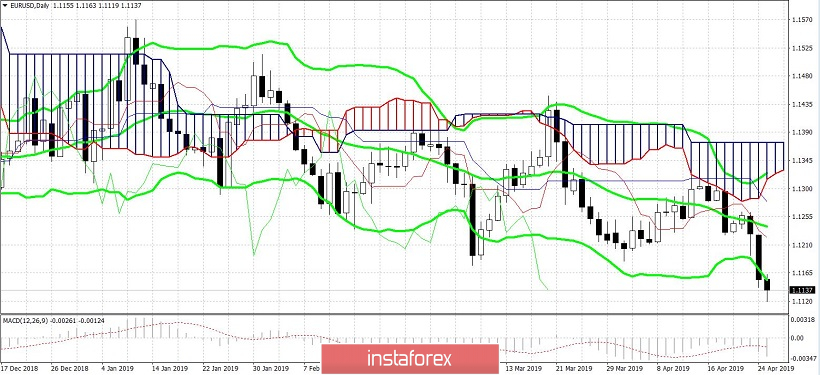

The US currency shows growth throughout the market for the second day in a row. With rare exceptions (for example, USD/JPY), the greenback dominates in all dollar pairs, and for the first time since May 2017, the dollar index tested the area with 98 points. The euro-dollar pair also set a kind of price record, falling to two-year lows (to be more precise, to the troughs of January 2017). After the EUR/USD bears were able to penetrate the support level of 1.1170 (the bottom line of the Bollinger Bands indicator on the daily chart), on the horizon, there were real prospects for a decline to the 10th figure. But this is not an easy task - as early as the US session on Thursday, the price moved from the low of the day to 1.1119 in anticipation of tomorrow's release of data on the growth of the American economy.

However, many currency strategists refer to the dollar's "April rally" with a certain skepticism. In their opinion, the dynamics of dollar pairs is largely due to the weakness of other currencies, and not the strengthening of the greenback. For example, the yen successfully opposes itself to the dollar, "monetizing" the status of the defensive asset. The Canadian dollar also halted its decline after the Bank of Canada's dovish meeting. The euro-dollar pair is in a losing situation in this context. First of all, the uncorrelation of the positions of the ECB and the Fed has been significantly enhanced lately. If the Fed has taken a strictly wait-and-see attitude, retaining the likelihood of a rate hike at the beginning of next year (or even in December of this year), the European Central Bank already allows for policy easing. Thus, ECB Vice President Luis de Guindos said today that the regulator is ready to resume the quantitative easing program (QE) in order to provoke a rise in inflation.

Let me remind you that the core consumer price index has been falling for the second month in a row. The pace of deceleration is depressing - if in March, core inflation was at the level of 1%, then in April it was already at the level of 0.8%, contrary to more optimistic expectations of experts. And although Mario Draghi did not talk about the resumption of QE, following the April meeting of the ECB, he hinted quite transparently that the regulator would react to the incoming statistical reports. Today, Guindos has actually clarified exactly how the central bank can respond to a further decline in inflation in the eurozone.

By and large, this statement has become today's catalyst for the EUR/USD pair's decline. It sounded almost simultaneously with the publication of the ECB Economic Bulletin, the tone of which reflects the sentiments of the members of the regulator at the last meeting. The essence of this document comes down to the fact that the eurozone economy still needs "extensive accommodation measures", while the risks of growth of the EU economy remain downward. And how can we not remember the insider information of American journalists? According to their data, some members of the ECB questioned the accuracy of the forecast models used by the regulator. In their opinion, this model gives a distorted picture and does not fully take into account the revised macroeconomic indicators. The ECB minutes published today, as well as Guindos' statement, confirmed the "dovish" attitude of the members of the European regulator.

Growing concern over the slowdown in the eurozone's economic growth is putting the background pressure on the single currency. At the same time, positive statistical reports from the US only aggravate the position of the EUR/USD bulls. In particular, the March sales of new buildings grew by 4.5%, exceeding the expectations of most experts. In terms of annual rates, this result is the highest since November of the year before last. Today an important release was also published: the volume of orders for durable goods. This indicator exceeded even the most daring expectations. The total volume of orders increased immediately by 2.7% (with a growth forecast of 0.7%), and excluding transport - by 0.4% (with a forecast of 0.2%). Such figures against the backdrop of favorable corporate reporting again supported the US currency.

Now the dollar will have to pass the main "test" of this week. We are talking about the publication of data on the growth of the US economy. Here it should be recalled that the US economy reached its "local" high in the second quarter of last year, when US GDP reached its peak – 4.2%. After that, the indicator began to gradually decline, reaching 2.2% in the 4th quarter of 2018. According to the forecasts of most analysts, the US economy will show a similar result in the first quarter of this year. If the real figures do not coincide with the forecast, the dollar will significantly lose its positions throughout the market, and the EUR/USD pair will not be an exception. It is also worth paying attention to the price index of GDP – according to forecasts, it should significantly decrease (from 1.7% to 1.3%). This fact can put strong pressure on the dollar, even if GDP growth is at the projected level.

From a technical point of view, the bears need to enter the 10th figure in order to finally declare their intention to approach the key resistance level of 1.1000. Bulls have a more difficult task: buyers need to return the price above 1.1240 (the average Bollinger Bands line on D1 coinciding with the Tenkan-sen line). And although the bears of the pair have absolute priority at the moment, Friday's "test" can return the price to the framework of the 12th figure.