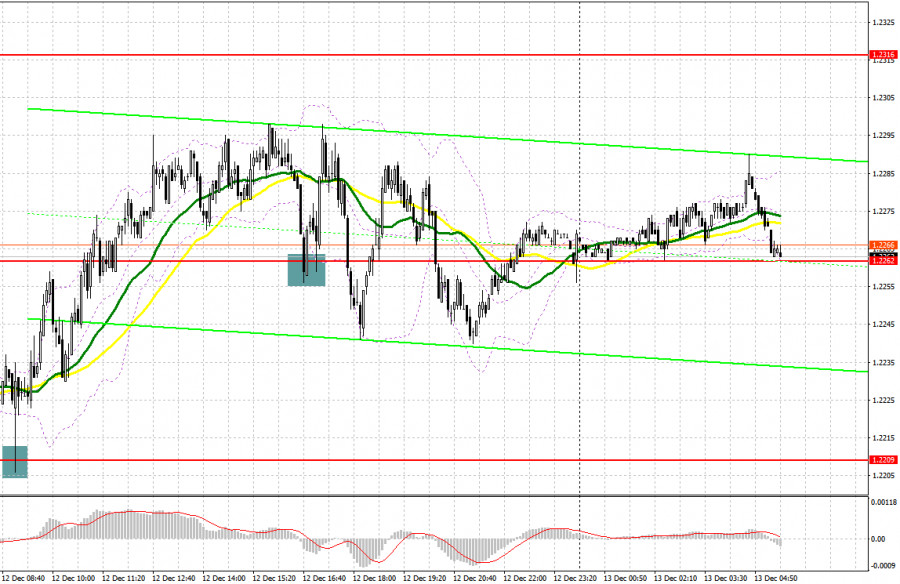

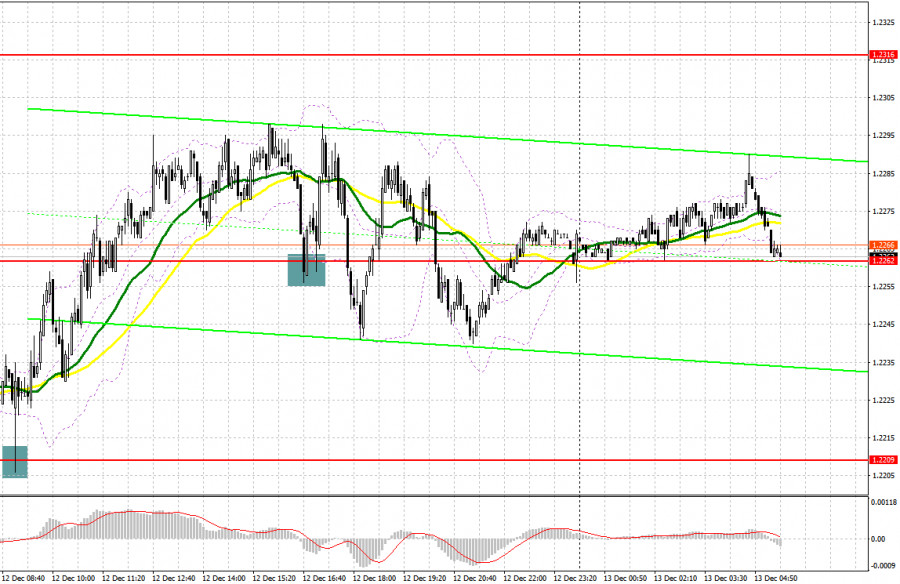

Yesterday, a few entry signals were made. Let's take a look at the M5 chart to get a picture of what happened. In the previous review, we focused on the mark of 1.2209 and considered entering the market there. A fall and a false breakout through the level produced a buy signal. The uptrend extended. The pair advanced by 75 pips. In the second half of the day, following a bearish correction, a false breakout through 1.2262 generated a buy signal. The price went up by 30 pips but failed to go above the daily high.

When to go long on GBP/USD:

