Modern retail traders are on the go around the clock. However, not all of them are able to sit at home in front of a PC all the time. To meet their requirements, developers of popular trading platforms created a WebTrader. It enables users to trade and keep track of a market situation at any place where they have access to the Internet.

Now let’s figure out what a WebTrader is like and discuss its main features.

What is WebTrader?

Trading platforms are available in three versions: web-based, desktop, and mobile. A desktop platform makes a trader riveted to a particular PC whereas a mobile version attaches a trader to a smartphone or tablet.

A WebTrader is more convenient because you do not have to download and install anything. You are free to trade from any gadget at any place on condition you have access to the Internet.

A WebTrader runs on any operating system and in all browsers. You can log in to a trading platform from your home PC and continue trading from your PC at work or at your friend’s place. Traders do not have to worry about the protection of their personal data as all sensitive information is encrypted.

Most reputable brokers design their own custom web-based trading portals. Such companies strive to upgrade their trading software to simplify the work of their clients.

Here are clear advantages of a WebTrader:

- Trading directly from a browser

- Access to Forex and stock markets

- One-click execution of trades

- Technical indicators for analysis

- Online tracking of market quotes

- History of transactions

- 9 time frames

- User-friendly interface

- Technical support

Importantly, this trading software is not installed on a device, so its operation crucially depends on the traffic speed and the overall load on the user’s network.

How to open and close trades on WebTrader

Before you enter a trading platform, you have to log in to your trading account that you opened with a particular broker. Next, a trader has to choose between the two web versions of trading platforms: MetaTrader 4 and MetaTrader 5. A WebTrader is available in 41 languages, so anyone can select one’s native language.

Your credential could be authorized either for MT4 or MT5. If you want to trade on both platforms, you have to open two trading accounts.

A WebTrader suggests two options for opening positions:

- Choose “New Order” on the toolbar

- Right click directly on a trading chart

Before opening long positions, you should select a trading instrument in the Symbol field and a trade size in the Size field. You are highly recommended to place stop-loss and take-profit orders with your broker for efficient money management. These features help a trader exit a losing trade until the whole deposit is drained.

A stop loss enables a trader to curb losses. Its main purpose is to ensure that losses won’t grow too big in case the price moves in the direction opposite to the expected one.

A take profit ensures that a trade is closed exactly at the time when the price reaches a target level. This order locks-in profits.

A WebTrader offers the opportunity of one-click trading which means fast execution of trades. Such trading methods are especially popular among active speculators.

To open short positions, you follow the same steps as with long positions. However, you click on the “sell” button.

For a fast buy or sell trade, you can use the appropriate buttons, i.e. “buy” and “sell” that are available right on the chart together with the window showing a lot size.

To close a trade, a WebTrader also suggests two ways:

- You may do it manually through the Instruments tab;

- Your trade may be closed automatically if you place a stop loss and take profit orders.

Ideas for choosing trading platform

Trading platforms are divided into two major categories:

- Trading software designed by brokers

- Trading software designed by independent developers

Trading platforms developed by independent firms are open-source software that is widely used both by forex brokers and retail traders.

Brokerage firms are interested in designing their custom trading platforms for the following reasons:

- They do not have to pay a commission to developers for employing their software;

- Clients get used to the trading interface of their broker and are less poised to look for another broker.

Retail forex traders prefer to use universal trading platforms. Indeed, they do not have to grasp the specifics of a new trading interface if they change a broker.

The first requirement to pick a trading platform is its reliability. It means that a trading platform should run smoothly when a lot of positions are managed in parallel. The second important criterion is the speed of transaction processing. If the execution of a client’s order is delayed by a couple of seconds, it might entail a complete loss of a deposit.

A sound trading platform enables traders to open pending orders. It is convenient because not all traders can afford to monitor charts all the time and manage positions manually.

Traders appreciate that a trading interface is available in several versions. Apart from a stand-alone downloadable program, a decent trading platform also exists as a web-based portal and a mobile app. Therefore, a trader may open positions through an interface installed on a home PC, keep track of the market situation on a mobile app, and close positions through a WebTrader on an office PC.

Here are the most popular trading platforms:

- QUIK (open-source software)

- Ninja Trader (open-source software)

- cTrader (open-source software)

- Libertex (software developed by Forex Club)

- AlorTrade (software developed by ALOR)

- MetaTrader (open-source software)

Webtrader MetaTrader 4 vs. Webtrader MetaTrader 5

Despite a lot of common features, these two trading platforms differ markedly as they are designed for a different purpose. The MT4 web version provides access only to the forex market. MT5 is not an update to MT4. Unlike MT4, MetaTrader 5 allows users to trade stocks, CFDs, and futures in addition to forex.

