The release of the CFTC report, due to the holiday in the United States, has been rescheduled from Friday to Monday, so the update on speculative positioning in the futures market will be considered on Tuesday.

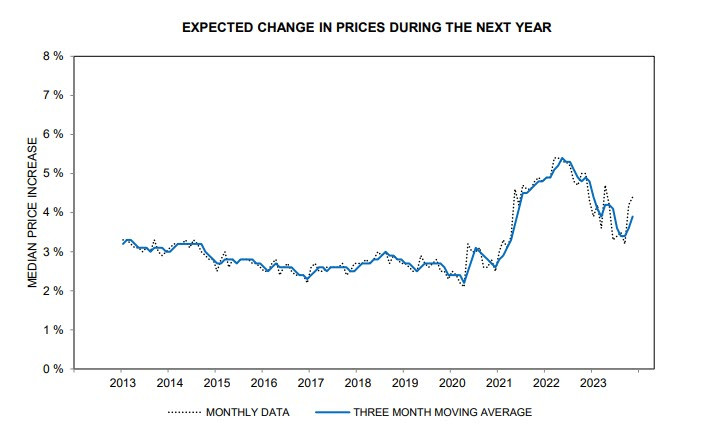

The University of Michigan's reading of its 12-month inflation expectations jumped from 4.2% to 4.4%, exceeding the forecasted 4.0%, but more importantly, the 5-10 year inflation expectations also rose to 3.2%, surpassing the previous figure of 3.0%. Both factors shifted the focus away from weak economic indicators in the United States, reducing the chances of a stronger dollar..

Comments from Federal Reserve representatives on Friday generally supported Fed Chair Jerome Powell's earlier concerns about inflation and his inclination towards further monetary policy tightening. In a conversation with CNBC, San Francisco Fed representative Mary Daly noted that although policy is restrictive, more could be guaranteed if inflation were to rise or even remain sideways. Atlanta Fed President Bostic was more dovish, stating that he expects to reach the 2% inflation target without any additional measures.

Now the market is focused on the US inflation report for October, which will be published on Tuesday. The forecast for the core index is neutral, with expectations that it will remain at the previous month's level of 4.1%. If core inflation increases, it will signal a potential for buying the dollar, as the probability of another Fed rate hike would rise.

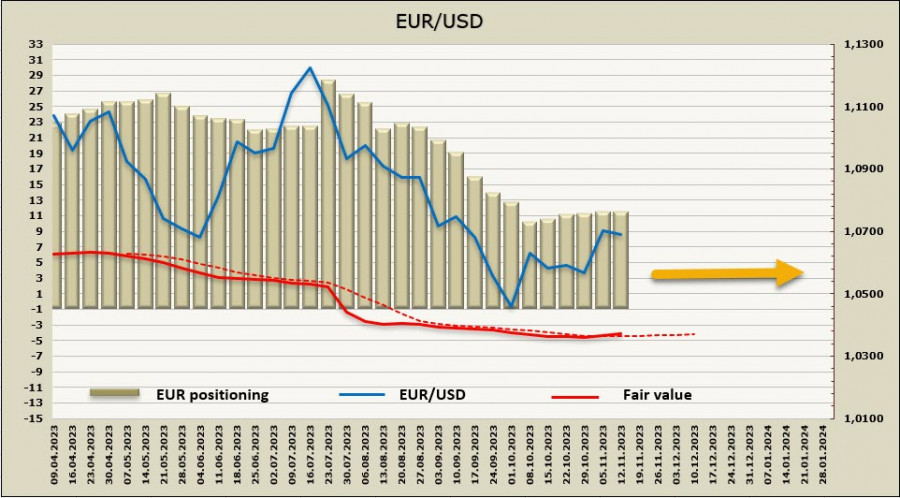

EUR/USD

European bond yields rose on Friday after European Central Bank President Lagarde's hawkish remarks. According to her speech, the deposit rate will remain at 4% for an extended period, and if necessary, borrowing costs may increase further.

The GDP growth rates in Europe have slowed down, and activity in the service sector is contracting alongside a slowdown in industry. The ECB has paused the process of tightening monetary policy, stating that policy is sufficiently restrictive to curb inflation. However, forecasts are very volatile and rely on the assumption that the situation in the energy market will not lead to an increase in natural gas prices. It is unclear how much the euro's exchange rate reflects the potential worsening situation, so the current consolidation can be considered a temporary phenomenon that may end with another downward wave.

In the absence of updated CFTC data, the price is close to the long-term average, and the direction is indistinctive. An attempt to turn upwards is noticeable, but we should not rely on this for now.

EUR/USD is trying to develop a corrective phase, with the nearest targets at 1.0760 and then 1.0810/20. There are chances to start an upward movement, but since it is a corrective move, we should not expect the pair to rally. We may witness a strong movement after the release of the US inflation report. If it turns out to be higher than expected, the euro will fall and the corrective growth will end.

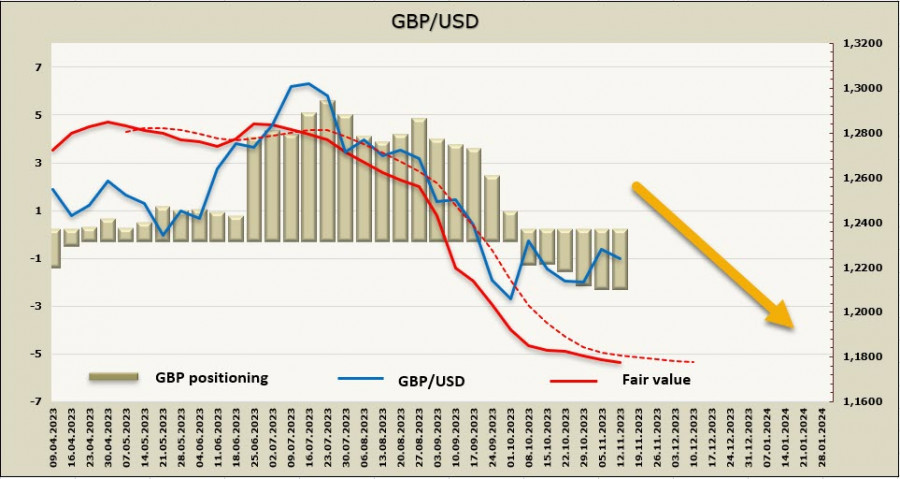

GBP/USD

The UK's GDP data for the third quarter turned out better than expected, with 0% change against a forecast for a 0.1% fall. Consumer spending, investments, and government spending were in the negative, while trade showed growth. NIESR predicts that even in the fourth quarter, GDP growth will be weak but positive, reducing the threat of a recession in the UK.

Weak economic growth, coupled with high inflation, weakens the pound. The risk of a recession has diminished but not disappeared, as higher interest rates put pressure on consumption and housing, ultimately leading to the disappearance of the positive yield spread that supported the pound until August. The positive NIESR forecast somewhat eases the pressure on the pound and may give it the opportunity to stabilize at current levels.

The price remains below the long-term average, reducing the chances of starting a corrective phase.

If the pound manages to maintain a bullish sentiment, the pair could move towards the resistance area at 1.2470/90, where the upper band of the corrective channel lies. It is more likely for the pair to stop rising below the resistance at 1.2427, followed by consolidation or a downward reversal. At the moment, there are no grounds for strong movements, making trading within the range of 1.2130/50 more probable.