The GBP/USD currency pair is trading near the 21st and 22nd levels. Despite a fairly busy economic calendar, GBP/USD traders are in no hurry to open large positions, neither the buyers nor the sellers. Overall, the markets are experiencing contradictory dynamics as investors assess the latest macroeconomic reports and news related to the conflict in the Middle East. The recent rocket strike on a hospital in Gaza (which both Israel and Hamas deny responsibility for, accusing each other), resulting in the death of at least 800 people, has added to an already complex fundamental picture. In particular, oil surged by 2% due to concerns about potential disruptions in black gold supplies from the region (in addition, crude oil inventories in the United States fell more than expected, according to API data).

In other words, geopolitics has once again taken center stage, as it will become clear in the coming days whether Israel will embark on a ground operation in Gaza or if the situation will unfold in a de-escalation scenario. It is evident that the Israeli authorities will make the appropriate decision following today's visit by Joe Biden to Tel Aviv. In the face of such uncertainty, traders are cautious, and the major dollar pairs of the "major group" are trading in a relatively narrow price range, reflecting the hesitancy of both buyers and sellers.

The GBP/USD pair is no exception. In fact, traders of this pair have largely ignored important macroeconomic reports published today and yesterday. In my opinion, these are "deferred action releases" that will still make their presence felt, particularly in the near future, considering that the next Bank of England meeting is just two weeks away on November 2nd. Given the dynamics of key indicators, it is not out of the question to expect a tougher stance or even an announcement of additional tightening of monetary policy.

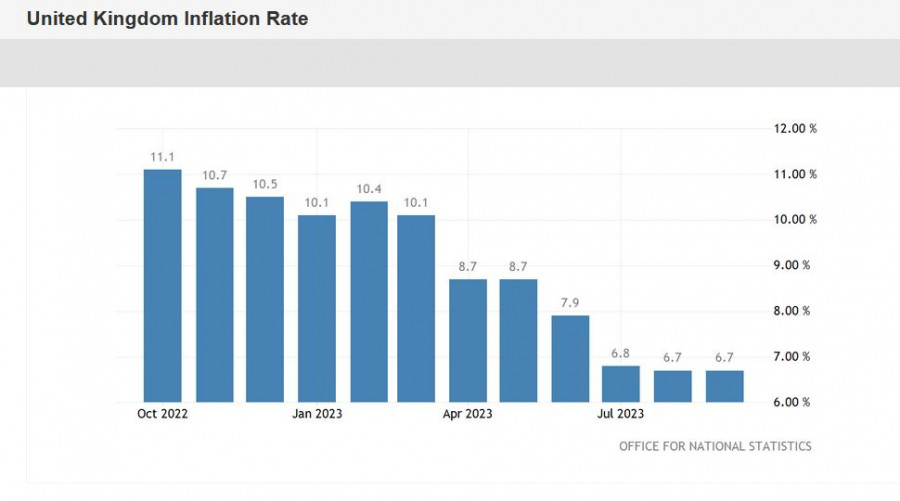

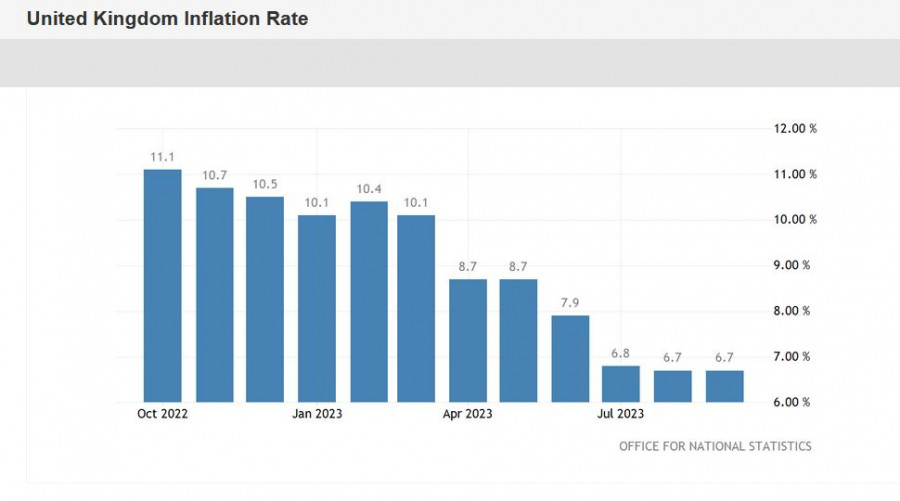

The cornerstone of this assumption is inflation. According to data released today, the overall Consumer Price Index in the UK remained at the August level, at 6.7% year-on-year, while most experts had predicted a decrease to 6.5%. The core index, excluding food and energy prices, also remained in the "green zone," reaching 6.1% (with a forecast of a decline to 6.0%).

The structure of the release suggests that the slowdown in the rise in food and furniture prices was offset by the increase in the cost of energy sources.

The Retail Price Index, which UK employers use in salary negotiations, showed a downward trend but still remained high (8.9%). Both the Producer Purchase Price Index and the Producer Selling Price Index were in the "green zone."

Wage inflation in the UK, measured by the change in average earnings, has shown contradictory dynamics. Without considering bonuses, wages increased by 7.8% (in line with forecasts). However, when including bonuses, the average wage rose by 8.1%. This result was slightly weaker than most analysts' forecast (8.3%). It's worth noting that in the previous month (i.e., in August), this component of the report increased by 8.5%.

It's worth mentioning that the market had expected a comprehensive labor market report yesterday, but representatives of the Office for National Statistics announced that the publication of employment and unemployment statistics had been postponed to the next week "to improve data quality." Therefore, only wage data were released yesterday.

In my view, the figures released this week will support the British currency, as the market will once again discuss the likelihood of a Bank of England interest rate hike at one of the two remaining meetings this year. Such a scenario is not ruled out by central bank representatives. For instance, Bank of England Chief Economist Huw Pill hinted last week that the regulator might resort to a rate hike. He stated that the question of the need for further tightening of the Bank of England's policy is "nuanced." According to him, the measures taken earlier have not fully manifested themselves, but the central bank will closely monitor the dynamics of key inflation indicators. Note that these comments were made before the publication of September's data.

It is also worth noting that according to a recent IMF forecast, the Bank of England is likely to have to tighten monetary policy further because inflation continues to remain at an excessively high level and demonstrates the slowest decline among G7 countries. Today's report indeed reflected the "stubbornness" of British inflation. Therefore, it is highly likely that the rhetoric of Bank of England representatives will tighten in the near future, and the question of a rate hike will be back on the agenda.

Currently, the situation regarding the GBP/USD pair is uncertain. Traders have ignored the reports released in the UK, and none of the Bank of England representatives has had the chance to comment on them yet. Therefore, in the near future, the pound will follow the greenback, which, in turn, is awaiting developments (or de-escalation) in the conflict in the Middle East.

From a technical perspective, the GBP/USD pair on the daily chart is trading near the middle line of the Bollinger Bands but below all the lines of the Ichimoku indicator, including the Kumo cloud. Long positions should only be considered after the price firmly consolidates above the 1.2200 level, which is above the middle line of the Bollinger Bands on the D1 chart. In this case, the next targets for the upward movement will be the levels at 1.2270 (Kijun-sen line) and 1.2310 (the upper line of the Bollinger Bands on the same timeframe).