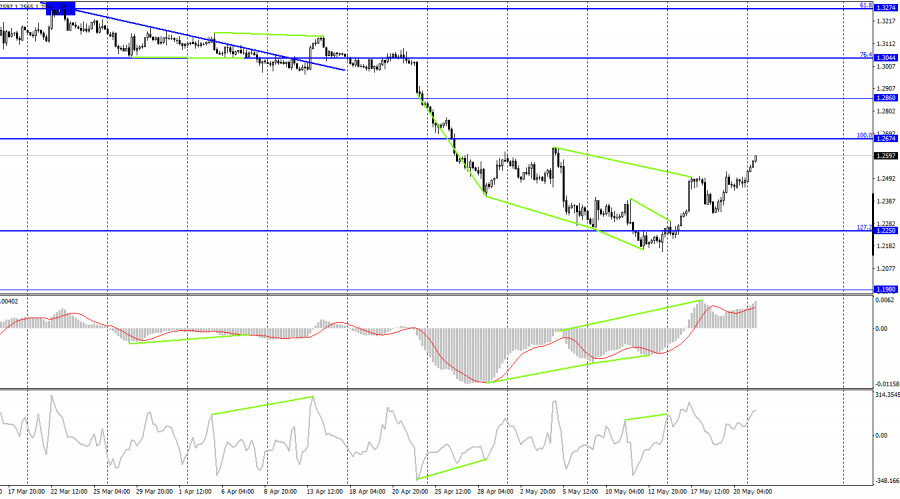

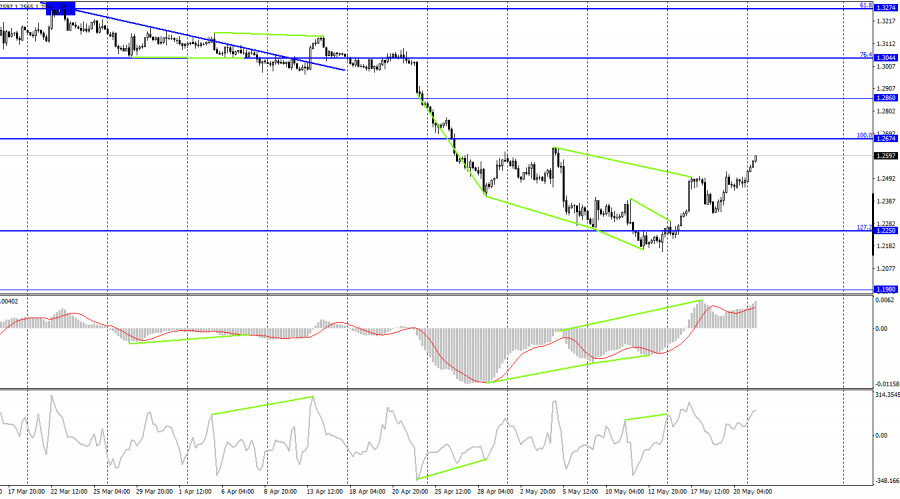

According to the hourly chart, the GBP/USD pair traded slightly above the corrective level of 423.6% (1.2432) on Friday, and today resumed the growth process and rose to the level of 1.2600. The rebound of the pair's rate from this level will work in favor of the US currency and the beginning of a fall in the direction of the lower border of the ascending trend corridor. Fixing quotes under the corridor will increase the chances of further growth towards the next Fibo level of 423.6% (1.2432). The pound today had no support from the information background. Nevertheless, it grew significantly in the first half of the day, and this growth has been going on for more than a week. I admit that the British can continue to grow for the same reasons as the Europeans. The main factor in the fall of both currencies in recent months has been geopolitics. But recently, the conflict between Russia and Ukraine is increasingly approaching the stage of "freezing". Approximately the same thing we observed in 2014 and over the next 8 years. Thus, traders have now clearly calmed down about this, and until the conflict escalates, the pound and the euro may grow.

