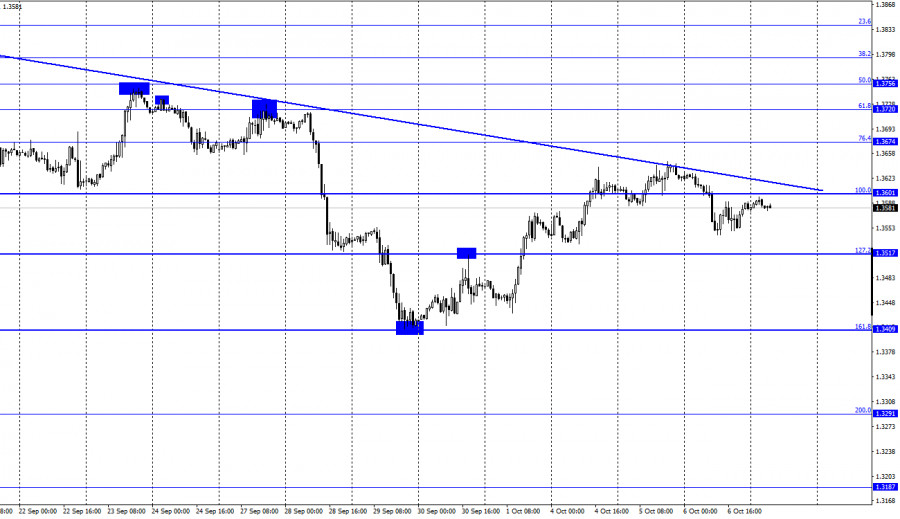

GBP/USD – 1H.

According to the hourly chart, the GBP/USD pair increased to the downward trend line and rebounded from it. Thus, the process of falling quotes can be resumed. Yesterday, I said that selling the pair is possible if the closing is performed under the level of 100.0% (1.3601). Today, the process of falling can be continued in the direction of the Fibo level of 127.2% (1.3517). Fixing the pair's rate above the trend line will work in favor of the British and will change the mood of traders to "bullish."

Meanwhile, in the UK, the situation with fuel and truckers is slowly beginning to improve. The UK government has taken all possible measures to attract as many drivers as possible to solve the problem. Both military and drivers quickly attracted from EU countries took part. However, this is only a local solution to the problem. In the long term, the driver shortage problem needs to be solved structurally and not by one-time measures. But the situation around Brexit and the Northern Ireland protocol is starting to heat up again.

French Foreign Minister Jean-Yves Le Drian said earlier this week that relations between Paris and London should be reviewed. The French Foreign Minister believes that the UK systematically violates its obligations in matters of trade and cooperation. London recently signed an agreement with the United States and Australia on defense cooperation. Because of this agreement, Canberra broke the contract with the French company Naval Group, which provided for the construction of submarines worth about $ 66 billion. Paris has already accused Canberra of "stabbing in the back" and even recalled its ambassador from Australia. Thus, Britain continues to establish ties outside the European Union but at the same time wants to remain in good relations with the EU itself. However, it remains to be seen how the story of the Northern Ireland protocol will end, which Britain wants to abandon completely and develop a new protocol that will work better than the current one.

