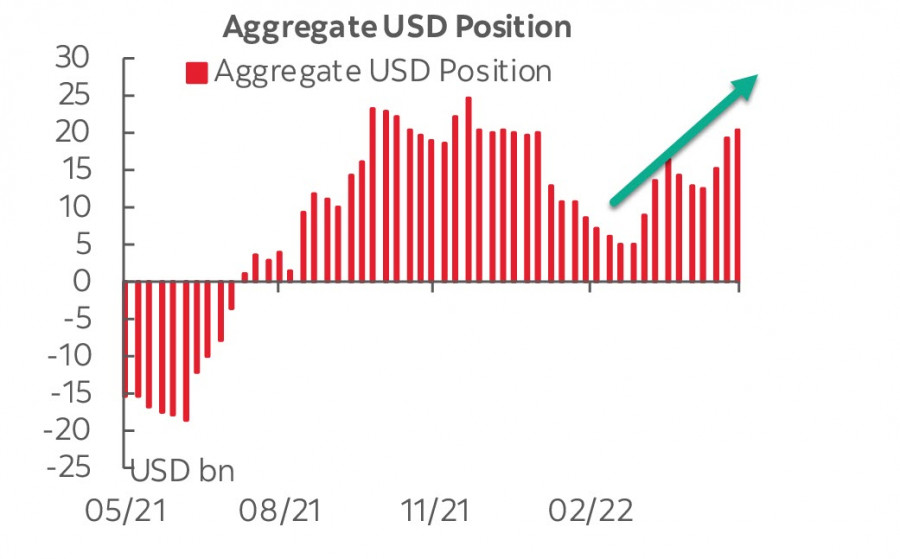

There were no surprises in the CFTC report published on Friday. Investors continue to build up net long positions in USD, with a weekly gain of 782m. Bullish outperformance reached 20.2bn.

A key feature of the report is a marked decrease in long positions in commodity currencies. This may indicate a growing risk of an approaching global economic crisis, which will also be accompanied by a decline in commodity consumption.

Stock indices ended Friday in positive territory. Asia-Pacific countries also supported the rising optimism, which was based on China's announcement of the start of the withdrawal from Covid restrictions. This is perhaps the only positive news. The US consumer sentiment dropped more than expected, falling sharply by -9.4% to 59.1 (consensus 64.0) and reaching its lowest level since August 2011. Purchases of durable goods are at their lowest level since data collection began in 1978. The same decline is seen in the home purchase index, which has fallen sharply in recent months to its lowest level since 1982.

Rising demand for the dollar remains the dominant idea on the foreign exchange market. However, the reason for this is not the strength of the US economy but a number of other less pleasing facts - the high rate of normalization from the Fed and the need to meet loan commitments in the face of rising funding costs.

