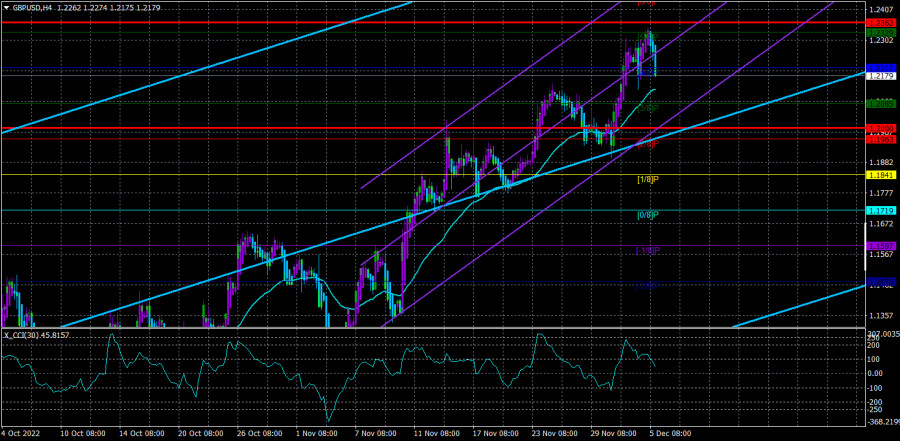

Also, on Thursday, the GBP/USD currency pair failed to break through the moving average line. If you examine the price movement since November 4 (or for a full month), you will see that only twice has the price been able to break below the moving average and quickly go back to the area above it. The British pound has increased by almost 2,000 points over the past 2.5 months, and the two-year downward trend is about 4,000 points. When there were good reasons and grounds for this, the pound fell by 4,000 points for two years. It has now increased by 2000 points in just 2.5 months. Depending on what?

One more time: the likelihood of another UK government change, the failure of Liz Truss' tax proposals, and the Supreme Court's decision to deny Scotland the right to hold a referendum are significant factors. Remember that the Bank of England has already increased the key rate eight times, which should help the pound. But are these explanations sufficient for the pair to change by 50% of the overall trend in just 2.5 months? Even though we have yet to see a single typical downward correction over the past 2.5 months. The pound's increase has been too brisk and abrupt. A significant pullback down is required for a new upward trend to continue (if one is, of course).

There are no headlines, important reports, speeches, or world events.

Typically, one major global issue dominates the information landscape, even though it may not directly affect the market's mood. Recent events include the UK's election of the Prime Minister, Liz Truss' resignation, the rejection of Truss' tax proposals, the passing of Queen Elizabeth II, and the Supreme Court of Great Britain's decision to deny Scotland the right to a referendum. Only those subjects that have recently been exclusively related to the UK are listed. As we can see, there was no fundamental issue for traders. Additionally, information was occasionally obtained from the Bank of England, which made every effort to revive the economy and balance the financial system. The early British economists Andrew Bailey and others made unfavorable predictions for the British economy, which also affected the mood.

Then what? The Scottish Referendum issue is resolved, and all disputes between the EU and Britain are put on hold. There needs to be more information from BA, the Ministry of Finance, or Rishi Sunak. In reality, there is nothing for traders to react to. Additionally, only some have access to strong macroeconomic reports, and even when they do, the market only sometimes responds to them logically.

The topic of the US congressional elections recently dominated the information sphere. Again, it is doubtful that this subject directly affected the dollar's value, but it at least provided fodder for conversation. Every time the Fed met, the rate increased by 0.75%. Then what? Although the Fed's monetary policy is tightening, the dollar is no longer rising. Long-term Fed interest rates will be high, but the dollar cannot adjust. Since important data is released every two to three days, there is little to talk about in the foreign exchange market. Even macroeconomic reports are released regularly. The fundamental background currently leaves much to be desired in general. The strategy enables the British pound to grow indefinitely, but it is simple to use when the price is at its highest point, and all indicators point upward. As before, at the very least, the price must surpass the moving average, which it has yet to do, to expect a strong downward correction.

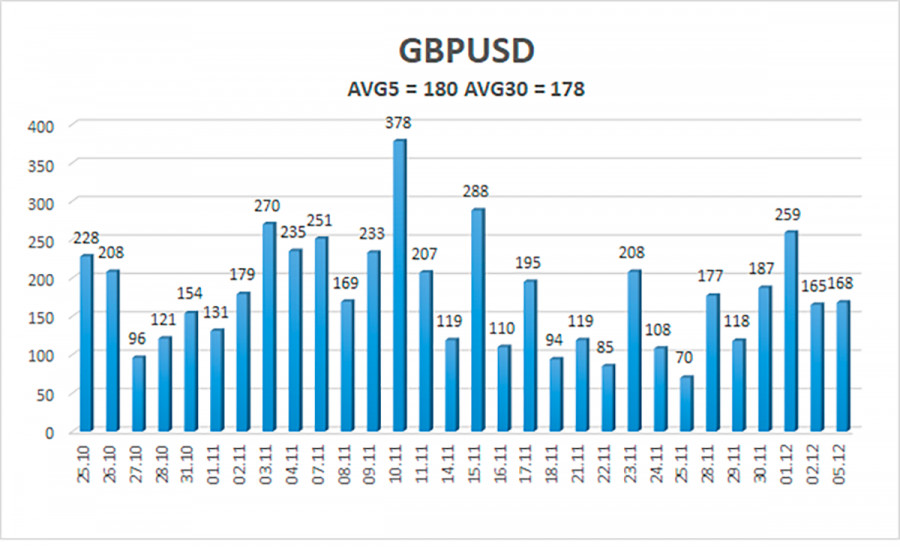

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 141 points. This value for the dollar/pound exchange rate is "very high." Thus, we anticipate movement inside the channel on Friday, December 9, constrained by 1.2076 and 1.2357. The Heiken Ashi indicator's downward reversal once more indicates an attempt by the pair to correct.

Nearest levels of support

S1 – 1.2207

S2 – 1.2146

S3 – 1.2085

Nearest levels of resistance levels

R1 – 1.2268

R2 – 1.2329

R3 – 1.2390

Trading Suggestions:

In the 4-hour timeframe, the GBP/USD pair attempts to move upward. Therefore, until the Heiken Ashi indicator turns down, you should maintain buy orders with targets of 1.2329 and 1.2357. With targets of 1.2085 and 1.2024, open sell orders should be fixed below the moving average.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.