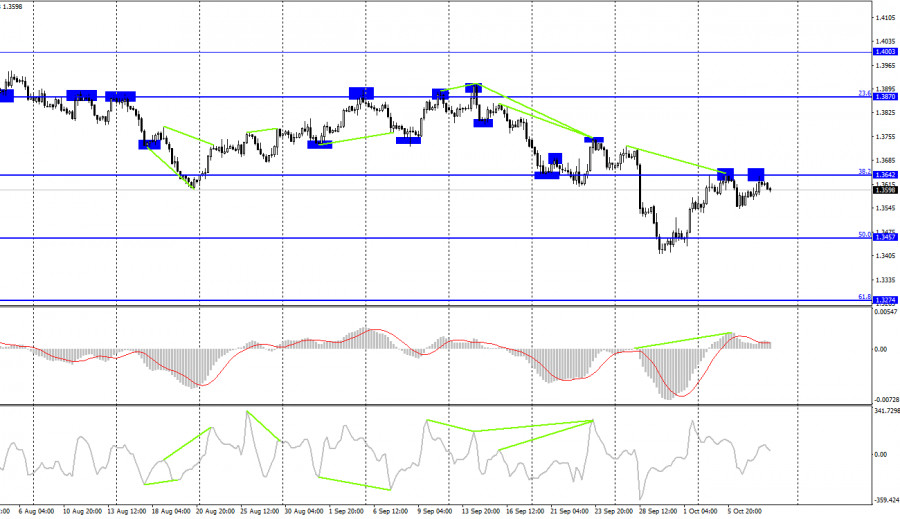

GBP/USD – 1H.

According to the hourly chart, the GBP/USD pair secured above the corrective level of 100.0% (1.3601) but could not continue the growth process. As a result, a reverse reversal was performed in favor of the US currency, and a new fall began in the direction of the Fibo level of 127.2% (1.3517). The GBP/USD pair moved very inactively yesterday, as did the EUR/USD pair. A very weak information background facilitated it. In general, now there is a somewhat paradoxical situation. If you look only at economic data, there are few of them, and traders often do not even pay attention to them. If you look more broadly, interesting and problematic topics arise before your eyes, such as the US debt limit or monetary policy and the Fed's QE program.

Nevertheless, it can hardly be said that these topics also somehow affect the mood of traders. More precisely, they can have some influence. However, it isn't easy to understand what and when because the pair is not moving in the same direction as the euro/dollar. Periods of decline are replaced by periods of growth. As recently as yesterday, the quotes performed a close over the downward trend line. Thus, the mood of traders could have already changed to "bullish," which implies further growth of the British dollar. Today, it should be easier with an informational background. Although a new speech by US Treasury Secretary Janet Yellen will take place today, traders are unlikely to put this event first.

The US Treasury Secretary has been repeating the same calls to Congress to raise the debt limit in recent months. Nothing else. Thus, the key event of the day will be the Nonfarm Payrolls report in the USA. Let me remind you that one report on the state of the labor market in the USA has already been released this week – ADP. However, the Nonfarm Payrolls report is more important. Traders' expectations are 490 thousand new jobs outside the agricultural sector. Any value above this can cause purchases of the US currency, which will result in a new fall in the euro/dollar and pound/dollar pairs.

GBP/USD – 4H.

The GBP/USD pair on the 4-hour chart performed a new growth to the corrective level of 38.2% (1.3642), another rebound from it, and a reversal in favor of the US dollar. A bearish divergence has also formed in the MACD indicator, which increases the probability of a new drop in quotes toward the corrective level of 50.0% (1.3457). Closing the pair's rate above the level of 1.3642 will work in favor of the British and resume growth towards the next corrective level of 23.6% (1.3870).

News calendar for the USA and the UK:

US - Treasury Secretary Janet Yellen will deliver a speech (12:05 UTC).

US - unemployment rate (12:30 UTC).

US - change in the number of people employed in the non-agricultural sector (12:30 UTC).

US - change in the average hourly wage (12:30 UTC).

On Friday, the calendar of UK economic events is empty, and the US calendar contains several important entries at once. I recommend paying the most attention to the Nonfarm Payrolls report.

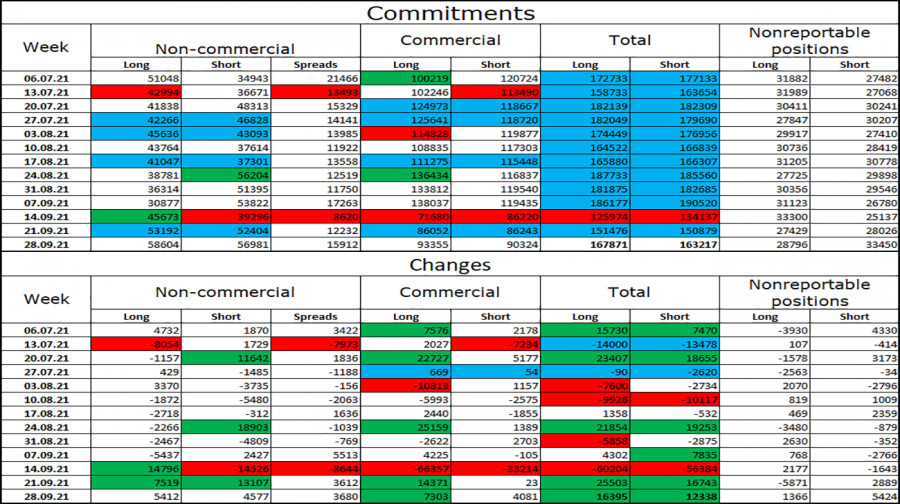

COT (Commitments of Traders) report:

The latest COT report from September 28 on the pound showed that the mood of the major players has become a little more "bullish." In the reporting week, speculators opened 5,412 long contracts and 4,577 short contracts. So the difference is not too big. In general, there is almost complete equality in the number of open long and short contracts for all categories of traders. It means that the mood of speculators is now as neutral as possible. Nevertheless, in recent months, the mood of the "non-commercial" category has only become more "bearish," so there is a trend that suggests a further decline in the British dollar.

GBP/USD forecast and recommendations to traders:

I recommend buying the British when closing quotes above the level of 38.2% (1.3642) on the 4-hour chart with a target of 1.3720. I recommended opening sales yesterday, as the quotes performed a rebound from the level of 1.3642 on the 4-hour chart, with a target of 1.3517. Now, these deals can be kept open.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy foreign currency not to make speculative profits but to ensure current activities or export-import operations.

"Non-reportable positions" are small traders who do not have a significant impact on the price.