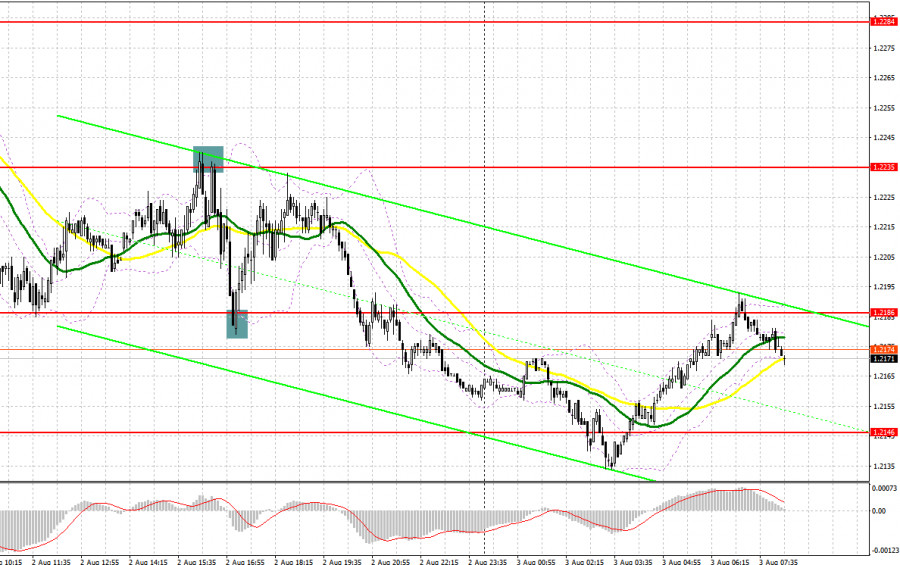

Yesterday, traders received several perfect signals to enter the market. Let us take a look at the 5-minute chart to find out what has happened. Earlier, I asked you to pay attention to the level of 1.2221 to decide when to enter the market. Buyers hoped that the pound sterling would reach a new high. However, the currency even failed to hit the nearest resistance level of 1.2273. A sharp drop in the pair and inability to upwardly test 1.2221 prevented traders from opening short orders, thus limiting the downward potential. In the second part of the day, bulls tried to return to the market. However, unsuccessful consolidation above 1.2235 led to a perfect sell signal. As a result, the pair lost more than 50 pips. A false break of 1.2186 and a buy signal led to a decline to 1.2235. Thus, traders earned another 40 pips.

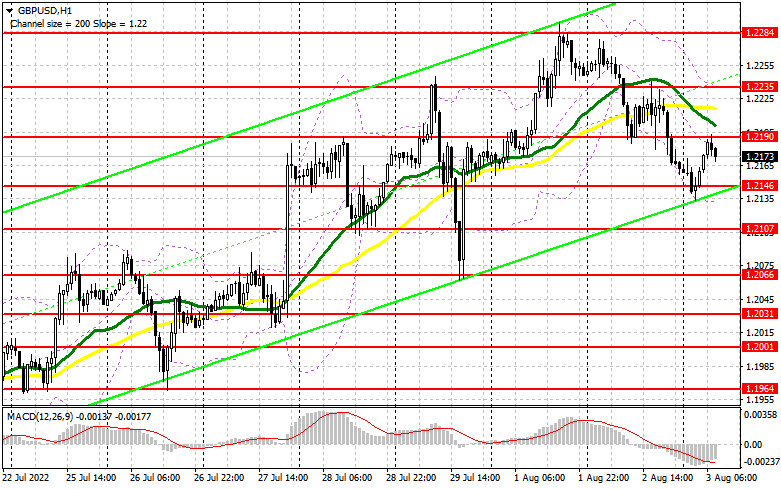

Conditions for opening long positions on GBP/USD:

Excluding the current geopolitical situation, which is exerting pressure on risk assets, today, traders should pay attention to the UK services and composite PMI data. According to the forecast, both indicators will show good performance. That is why buyers may receive a chance to protect the lower limit of the sideways channel and push the price towards monthly highs. Otherwise, the situation may change dramatically. Bulls may start leaving the market more actively since the uptrend will stop, thus increasing pressure on the pound sterling. This, in turn, will lead to a new drop. If the prediction comes true, it will be wise to go long after a false breakout of the nearest support level of 1.2146. The pair may jump to 1.2190. A breakout of this level will allow the price to hit the high of 1.2235. Slightly below this level, there are bearish moving averages. The next target is located at this month's high of 1.2284, where it is recommended to lock in profits. If the pound/dollar pair declines and buyers fail to protect 1.2146, pressure on the British pound will surge, forcing buyers to lock in profits. In this case, I recommend that traders avoid buy orders until the price hits 1.2107. It will be possible to buy at this level only after a false breakout. Long positions could be opened just after a bounce off 1.2066 or lower – from 1.2031, expecting a correction of 30-35 pips.