Unfortunately, I think that an escalation of the conflict is very possible. The European Union continues to impose sanctions against Russia, even though Hungary has now rejected the sixth package of sanctions. Nevertheless, the attitude of European politicians remains negative towards Russia, so now there is no question of lifting sanctions. Kyiv and Moscow have stopped peace talks and are not going to return to them. But if in 2014 Ukraine did not have the support of the West and intentions to take Donbas and Crimea by military means, now the support of the West is not just tangible, it is very strong. Thus, in the coming months, the military confrontation may flare up with renewed vigor, and the European economy may be under even greater threat. Already, European experts are discussing the shortage of food in Europe and around the world, since it is Ukraine and Russia that are the main exporters. Of course, hunger does not threaten the UK and Europe, but the economy may shrink, and prices will rise even more for everything.

On the 4-hour chart, the pair secured above the corrective level of 127.2% (1.2250), which allows it to continue the growth process towards the next Fibo level of 100.0% (1.2674). The "bearish" divergence of the MACD indicator allowed the pair to perform a slight drop, but now the growth process has resumed. No new emerging divergences are observed in any indicator today.

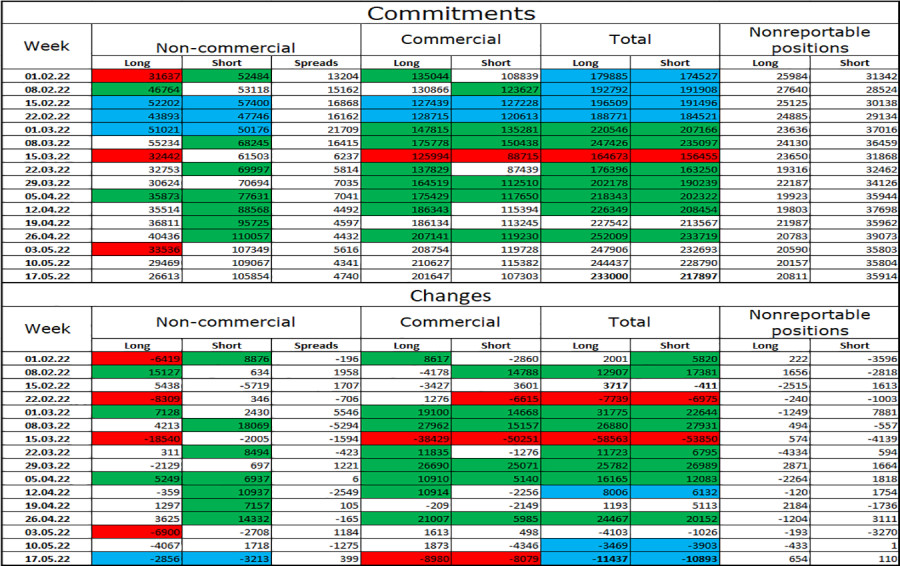

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has not changed too much over the past week. The number of long contracts in the hands of speculators decreased by 2,856 units, and the number of short by 3,213. Thus, the general mood of the major players remained the same - "bearish". The ratio between the number of long and short contracts for speculators still corresponds to the real picture on the market - longs are 4 times more than shorts (105,854-26,613), and large players continue to get rid of the pound. Thus, I expect that the pound may resume its decline in the coming weeks. But also such a strong gap between the number of longs and shorts may indicate a change in the trend in the market. Therefore, I do not rule out the fact that the Briton has completed his long fall.

News calendar for the USA and the UK:

UK- Bank of England Governor Andrew Bailey will deliver a speech (14:15 UTC).

The governor of the Bank of England will speak in the UK on Monday. In the USA, the calendar of economic events does not contain a single interesting entry. For the rest of the day, the influence of the information background on the mood of traders may be weak.

GBP/USD forecast and recommendations to traders:

I recommend selling the pound if there is a rebound from the 1.2600 level on the hourly chart with the goals of the lower boundary of the corridor and 1.2432. I recommended buying the British when closing quotes above the level of 423.6% on the hourly chart with a target of 1.2600. The goal has been achieved.