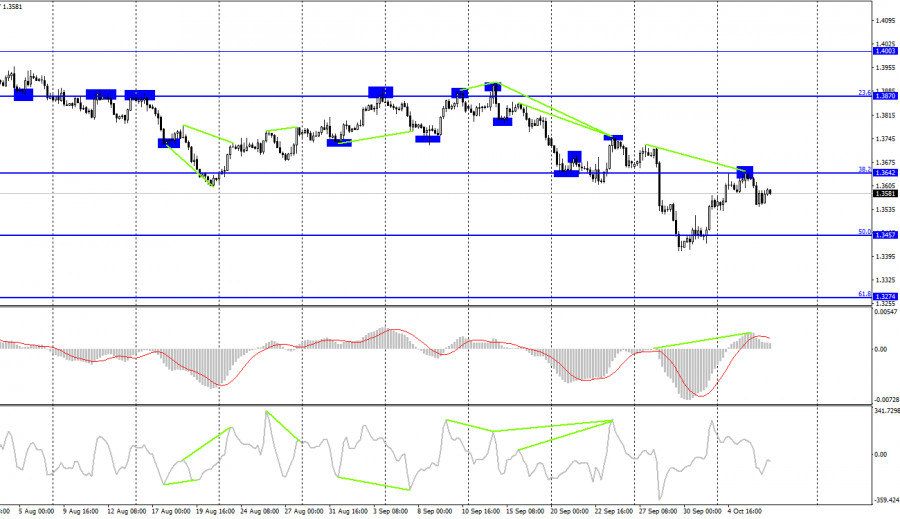

GBP/USD – 4H.

The GBP/USD pair on the 4-hour chart performed an increase to the corrective level of 38.2% (1.3642), rebound from it, and a reversal in favor of the US currency. A bearish divergence has also formed in the MACD indicator, which increases the likelihood of a further drop in quotes in the direction of the corrective level of 50.0% (1.3457). Closing the pair's rate above the level of 1.3642 will work in favor of continuing growth towards the next corrective level of 23.6% (1.3870).

News calendar for the USA and the UK:

US - number of initial and repeated applications for unemployment benefits (12:30 UTC).

On Thursday, the calendars of economic events in the US and the UK contain only one report for two. Applications for unemployment benefits have long been of no interest to traders, so it is unlikely that it will cause a reaction today. However, there will be no other reports and events today.

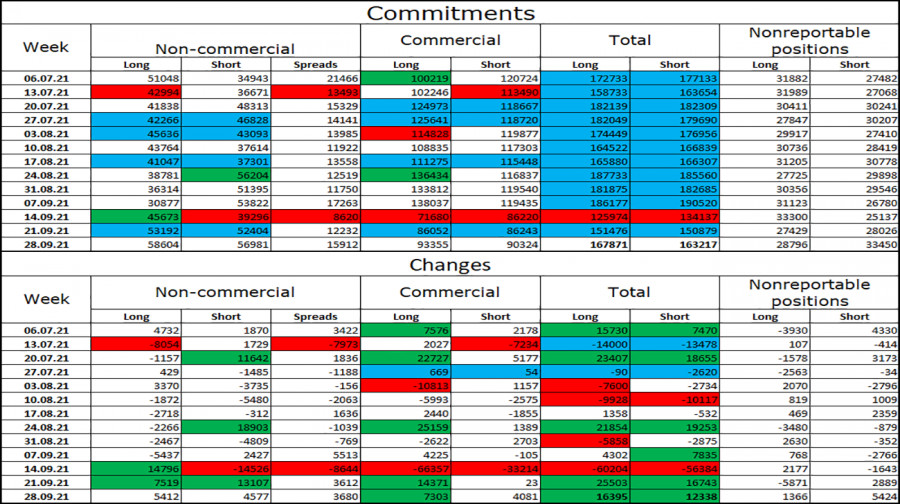

COT (Commitments of Traders) report:

The latest COT report from September 28 on the pound showed that the mood of the major players has become a little more "bullish." In the reporting week, speculators opened 5,412 long contracts and 4,577 short contracts. So the difference is not too big. In general, there is almost complete equality in the number of open long and short contracts for all categories of traders. It means that the mood of speculators is now as neutral as possible. Nevertheless, in recent months, the mood of the "non-commercial" category has only become more "bearish." Thus, there is a trend that suggests a further decline in the British dollar.

GBP/USD forecast and recommendations to traders:

I recommend buying the pound when closing quotes above the trend line on the hourly chart with a target of 1.3720. I recommended opening sales yesterday, as the quotes performed a rebound from the level of 1.3642 on the 4-hour chart, with a target of 1.3517. Now, these deals can be kept open.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.