Position trading is often confused with investing. Indeed, in both cases, a speculator owns an asset for quite a long time, even for a few years.

Still, these concepts are not equivalent. The buy-and-hold idea refers to trading but not investment activity. In essence, it is about earnings on speculation with changes in market quotes. In this article, let’s figure out the key features of this type of trading.

You may also get to know other trading styles, their features as well as cons and pros in the article Types of trading: comprehensive guide.

Position trading

This trading style is based on the buy-and-hold idea: a trader keeps a position open for a lengthy time from several months to several years. It is the longest-term trading strategy!

Obviously, positions are held open for a longer time than in medium-term trading. Daily minor price fluctuations do not matter here.

Compared to other trading styles, a position speculator opens just a few trades a year. Speaking of medium-term trading, a speculator can manage from 25 to 100 trades whereas an intraday trader executes 1,000 and more trades a year.

The task of major importance for a position trader is to pinpoint the right direction of the ongoing price movement of a particular asset. A trader should not enter the market at the stage of consolidation or correction.

The exception is a wide price channel within which the price logs gyrations. However, such price swings look more like trend-following moves. Hence, position trading may also be applied here.

Oftentimes, traders employ technical indicators to recognize the ongoing trend. However, technical indicators are helpful to find out a clear-cut trend because a lot of indicators lag behind a trend.

This could be a puzzle for an intraday trader because positions should be opened at the beginning of a trend. In contrast, a position trader does not consider this a problem because it is essential to catch a trend itself but not its beginning.

Importantly, position traders focus on fundamental analysis because global political and economic events could make an impact on an asset’s quotes in prospect.

Long versus short positions

Swing trading involves holding a position either long or short open for more than one trading session. Let’s find out the difference between long and short positions.

A long position means to buy an asset with the prospect of its further increase in price. Thus, profit is obtained by buying at a lower price and selling at a higher price.

Here the scheme of earnings is quite simple and clear. Besides, in reality, for the most part, securities tend to rise in the long run.

However, you can earn not only from appreciation of an asset’s value, but also from the price decline. When a position is opened on the expectation that an asset will fall in price, it is called short-selling.

Indeed a crisis may break out, during which economies go through a downturn. Accordingly, market quotes of stocks and other assets also take a nosedive. Moreover, certain sectors of the economy also may lose momentum for a while.

There are also more minor fluctuations that occur much more often. Any asset goes through downward correction, during which an asset can decline in the range from 10% to 20%. Corrections also offer trading opportunities.

At the same time, the key point for a short position is that assets are not initially owned by traders. They take them on the basis of margin trading from a broker in order to sell them on the market.

After that, the investor waits until the securities lose value and acquires the exact same number of shares, but at a lower price. Now they become the investor’s property, and the broker returns the cash deposit to them.

The investor's profit in this case is the difference between the cost for which they buy assets and the selling price. However, there is a certain period, quite short, during which the trader must return the borrowed shares to the broker. Hence, this practice is termed short selling.

It is essential to distinguish between a short position and selling assets from an investor's own portfolio. In the latter case, a long position is closed. The key to short trades is that the stock is not initially owned by the trader.

At the same time, for the investor, a yield of 20-25% per year is considered optimal. Position traders aim to earn this level of profit on a monthly basis.

How to open short positions without losing money

It is easy to grasp the point about long positions. Shares are bought at the trader’s expense as the trader is betting on the growth in their value in prospect.

Let's take a closer look in this section on how to trade short positions and profit from it without making losses.

Importantly, opening short positions is not recommended for novice traders. This is due to the fact that trading is actually carried out on borrowed funds. In this case, the trader's forecast may turn out to be incorrect, and the stock will begin to rise in value instead of falling in value.

In any case, the securities will have to be returned to the broker, but if they rise in price, the trader will have to buy them back at a higher price.

In order to hedge themselves against such expenses, experienced traders recommend setting protective stops and not borrowing too large amounts of money from the broker.

However, opening short positions is risky not only for traders, but also for brokerage companies. Therefore, as a rule, they allow you to make such transactions only with the most liquid instruments.

Brokers also set certain requirements for the amount of the trader's deposit, so that in case of failure, traders would have the opportunity to cover the costs in case of a reverse dynamics in the value of assets.

