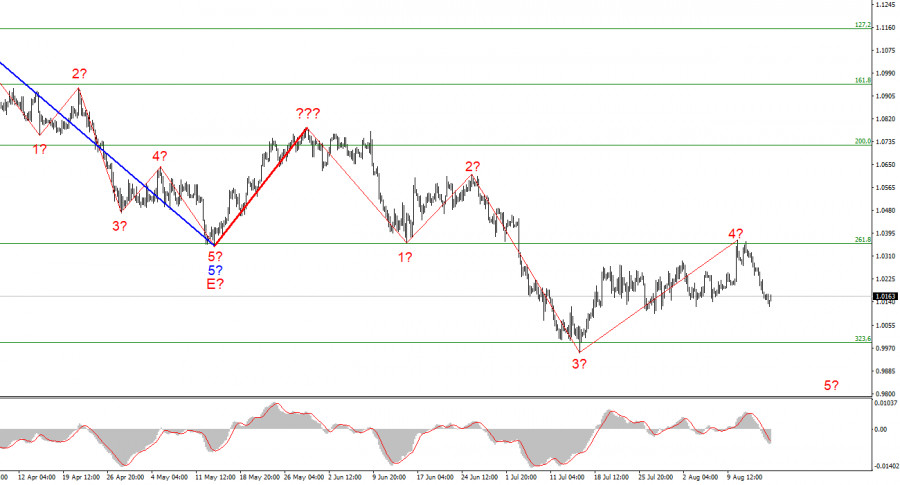

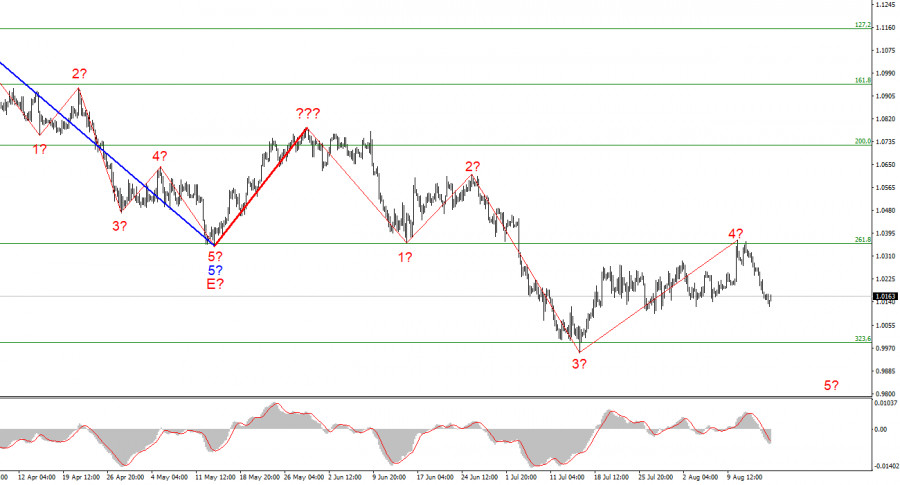

The wave marking of the 4-hour chart for the euro/dollar instrument still does not require adjustments, despite the increase in quotes within the framework of the expected wave 4 turned out to be stronger than I expected. The new wave marking does not yet consider the rising wave marked with a bold red line. The whole wave structure can become more complicated again, which is the disadvantage of wave analysis since any structure can always take a more complex and extended form. The construction of an ascending wave, which is interpreted as wave 4 of the downward trend section, is presumably completed. If this assumption is correct, the instrument has already started building wave 5. The assumed wave 4 took a five-wave but corrective form. However, it can still be considered wave 4. An unsuccessful attempt to break through the 1.0356 mark, which equates to 261.8% Fibonacci, indicates that the market is not ready to continue buying the EU currency. Therefore, I expect the decline in the quotes of the instrument will continue with targets located below the 1.0000 mark within wave 5.

There is no news, but the background puts pressure on the euro

The euro/dollar instrument has already managed without a decline on Tuesday since just an hour ago, the demand for the euro currency began to grow, which allowed the instrument to recoup the morning losses. Nevertheless, the wave marking does not raise a single question so far, which means that the decline in euro quotes should continue. There were no important economic reports in the European Union or the United States on Monday and Tuesday. I don't even want to pay attention to reports like ZEW since they mean so little in the current situation that the market doesn't notice them. Many more important topics can continue to push the euro down. In particular, the talk is getting stronger every day that the European economy cannot avoid a recession this year. Let me remind you that the Eurozone's GDP has been closing in on positive territory for the last two quarters, and the ECB is in no hurry to raise the interest rate, which would lead to a slowdown in the economy.

But in Europe, the problem is not the central bank's actions. The problem lies in the rising fuel, gas, and oil cost. If the oil problem can be solved with supplies from other countries (and not from Russia, against which unprecedented sanctions have been imposed), then everything is much more complicated with gas. Today it became known that the price for 1 thousand cubic meters of gas has increased at European sites above $ 2500. Along with gas, other types of energy are also growing, particularly electricity. Even if we do not pay attention to the fact that European consumers will pay many times more for electricity and heating this winter than last winter, there is still industrial production, which may partially stop due to lack of fuel. It is with this factor that a possible recession is associated. The EU government is trying its best to fill its storage facilities with gas before winter, but it is already clear that in winter, you will have to save money, and the temperature in the apartments of Europeans will be lower than what they are used to.

General conclusions

Based on the analysis, I conclude that the construction of the downward trend section continues. I advise you to sell the instrument with targets located near the calculated mark of 0.9397, which is equal to 423.6% Fibonacci, for each MACD signal "down," counting on the construction of wave 5. A successful attempt to break through the level of 261.8% Fibonacci may lead to the cancellation of the working option with the instrument sales.

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any length, so I think it's best to isolate three and five-wave standard structures from the overall picture and work on them.