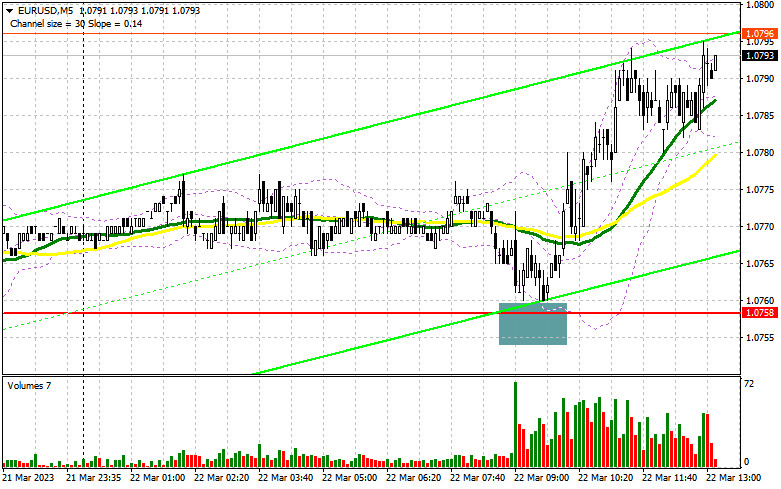

In my morning article, I turned your attention to 1.0758 and recommended making decisions with this level in focus. Now, let's look at the 5-minute chart and figure out what actually happened. After a decline, the pair lacked only few pips to make a false breakout of 1.0758. So, traders went long from this level. For the afternoon, the technical outlook remained the same.

When to open long positions on EUR/USD:

The euro could resume an upward movement before the Fed's rate decision. The key rate is projected to reach 5.0%. A sharper rise may take place only if the central bank leaves the interest rate unchanged. If Jerome Powell makes hawkish comments, confirming further tightening to cap inflation, the pressure on the pair will escalate. So, EUR/USD could lose momentum in the afternoon. If the pair falls, it is better to open long positions only after a test and a false breakout of the support level of 1.0761. The pair may grow to the resistance level of 1.0801. A breakout and a downward retest of this level will give an additional entry point into long positions with a jump to 1.0834. It will be hard for the bulls to push the pair above this level. A breakout of 1.0834 amid Powell's dovish rhetoric will force the bears to close Stop Loss orders, creating new entry points with the possibility of a rise to a high of 1.0873. At this level, I recommend locking in profits. If EUR/USD declines in the afternoon and buyers show no activity at 1.0761, the pressure on the euro may return. The moving averages are also passing at that level. A breakout of this level may cause a fall to the support level of 1.0724. Only a false breakout of this level will provide new entry points. You could buy EUR/USD after a bounce from 1.0691 or 1.0652, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on EUR/USD:

The bears need to protect a new monthly high of 1.0801, which acts as the resistance level. A test of this level may occur in the afternoon. It would be wise to open short positions after a false breakout of this level. The euro may fall to the support level of 1.0761, formed during the European session. A breakout and an upward retest of this level will push the pair lower, generating new entry points in short positions. The pair could drop to 1.0724. A slide below this level after the Fed's rate decision and Jerome Powell's testimony may trigger a more significant downward movement to 1.0691. At this level, I recommend locking in profits. If EUR/USD rises during the American session and bears show no energy at 1.0801, which is quite likely, I would advise you to postpone short positions until a false breakout of 1.0834. You could sell EUR/USD at a bounce from 1.0873, keeping in mind a downward intraday correction of 30-35 pips.

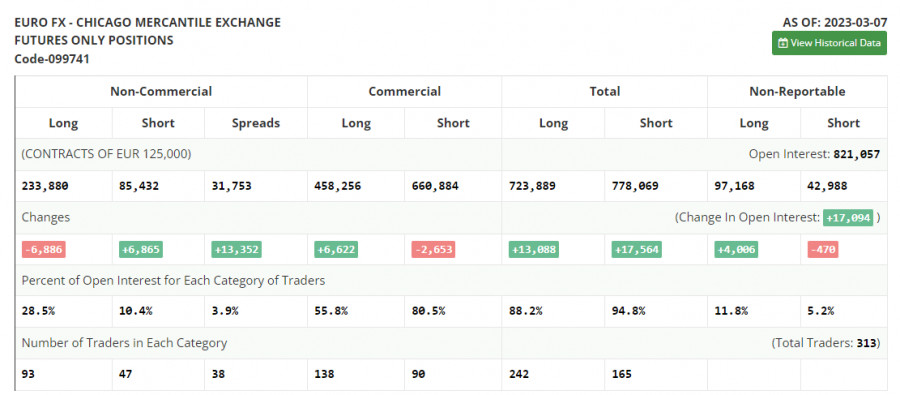

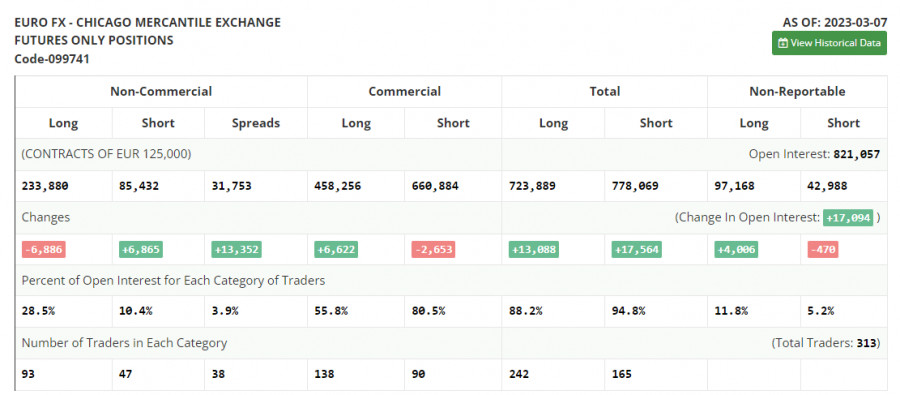

COT report

According to the COT report from March 7, the number of long positions dropped, whereas the number of short positions increased. Notably, the data is of zero importance at the moment as it was relevant two weeks ago. The CFTC is still recovering after a cyberattack. It is better to wait for new reports. This week, the Federal Reserve will hold a meeting, during which it may pause the monetary policy tightening. The fact is that the problems in the banking sector and the launch of a new credit swap line to support other banks with liquidity may seriously affect the economy. If Jerome Powell decides to raise the key rate higher, the US dollar is unlikely to receive support. Traders are pricing in the Fed's switch to a less hawkish stance and monetary policy loosening by the end of the year. The COT report unveiled that the number of long non-commercial positions dropped by 6,886 to 233,880, while the number of short non-commercial positions increased by 6,865 to 85,432. At the end of the week, the total non-commercial net position decreased to 148,448 against 165,038. The weekly closing price dropped to 1.0555 against 1.0698.

Indicators' signals:

Trading is carried out above the 30 and 50 daily moving averages, which indicates a further rise.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If EUR/USD declines, the indicator's lower border at 1.0761 will serve as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.