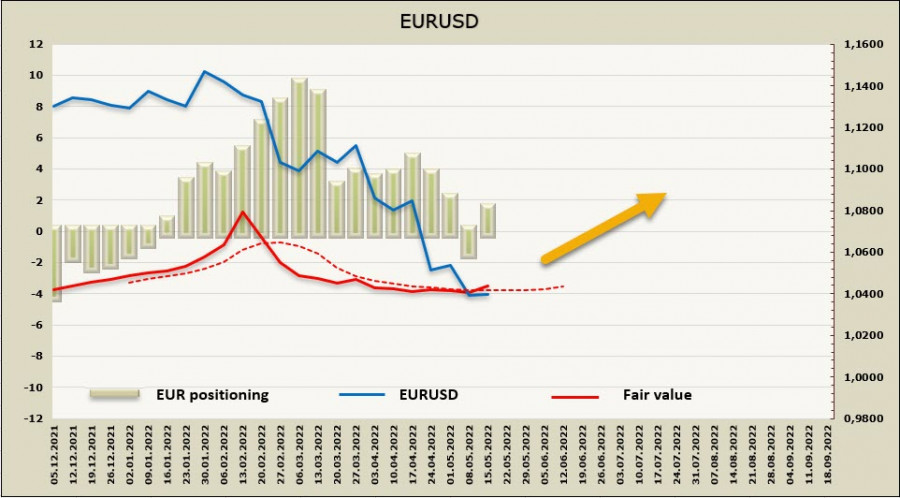

EURUSD

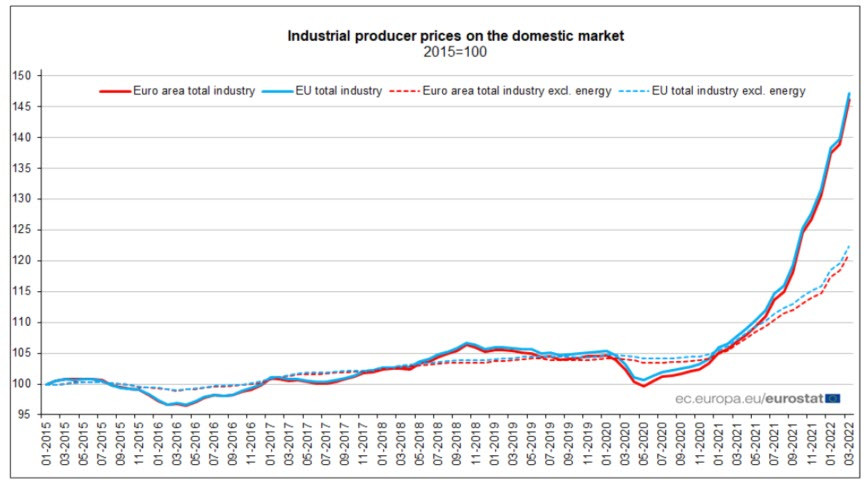

Producer price growth in the Eurozone was 5.3% in March. On a year-on-year basis, an increase of 36.8% was recorded. This is an all-time high in the history of data collection.

There has been a steady upward trend in prices in all sectors of the economy in Europe. Rising consumer inflation is accelerating, which dramatically increases the likelihood of a recession. On Wednesday, consumer inflation for April will be published. On Thursday the ECB meeting minutes will be released. Markets are waiting for signals that the ECB may start to get tougher on rising prices, which could eventually halt the euro's fall.

The positioning on the euro has unexpectedly changed direction. More than $3bn was added to long positions in the euro. This is the biggest weekly change in favour of the euro since August last year. A net long position of $2.2bn has been formed. It is not yet clear what has caused such a dramatic change in sentiment, but it must be assumed that the euro sell-off may be over. The settlement price makes an attempt to move above the long-term average, which gives a chance for a corrective rise.

Support at 1.0330 is still key. In the event of a breakdown, an acceleration of the euro's fall is possible, with parity getting closer. However, the positioning on the Euro has changed from minus to plus sign. This might be a signal that the bears are not yet strong enough to move towards parity, which increases the chances of a pullback. The nearest resistance is 1.0470. Attempts to pull back higher are likely before a decisive move towards parity.

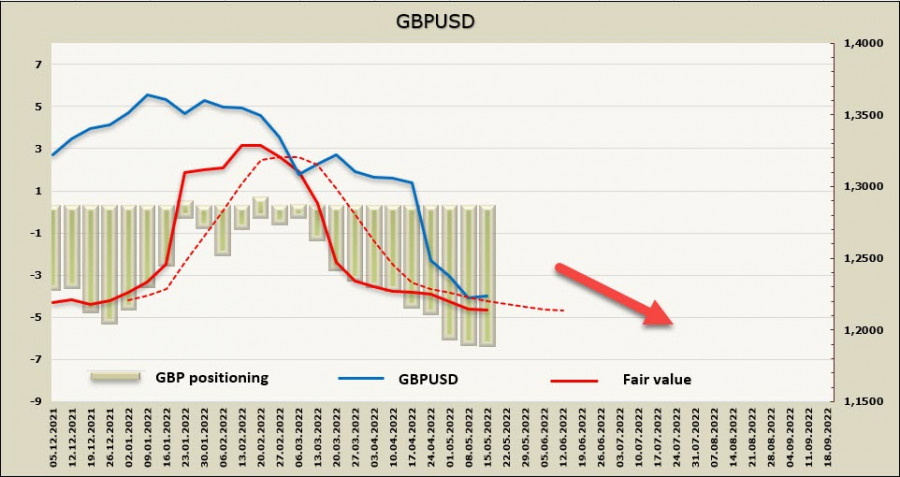

GBPUSD

The macroeconomic data published last week did not bring the pound any positive news. GDP growth in March points towards recession (-0.1%). The trade balance is deteriorating, and industrial production fell by 0.2% in March instead of the expected growth.

Tuesday will see the March/April labor market report. On Wednesday, the consumer price index will be released and on Friday, there will be a retail sales report. On the labor market, the focus will be on wage growth as March has already seen a 5.4% increase, with inflation forecast to rise to 9.1%, causing problems for the Bank of England. As rising inflation reduces real household incomes, the retail sales report could cause increased volatility if it shows a deviation from forecasts.

During the reporting week, the Pound lost another 361 million. The net short position reached -6.127 billion. The bearish outperformance is obvious, there are no signs of a reversal. The settlement price is below the long-term average and is directed downwards.

We assume that the downtrend in the pound will continue. The nearest target is 1.2070. Further an attempt of updating of psychological level 1.20 is probable. For full correction there are no fundamental bases.