There are two most popular and commonly used ways to profit from falling stock prices:

1. Opening short positions, that is, the ability to speculate on changes in the value of assets that the trader does not even own. However, as we have already mentioned, this method has a rather high level of risk.

2. Use "waiting mode", that is, be patient and wait for the share price to fall and buy them, and then sell them at a better price.

Position trading in stock market

Although this type of trading can be used in any market, it is best to trade this way in stock markets.

When we talk about “buy and hold” trading, the first thing that comes to mind as a trading tool is company securities, namely stocks.

However, a lot also depends on the timeframe chosen by the trader. So, for assets of the stock and commodity markets, it is best to use weekly and monthly timeframes.

For position trading in currency pairs, shorter time frames are commonly used, starting from the daily time frames.

For this type of trading, unlike swing trading, for example, it is not a good idea to trade assets with too high volatility. For position trading, it is much better when the value of an asset moves forward in a certain direction for a long period of time.

In ideal cases, trends can last for several months or even years, which opens up great opportunities for traders.

At the same time, a fairly limited number of factors influence stock and commodity assets, while currencies are sensitive to a great number of circumstances.

Stock indices are also considered good trading instruments. They are also called “blue chips”. Their movement largely depends on the state of the global economy: when it is on the rise, stock indices grow, and during a recession, they decrease.

So, during the rally in the stock market in 2019, investors yielded profits up to 25% and earned the same amount on their fall in 2020 during the global economic downturn caused by the coronavirus pandemic.

Position trading on Forex

As we discussed above, this style of trading does not suit well too volatile assets which are prone to nonstop sharp fluctuations.

However, many speculators apply position trading to the Forex market. Indeed, the principle "buy and hold" enables traders to obtain a fairly significant income.

At the same time, you can limit your possible losses by setting protective stop orders.

Another advantage of position trading is the feature to close a position at any time convenient for the trader. If the trader realizes that he has already gained enough profit from the change in the value of the asset, he may not wait for the trend to change and close the position.

For experienced traders, it is not difficult to determine whether the current trend will continue or if some changes are imminent in the market just by looking at the price chart. Moreover, in long-term trading, trends are more stable.

For analysis, higher timeframes are used: weekly or monthly. They make it possible to see a more complete and unbiased picture, without the price "noise" that occurs on lower timeframes.

In order to better understand and analyze the situation on the market, you can use technical indicators that are applied to the price chart, and patterns that are formed by the lines of price moves on the chart.

However, the transfer of an overnight position incurs additional costs like brokerage commissions also termed swaps. Therefore, the trader must be as sure as possible about the need to leave the transaction open the next day or for a longer period.

Strategy of position trading

Sufficiently long periods for which transactions are concluded with the “buy and hold” trading style do not relieve the trader from the need to adhere to the rules of the trading strategy.

The basic rules of any trading algorithm include finding entry and exit points for a position, as well as money and risk management.

There are a fairly large number of trading systems for position trading. We will consider the most commonly used and popular ones.

1. Strategy using a moving average (SMA). In this algorithm, moving average is used as an analytical tool. To open a position, you need to focus on the intersection of the asset value chart and the SMA line.

• If the price chart of an asset passes through the moving average line upwards, this is considered a signal to open a long position;

• If the price chart goes through the moving average in the opposite direction, then this is a signal to open a short position.

There is also a rule in this algorithm for closing a position: it must be done manually when the price chart crosses the moving average in the opposite direction. You can also use stop orders, which are set within 5% of the SMA level.

2. Intrachannel strategy. As you know, the support level is a conditional line, below which the price does not sink as a rule. Likewise, the resistance level is a line, above which the price does not rise. Oftentimes, these levels are used to enter a position, where the support level is the starting point for the upward movement of the asset's value.

The resistance level is used to close the position because the price starts to go down from this line.

3. Breakout trading strategy. It actually follows from the previous algorithm. We talked about the fact that the value of an asset usually moves within the corridor formed between the support and resistance lines. However, there are times when the swings are so strong that the price manages to break through these levels. In this case, it is necessary to open a long position when the chart breaks through the resistance line, and short position when the chart breaks through the support level. Here it is also important to additionally add volume indicators and verify that the chart exit beyond the channel is accompanied by an increase in trading volumes.