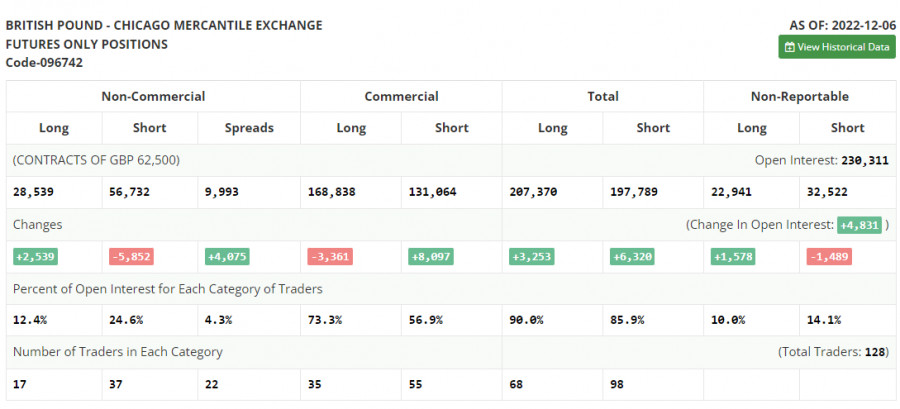

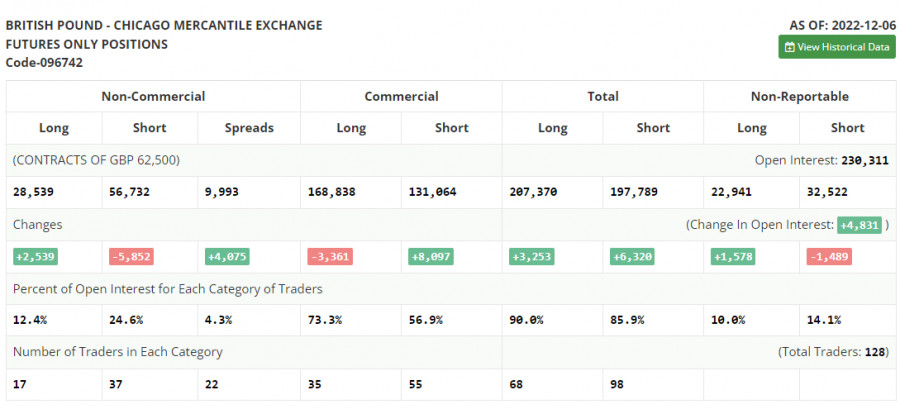

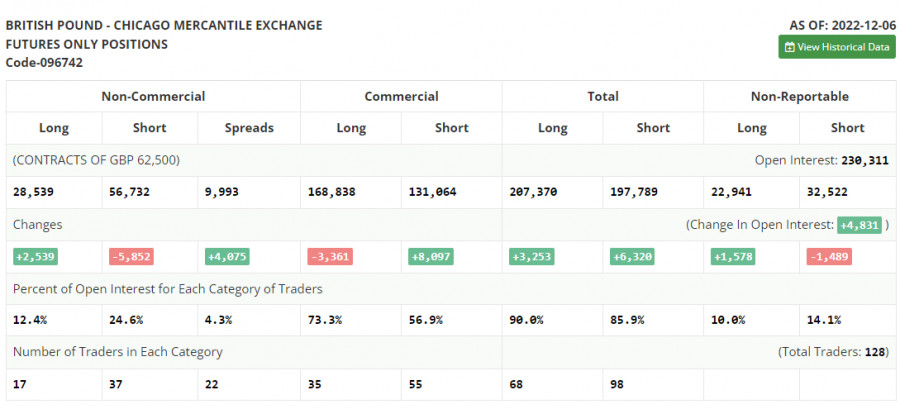

Before we proceed with technical analysis, let's look at the situation in the futures market. Commitments of Traders for December 6th reflect a rise in long positions and a decrease in short positions. Clearly, the bulls intend to extend the uptrend now when the Federal Reserve's stance on monetary policy is expected to be less aggressive, and the Bank of England is gradually catching up with its American counterpart in terms of interest rates. Business activity data in the UK came disappointing last week, which indicated that the British economy is on its way to a recession. Meanwhile, GDP data came slightly better than expected. Still, the third straight month of a slowdown in economic activity confirms growing recession concerns. The Bank of England is planning to continue fighting stubborn inflation and raising borrowing costs. Therefore, nothing good lies ahead for the British economy in the short term. It explains why traders are cautious when buying the instrument despite the short-term uptrend. According to the latest COT report, short non-commercial positions dropped by 5,852 to 56,732 and long non-commercial positions grew by 2,539 to 2,8539. Consequently, the non-commercial net position came in at -28,193 versus -36,584 a week ago. The weekly closing price of GBP/USD grew to 1.2149 against 1.1958.

Volatility is likely to increase in early European trade. The macro data set to come out in the UK today may trigger market jitters. Although the pair moves in the sideways channel, the situation may change unexpectedly. The UK will deliver its labor market statistics today, namely, the claimant count change, unemployment, and average earnings. A further decrease in average earnings amid persistent inflation will clearly indicate a further decline in the incomes of British households, which is bad for the economy and the pound. The market will also focus on Governor Andrew Bailey's speech. The bulls should protect the nearest support level of 1.2256, which is in line with the bullish moving averages. If they lose control over the mark, it will lead to a breakout through the middle of the sideways channel. A false breakout through 1.2256 will produce a buy signal and confirm the presence of the bulls in the market. The price will retest the level of 1.2316, which is an important barrier when it comes to a continuation of the uptrend. Then, the price may break through 1.2316, retest it to the downside, and head toward the high of 1.2367. The most distant target is seen at 1.2410 where it would be wiser to lock in profits. If GBP/USD goes down when there is no bullish activity at 1.2256, the balance of trading forces in the market will remain. In such a case, it will become possible to go long at 1.2209, the lower limit of the sideways channel, after a false breakout. Long positions could also be opened at 1.2158 on a rebound, allowing an intraday correction of 30-35 pips.

When to go short on GBP/USD:

Bearish activity is hardly felt although the pair failed to reach the high of the previous week. The sellers should protect 1.2316 if they want the pair to move in a downtrend. If GBP/USD goes down after the release of upbeat labor market data, only a false breakout through 1.2316 will make a sell signal with the target at 1.2256, the middle of the sideways channel. A breakout and a retest of the level to the upside will create a sell entry point with the target at the low of 1.2209, and the pound will feel stronger pressure. A more distant target is seen at 1.2158 where it is wiser to lock in profits. A test of the level of 1.2108 will mark the beginning of a downtrend. If GBP/USD goes up when there is no bearish activity at 1.2316, the bulls will regain control over the market, and the pair will hit a monthly high of 1.2316. A false breakout through the mark will create a sell entry point, and the downtrend will extend. If there is no activity there, GBP/USD may swell to 1.2410 where it would be wiser to sell the instrument on a rebound, allowing a bearish correction of 30-35 pips intraday.

Indicator signals:

Moving averages

Trading is carried out within the range of the 30-day and 50-day moving averages, reflecting a sideways trend in the market.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

The pair will soar in case of a breakout through the upper band at 1.2295. Meanwhile, the pair will feel stronger pressure if there is a breakout through the lower band at 1.2256.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.