Most users pointed out in their reviews that MT4 suits better novice traders whereas MT5 meets the needs of experienced traders.

The MT5 trading interface contains a larger number of tools for technical analysis: 38 indicators on MT5 against 30 on MT4 and 44 trading algorithms against 33 on MT4.

The significant difference is that MT4 is designed in the MQL4 language but MT5 – in the MQL5 language. MQL4 is focused on order implementation. A few functions should run in parallel to execute only one trade. MQL5 enables extremely fast order procession because one transaction is triggered by only one function. Besides, users are able to develop and edit scripts in the MQL5 programming language. They cannot do it in MQL4.

The MT5 web version supports hedging and netting techniques whereas MT4 allows only hedging. The hedging option involves managing several trades either in the same or in the opposite direction with the aim of cutting risks.

Unlike MT4, MT5 displays not only price moves in ticks but also contracts and a number of lots.

InstaForex WebTrader

Alongside other brokerage firms, InstaForex has also developed its own web-browser version of the client platform. Let’s discuss its main features.

- It allows clients to trade Forex, futures, and CFDs;

- It provides a user with a full spectrum of analytical tools available with a desktop version;

- A trader can use all types of accounts;

- There are analytical materials and news feed;

- Online charts of balance changes;

- There are a few user skins.

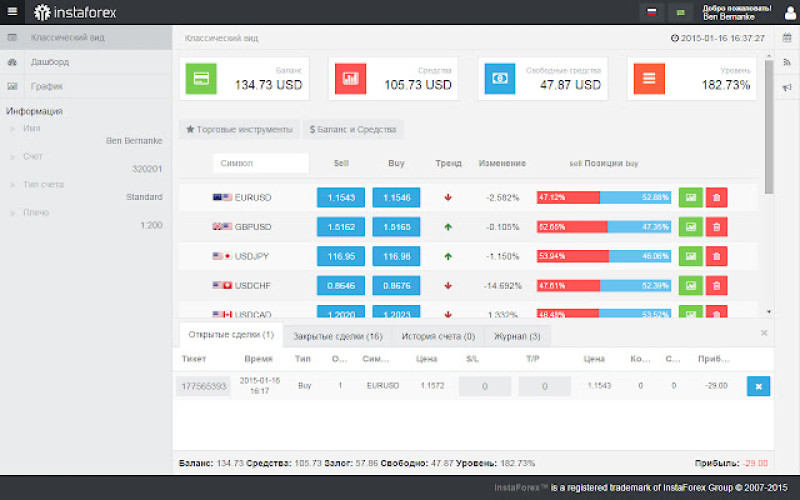

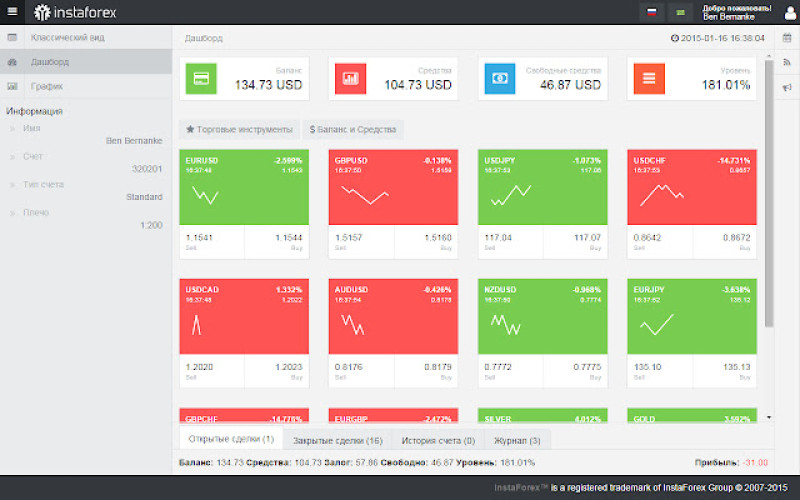

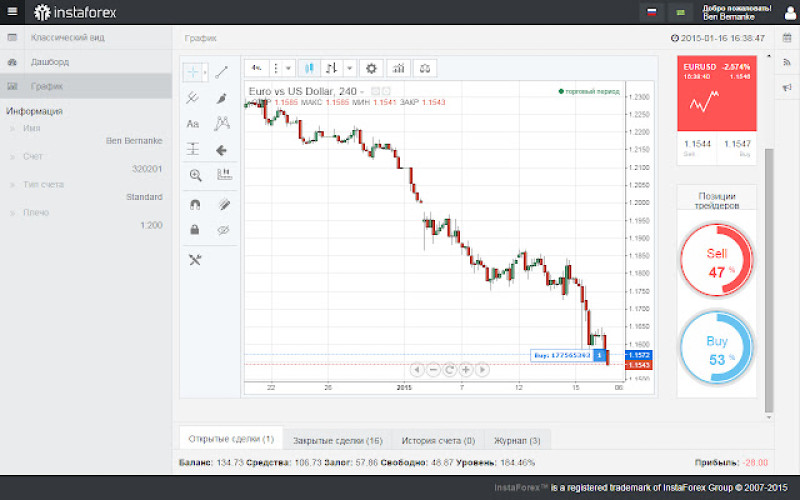

To customize a trading interface for client’s needs, InstaForex suggests three versions:

- Classic

- Dashboard

- And chart

In the classic version, trading assets are presented as a list. This interface also includes a trend direction, price fluctuations, and user’s positions for each trading instrument.

A dashboard enables a trader to monitor fluctuations in 12 assets in parallel which are presented as tick charts.

This user’s skin visually displays any trading instrument as a tick chart and provides tools to work with it.

On the web-based platform by InstaForex, users can place their most frequently used trading instruments in a preferable order. This set-up is saved for the desktop version and the mobile app.

Besides, InstaForex offers a wide array of bonuses. To apply for a particular reward, a trader should fulfil certain conditions. The broker sets the biggest size for each of the bonuses. InstaForex rewards a client with a bonus for account registration and for the first deposit. Other bonuses are credited depending on the amount of further deposits.

Find the full list of bonuses on the official website and pick the one that suits your needs best.

How to withdraw money from WebTrader?

Despite all its advantages described above, users underscore at least one significant disadvantage. A web-browser trading platform does not have the option of withdrawing money to an account. Money gained from trading is transferred to a broker’s corporate account. There are a few reasons for that.

