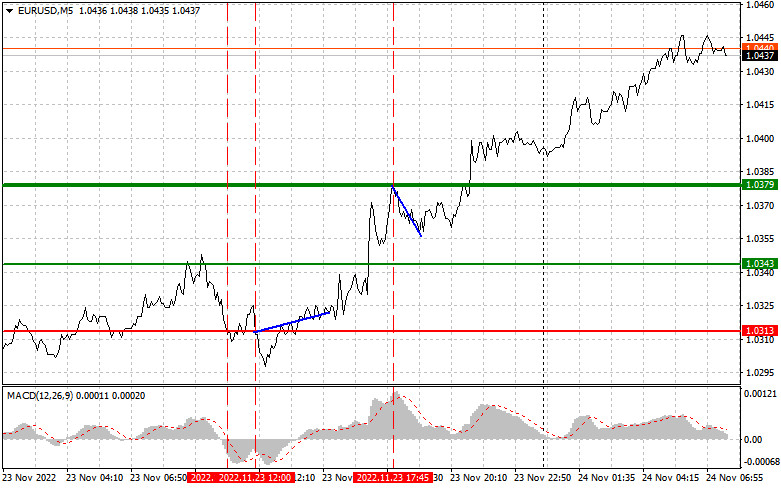

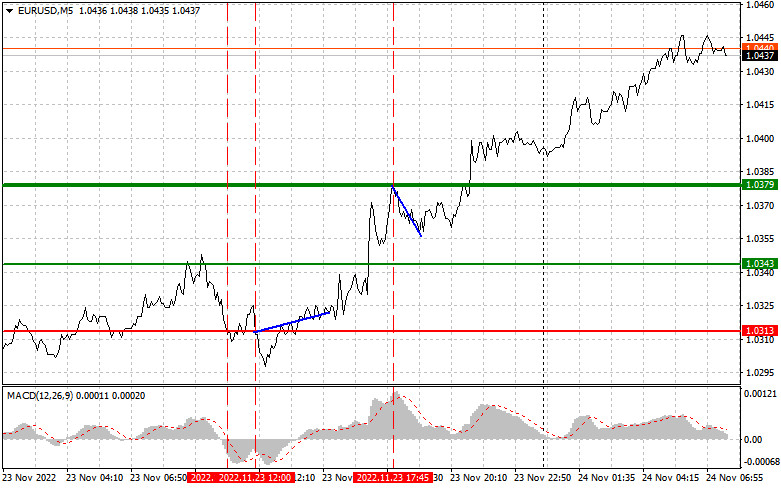

The level of 1.0313 was tested when the MACD indicator had passed downward considerably from the zero mark. This capped the downward potential of the instrument. For this reason, I didn't sell the euro, awaiting a buy signal. In a short while, there was a second test of 1.0313 where MACD had already entered the oversold zone in my opinion and had begun its recovery, thus forming a buy signal. Nevertheless, the price failed to develop a large upward move. In the second half of the day, traders were selling the pair at a bounce from 1.0379. I told you about it in my previous analysis. Short positions brought me about 25 pips of profit.

PMI reports on the eurozone's manufacturing sector and service sector as well as the composite PMI turned out to be stronger than expected. This stemmed the euro's decline in the first half of the day. Interestingly, similar PMI from the US discouraged traders. This triggered an active sell-off of the US dollar during the New York trade. As for the FOMC minutes released yesterday, the policymakers of the rate-setting committee informed that the likelihood of a recession in the US increased almost to 50% next year due to the risks of dwindling consumer spending, global economic headwinds, and further rate hikes. This is a bad omen for the US dollar which is expected to weaken further against the euro.

The economic calendar reminds us about a series of surveys by IFO experts on business climate, current economic sentiment, and economic expectations for Germany. The forecast is weak which could put pressure on the euro in the first half of the day. The highlight of the European session will be the ECB minutes of the last policy meeting. Besides, Member ECB Executive Board Isabel Schnabel is due to speak in the afternoon.

Hints about further aggressive monetary tightening will prop up the euro. In the second half of the day, US trading floors are shut on occasion on Thanksgiving Day. Hence, the trading volume will be sharply lower than usual. EUR/USD is set to trade under low volatility. I wouldn't recommend trading the currency pair in the thin market during the New York session.

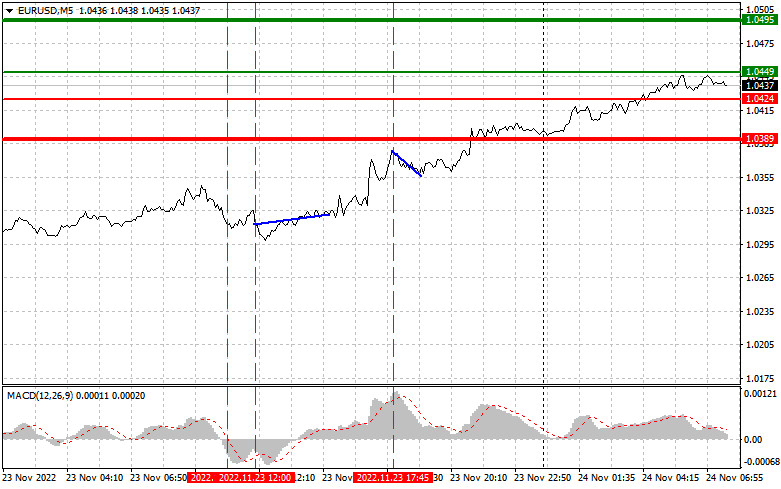

Buy signal

Scenario 1. We could buy EUR/USD today after the price reaches 1.0449 plotted by the green line on the chart with the upward target at 1.0495. The level of 1.0495 is the market exit point. Then, we could sell the euro in the opposite direction, bearing in mind a 30-35-pips downward move from the entry point with short positions. We could reckon on EUR's growth only in the case of the upbeat statistics from Germany. Importantly, before buying EUR/USD, make sure MACD is above the zero mark and is going to grow from it.

Scenario 2. Another option today is to buy EUR/USD after the price reaches 1.0424. However, MACD should stay in the oversold zone which limits the downward potential of the pair and entails the reversal of the trajectory. We could expect a climb to 1.0449 and 1.0495.

Sell signal

Scenario 1. We could sell the currency pair after the price reaches 1.0424 plotted by the red line on the chart. The target level is seen at 1.0390 where I recommend profit-taking. Then, we could go long on EUR/USD in the opposite direction, bearing in mind a 20-25-pips upward move. The currency pair might come under selling pressure in case of a failed breakout of a one-month high and weak statistics from Germany. Importantly, before selling the pair, make sure that MACD is below the zero mark and is going to start its decline from it.

Scenario 2. Alternatively, go short on EUR/USD today in case the price reaches 1.0449. At that moment, MACD should be in the oversold zone which will limit the upward potential of the pair and cause the upward market reversal. We could expect the price to decline to 1.0424 and 1.0389.

What's on the chart

The thin green line is the key level at which you can place long positions in the GBP/USD pair.

The thick green line is the target price, since the price is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the GBP/USD pair.

The thick red line is the target price, since the price is unlikely to move below this level.

MACD line. When entering the market, it is important to adjust trading decisions to the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid trading during sharp fluctuations in market quotes. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

Remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation will inevitably lead to losses for an intraday trader.