Advantages and disadvantages

Like any other type of trading, position trading has its pros and cons. Let's look at them in more detail in this chapter.

So, the advantages of this type of trade include:

• The opportunity to see the full picture of the market and the main trajectory of the ongoing trend, without being distracted by small and insignificant changes in the asset’s value. This allows you to make well-rounded decisions.

• Ability to work in a comfortable mode. There is no rush to make decisions here. You can carefully consider and weigh everything, analyze, and open a deal only after that.

• There is no need to constantly sit at the computer and keep track of every change in value. The trader needs to spend some time on analysis before opening a trade, but after that they only have to check the situation now and then. All this allows you to combine this type of trading with the main work.

• Ability to use both technical and fundamental analysis in decision making. Since more tools are available to the trader, they can better understand the situation on the market and, accordingly, make the right decisions.

• Lower level of risk. Since the transaction remains open for a long period of time, the trader has the opportunity to adjust their positions if necessary. They also always have the opportunity to close positions ahead of time.

The main disadvantages of the “buy and hold” trading style include the following:

• Speculators have to follow clear exit rules for their trades. To do this, a trader needs to have profound knowledge, understand the analysis tools, and be able to apply them.

Still, traders run the risk of the wrong recognition of a reversal point of the current trend. In this case, the trader may lose part of the profit if they close the deal after the change in the current price. However, this problem can be solved by placing protective orders.

• There is no opportunity to quickly make a profit and reinvest. In position trading, a trader cannot extract capital from an open trade and invest it in something else because positions remain open until the trend approaches a reversal point.

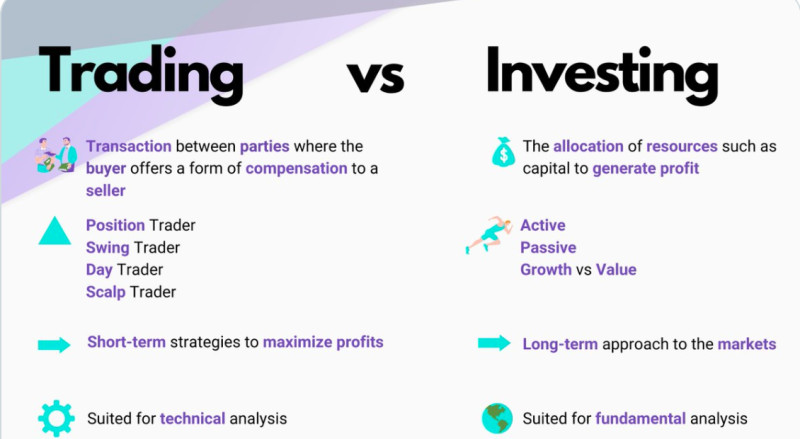

Trading versus investing

As we have already said, market participants have some misconception that position trading and investing are the same thing.

In fact, these are different trading styles, which, of course, have some common features, but still have a number of significant differences. Let's take a look at how they are similar and how they differ.

The main similarity between position trading and investing, which misleads many users, is the long-term holding of positions. In both position trading and investing, securities can be bought for the term up to several years.

However, when investing, the investor does not just count on an increase in the shares’ value. The investor sets the goal to receive passive income in the form of dividends, returns, and other payments.

Money is invested once and then should bring profit without any involvement of the investor. At the same time, when selecting assets, investors study the financial performance of the company and the prospects for its development or the growth of any price of another asset.

In position trading, the prime goal of a trader is not to invest in stocks, but to make a profit by reselling them at a better price. The trader expects to buy at a lower price and then sell at a higher price.

At the same time, the trader uses technical analysis to a greater extent, supplementing it with fundamental analysis. However, the analysis is always based on the study of the chart and fluctuations in the asset’s value.

The income of a trader using a buy-and-hold trading style is calculated annually. An investor can calculate the real return on their investments only after several decades.

Automated trading

Position trading is quite an attractive and potentially profitable way of speculations. A trader does not need to spend a lot of time on analysis and trading directly, however, even these tasks can be facilitated.

So, special computer programs called trading robots can greatly facilitate the life of a trader. They are fully automated and semi-automatic.

Semi-automatic bots are called trading advisors. They carry out technical analysis of the market situation instead of the user and give them signals to open trades.

