Long-term perspective.

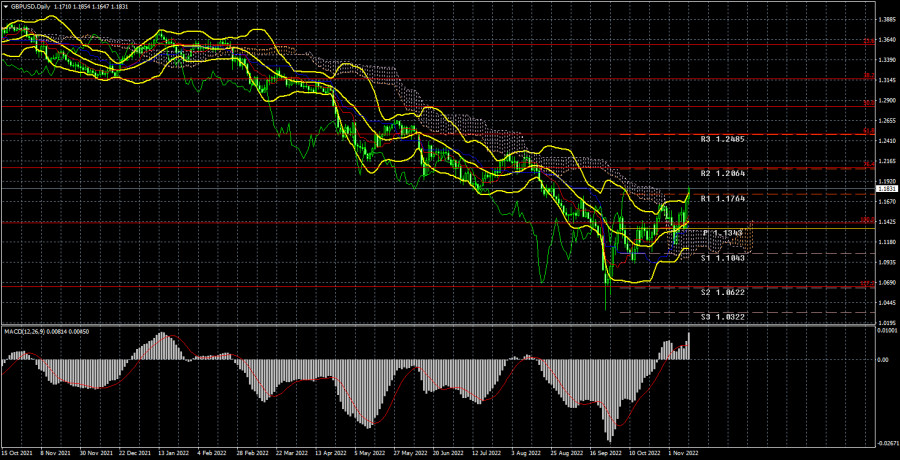

The GBP/USD currency pair has increased by 500 points during the current week. In principle, all the conclusions we made in the article on the euro/dollar pair are also valid for the pound/dollar pair. From our point of view, the British currency has risen this week illogically, but at the same time, very logically. It all depends on how you look at the problem. Considering only the "technique," the following picture turns out. The downward trend in the pound lasted for almost two years. Therefore, sooner or later, it was time for a banal correction. Since we are talking about a global trend, the correction should be global, not by 200 points. Therefore, the movement we are seeing now is a simple technical correction in global terms.

On the other hand, if you look at the "foundation" and macroeconomics with geopolitics, there were not a lot of reasons for the dollar to fall last week. Yes, the inflation report turned out to be a failure (or rather, very good), which provoked the fall of the US currency, since now the Fed will finally be able to stop raising the key rate in the coming months. Of course, we still need to wait for the December inflation report, but what will the market do if, for example, there is no slowdown in December? Will they rush to buy the US currency again since, in this case, the probability of new aggressive measures by the Fed will grow again?

We should also remember the UK itself. No matter how many people talk about the recession in the United States, the officials of this country reject the idea that it will start anyway. Forecasts from major analytical agencies and publications indicate a 30-40-50% recession probability in the next two years. And in the UK, the head of the Bank of England announces the beginning of a recession in the third quarter of 2022. And yesterday's GDP report confirms its words by 100%. Of course, the monetary policy of the Bank of England has a greater impact on the pound's exchange rate than the economy's state. But why did the pound not grow when the Bank of England raised the key rate seven times??? We believe that the pair can continue to grow solely on technical factors.

COT analysis.

The latest COT report on the British pound showed a slight weakening of the "bearish" mood. During the week, the Non-commercial group closed 8.5 thousand buy contracts and 11.5 thousand sell contracts. Thus, the net position of non-commercial traders increased by 3 thousand, which is very small for the pound. The net position indicator has been gradually growing in recent weeks, but this has happened before. The mood of major players remains "pronounced bearish," and the pound sterling maintains a downward trend in the medium term. And, if we recall the situation with the euro currency, there are big doubts that, based on COT reports, we can expect a strong pair growth. How can you count on it if the market buys the dollar more than the pound? The Non-commercial group has opened 79 thousand sales contracts and 34 thousand purchase contracts. The difference, as we can see, is still very big. The euro cannot show growth in the "bullish" mood of major players, and the pound will suddenly be able to grow in a "bearish" mood. As for the total number of open buy and sell, the bulls have an advantage of 21 thousand. But, as we can see, this indicator only helps the pound a little. We remain skeptical about the long-term growth of the British currency, although there are certain technical reasons for this.

Analysis of fundamental events.

During the current week, data on GDP and industrial production were published in the UK. If the second report turned out to be quite good (above the forecast values), then GDP failed. Traders expected the British economy to fall by 0.5%, but in reality, they saw a decrease of 0.6%. However, they did not react to this report in any way, as they were too busy selling off the dollar after the publication of American inflation. However, even if we believe that the inflation report provoked such a fall in the dollar, how much longer can it continue? One report (not the most shocking or discouraging in its meaning) cannot provoke currency sales within a week or two! Thus, the illogical movements continue in a sense.

Trading plan for the week of November 14 – 18:

1) The pound/dollar pair has overcome all the key lines of the Ichimoku indicator, so now it has technical grounds to form a new long-term upward trend. We remain skeptical about this scenario, as we do not see any specific fundamental and geopolitical grounds for it. But at the same time, we recognize that a couple can grow on a "bare" "technique." The nearest targets are 1.2080 and 1.2824.

2) The pound sterling has made a significant step forward but remains in a position where it is difficult to wait for strong growth. If the price fixes below the Kijun-sen line, the pair's fall can quickly and cheerfully resume with targets in the area of 1.0632 – 1.0357. However, sales are not relevant now.

Explanations of the illustrations:

Price levels of support and resistance (resistance /support), Fibonacci levels – targets when opening purchases or sales. Take Profit levels can be placed near them.

Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

Indicator 1 on the COT charts is the net position size of each category of traders.

Indicator 2 on the COT charts is the net position size for the "Non-commercial" group.