- Technically, it is hard to set up money transfers to a multitude of accounts of retail traders.

- This practice is convenient for a broker because a firm can manage your money until you request a withdrawal.

Therefore, once your funds are accrued on a broker’s account, you should find a way of withdrawing your money to your private account.

Knowledgeable traders recommend this situation should be foreseen and sorted out before the first deposit is made. To register a trading account, verification is required.

Brokers might not insist on your account verification and might not remind you of it. You are the one who is interested in having your account verified. Make sure you fill in all verification forms with care and provide all necessary documents.

Later on, this will help you identify your account and confirm that you are the owner. On top of that, verification proves that you deal with a trustworthy broker.

Before you begin a withdrawal, check whether you have fulfilled the prerequisite conditions:

- A broker’s bonuses have been worked out;

- The amount you request is not higher than the ultimate limit;

- The amount is not lower than the smallest limit;

- You have enough funds on your account;

- Check the number of open and closed positions

The first thing to do is to request a withdrawal directly from your broker. If the company procrastinates or impedes crediting money on your account, you can resort to a chargeback procedure.

For a chargeback, you should apply to a bank. Make sure you submit all necessary documents to a bank, including proof of verification, screenshots of your correspondence with the broker, and others.

Important conditions for a chargeback procedure are the following:

- The last deposit to your account should be made no earlier than 18 months (450 days) ago;

- The money was deposited by means of a Visa or MasterCard bank card.

After all formalities are settled and all conditions are fulfilled, the bank will enforce a money transfer from a broker’s account in favor of a trader.

Bottom line

In this article, we have given insight into a WebTrader, its essential features, and some specifics. We consider this version of a trading platform the most convenient because a user can trade easily anytime anywhere. Access to the Internet is all you need.

A WebTrader offers a lot of advantages: available for all operating systems, trading directly from a web browser, analytical tools, one-click trading, etc.

The major disadvantage of a WebTrader that a trader should be warned about is the lack of a direct withdrawal function. Hence, money goes to a broker’s account but not to a user’s private account.

Nevertheless, a trader should follow simple steps and procedures not to lose all invested funds.

A trader should select a reputable brokerage company, go through verification, and keep all documents, including correspondence with your broker.

Everyone should be aware that trading always poses some risks of losing invested funds.

Back to articles

Back to articles