Fully automated programs not only analyze the situation on the market, but can also make transactions on their own, in particular, they open positions.

This is very convenient, but risky since the trading robot operates according to a strictly embedded algorithm. He cannot be flexible, like a person, and adapt to the changing market situation.

In addition, in order for the bot to work as correctly as possible and follow trading preferences, its work must be based on a correct and clearly formulated strategy.

Depending on the trading algorithm underlying the Expert Advisor, they are divided into trend-following and flat ones.

1. Trend Expert Advisors, using technical indicators, identify the current trajectory of the asset’s value of and open positions depending on its direction. Such bots work only in conditions of a clear-cut trend. In the flat market, they will close transactions by a stop order.

2. Flat bots, on the contrary, are designed to trade within a certain range, limited by support and resistance lines. They enter a position at one level, and then exit it when they reach the second level.

Depending on the trading style, trading robots are divided into three main groups:

• Scalpers - make a large number of instant trades with little profitability;

• Medium-term robots can keep a deal open for more than one day and up to several weeks, the profit is obtained by changing the value during this time;

• Long-term or positional robots are used for trading on high time frames. They can keep positions open for several months or even years to get the utmost income from the current trend.

Rules of “buy and hold” trading

The considered type of trading can bring a decent income to the trader. However, in order for it to be truly successful and efficient, the trader should obey a number of rules. We have collected the main ones in this chapter.

1. If you decide to take up this type of trading, prepare a hefty sum. To get a decent income, you need to have a large deposit. With a small account size, you will not be able to get a big profit.

2. However, when you make the first steps in position trading, it is better to try with a small investment in order to understand if this style of trading suits you or not. Not all traders, due to their personality and mindset, can leave a deal open for several months or even years. This requires patience and perseverance.

3. Make sure to follow the rules of money and risk management. It is not recommended to use more than 5% of the total deposit per trade, and the total risk per trade should not exceed 15% of the deposit.

4. It must be remembered that corrections when trading on long periods can be from 100 to 500 points, so it is recommended to set stop loss orders at the level of 100-200 points.

5. Long-term trading in general and position trading in particular allows you to trade several instruments at the same time. Take advantage of this opportunity so you can diversify your risks. Even if the situation for one of the assets does not turn out the way you expected, and you get a loss, you will be able to "recoup" at the expense of other instruments.

6. There is no particular problem with long positions: you buy a certain amount of securities at a lower price and wait for their value to increase in order to sell them at a higher price. At the initial stages, it is better to try to open long positions.

7. With short positions, the situation is a little more complicated, so we do not recommend that beginners immediately try to enter short positions. Here, trading is carried out not for own, but for borrowed funds. Therefore, if the trader's forecast turns out to be incorrect, they will have to buy shares at a higher price.

8. For novice traders, if they want to capitalize on depreciating assets, we recommend using a different tactic. When events occur in the market that can affect the value of an asset, many investors in a panic begin to get rid of it. Thus, the asset begins to lose sharply in value. You can safely wait for the price to drop and buy securities at a better price for yourself.

Bottom line

In this article, we looked at the key features of position trading, its advantages and disadvantages, and how it differs from investing and other trading styles.

This type of trading is very attractive as it does not require a lot of time. Indeed, positions can remain open for several months or even years.

There are also two main trading options: long and short positions. By opening a long position, a trader expects an increase in the asset’s value. That is, he acquires an asset at a lower price and expects to subsequently sell it at a higher price.

With short positions, the opposite is true: the trader makes an outlook that the asset will lose in value, hence, he will be able to buy it at a lower cost.

At the same time, the trader always has enough time to analyze and make a decision. In addition, some processes can be automated using trading robots.

For position trading, the tools of the stock and commodity markets are most suitable, but it can also be used in the forex market. For this, it is necessary to choose shorter time intervals.

Among the disadvantages of this type of trading, traders have to pay a commission for keeping overnight positions. Besides, it is hardly possible to quickly make a profit and reinvest in other assets.

In any case, the "buy and hold" style is a speculative way of trading driven by the wish to capitalize on changes in market quotes. Investments are about investing money with the aim of gaining dividends, interest, and other payments.

Back to articles

Back to articles