Conditions for opening short positions on GBP/USD:

Yesterday, sellers benefited from the escalation of the conflict between the US and China. They enlarged the volume of short orders to form a strong downward correction. If bulls fail to protect 1.2146, the pound/dollar pair will decline and stagnate in a wide range. In this case, traders may go short after a false break of 1.2190. The pair may climb to this level amid strong data from the UK. If the predictions come true, the pair may slide to the nearest support level of 1.2136, which was formed during the Asian trade. A breakout of the level and an upward test may give a sell signal with the target at 1.2107. The next target is located at 1.2066, where it is recommended to lock in profits. If the pair increases and bears fail to protect 1.2190 in the first part of the day, bulls will have a chance to improve the situation. However, the risk of a graver geopolitical conflict will cap the upward potential. Under the current conditions, traders should be very cautious. Only a false break of the high of 1.2235 will give a short signal. If bears show zero activity, the price may soar to a monthly high. In this case, traders should avoid sell orders until the price hits 1.2284, where it is possible to go short just after a rebound, expecting a decline of 30-35 pips.

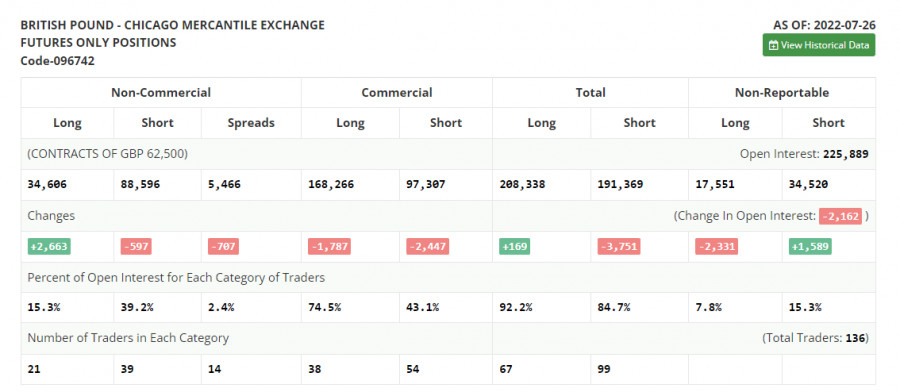

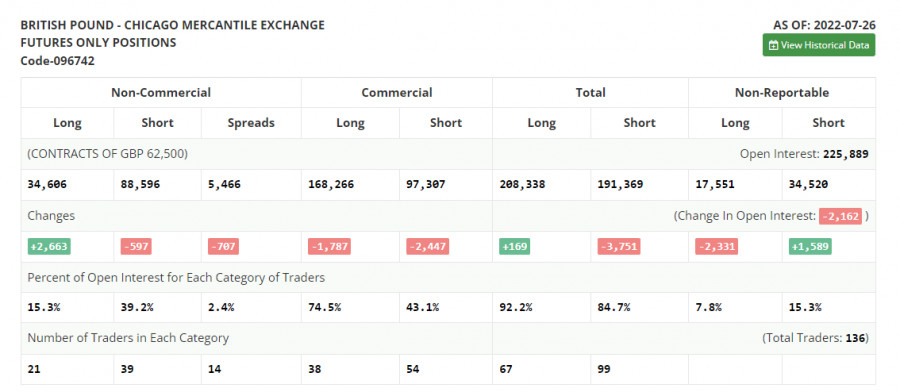

COT report

According to the COT report from July 26, the number of short positions dropped, whereas the number of long positions surged, reflecting the current market situation. The British pound is in demand. What is more, there is no doubt that the BoE will continue raising the benchmark rate this month. The regulator's aggressive policy has been having a positive influence on the national currency despite some economic problems. Last week, the US Fed decided to hike the key interest rate to combat surging inflation. This action is likely to affect the BoE's decision. Notably, demand for the pound sterling is not as high as it might seem. The pound/dollar pair is gaining in value amid the falling greenback. The fact is that there are rumors that the Fed may loosen its monetary policy this autumn. Even amid this backdrop, the pound sterling is unlikely to go on rising due to the cost of living crisis and economic slowdown. The COT report unveiled that the number of long non-commercial positions increased by 2,663 to 34,606, whereas the number of short non-commercial positions declined by 597 to 88,596. As a result, the negative value of the non-commercial net position decreased to 53,990 from -57,250. The weekly closing price rose to 1.2043 against 1.2013.

Signals of indicators:

Moving Averages

Trading is performed below 30- and 50-day moving averages, which points to the continuation of the downward correction.

Note: The period and prices of moving averages are considered by the author on the one-hour chart that differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

In case of a rise, the resistance level will be located at 1.2235. If the pair declines, the lower limit of the indicator located at 1.2130 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are a total number of long positions opened by non-commercial traders.

- Short non-commercial positions are a total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.