Forex can be compared to an exchange office, operating globally and making earning on exchange rate fluctuations possible. The article “How to open an account on Forex: Standard, Cent or Demo” will tell you how to begin your journey in the market.

In this article, we will talk about a Mini Forex account: what it is for, how to open it, and what is the right way of using it. If your goal is to trade small amounts at lower risks, this article is for you.

Types of accounts

Many people know about the forex market. While some are already involved in active trading, others are just planning to join the community of traders.

The first thing a beginner should do is open a Mini account with a broker. Given that brokers offer their clients a variety of account types, novice traders sometimes make wrong choices.

Unwise decisions can lead to unpleasant consequences for the emotional and financial well-being of newcomers.

When it is about actual trading and not about demo one, a trader should open a live account and make an initial deposit. After a number of successful trades, a profit can be withdrawn.

In other words, a live account is a place for storing actual money and not virtual money like in the case of a demo account. The currency of your account could be USD, EUR, and so on.

Live accounts can be of different types. The most common ones are Standard, Mini, and Micro. Some brokers offer their clients Nano accounts.

Their difference is in the minimum trade size. Thus, the trade size is the largest for Standard accounts and the smallest for Nano ones.

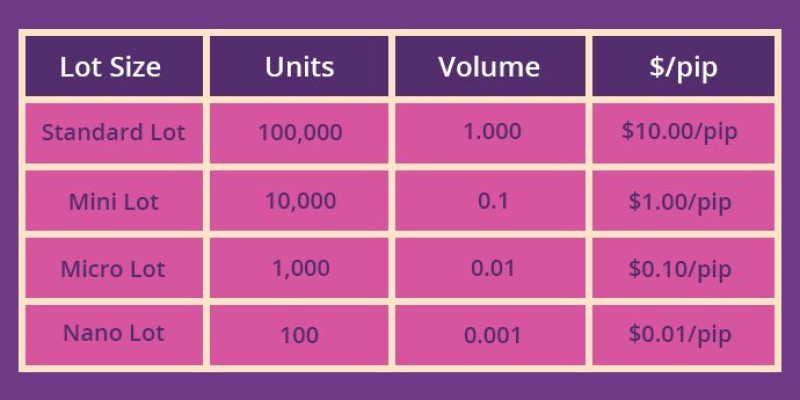

Here is the table that shows their disparity

Minimum trade size on various accounts

| Standard | Mini | Micro | Nano |

| 100,000 | 10,000 | 1,000 | 100 |

If we compare FX trading to walking, owners of Nano accounts make the smallest steps, while those having Standard accounts make the biggest ones.

In the end, all of them reach their goals, that is, they get from point A to point B. The difference is in the distance they go in one step.

In the case of Forex, the length of a step equals the size of a trade. The larger the size, the bigger the trading scale.

The option a trader chooses depends on their experience, knowledge, and goals.

What is Mini Forex account?

Let’s take a closer look at a Mini Forex account. According to our table, it allows us to trade 10,000 units of the base currency. This is equal to 1 lot on a Mini account.

As a reminder, a standard lot in this market is 100 times larger. That is, a mini lot is one-tenth of a standard lot.

Why do fractional lots exist and why are they so attractive to some players? Let's answer these questions by listing the key principles of a mini lot:

1. Trading volumes affect the value of a pip; hence the difference in profits and losses.

Thus, when trading a standard lot of EUR/USD, fluctuations in the asset of 1 pip bring $10 of a profit or loss to a trader. In the case of a mini lot, a profit or loss is just $1.

In a few minutes, the price can change not by one, but by tens or even hundreds of pips. So, if a trader does not want to risk large amounts, it is wiser to open a Mini account;

2. Trading on a Mini account significantly reduces risks. With a Mini account, potential losses are 10 times lower.

However, a potential profit is 10 times lower as well;

3. Various trade sizes require different deposit amounts. Without leverage, deposits in USD, EUR, or another currency can be of 100,000 and 10,000 for Standard and Mini accounts respectively;

4. A Mini account allows a trader to diversify investments, as they can open smaller-size trades: multiple of 10,000 units of a currency instead of 100,000.

Let’s say, traders’ financial capabilities allow them to trade 1 market lot. At the same time, the same amount can be used to trade 10 mini-lots by distributing the capital among several currency pairs.

Such diversification reduces risks and allows a trader to set a trade size more accurately.

Who can use Mini accounts?

Small victories lead to big rewards, and Forex is no exception here.

It simply cannot be that your fortune grows several times in the first days and even months in the market. A substantial profit is earned little by little. It takes energy and time.

Trading is serious work, and those who rely solely on luck are wrong.

A Mini account can help a beginner to achieve small victories, master skills, and trade big whenever they are ready.

In other words, a Mini Forex account is perfect for novice traders. In such a case, it solves the following problems:

- Putting trading and technical skills into practice after demo trading

- Testing a strategy online

- Learning about assets and their price dynamic

- Breaking down an emotional barrier after switching to a live account from a demo one

- Building personal risk-management principles

In addition, a Mini account can help beginners understand what it is like to be a trader and whether such a risky way of making a profit is suitable for them. After all, in spite of all the benefits of demo trading, only the actual trading process shows what Forex is about.

Anyway, it does not mean that a Mini account is just for beginners. In some cases, savvy traders can also take advantage of this type of account.

Benefits for professional traders:

- Trying new trading strategies. By dividing the capital into several parts, a trader can use a Mini account to see if a new trading strategy will work.

- Depending on the result, a trader can decide whether it is wise to trade based on such a strategy or not.

- Putting a new trading strategy into practice. Thanks to low risks, trading on a Mini Forex account can be of good use when experimenting in the market;

- Trading diversification. Trading with fractional lots allows traders to expand the list of their assets.

- Increasing control over trading

- Adjusting trading strategies for algorithmic trading

Advantages and disadvantages

A Mini Forex account has the following advantages in terms of practicality and usefulness:

- adapting to the market, its conditions, and trading

- minimizing transaction risks

- making smaller deposits

- improving skills in working with the trading platform

- diversification, which involves investing in different assets

A Mini account can help beginners cope with emotional distress when switching from a demo account to a live one and improve their skills. Thanks to it, novice traders can advance professionally and trade big.

As for savvy players, a Mini account offers them new trading opportunities.

At the same time, a Mini account has some disadvantages, including:

- Smaller profits: the value of a pip depends on the trading volume.

For a Mini account, the trading volume is 10 times less than for a Standard one, meaning a profit will also be 10 times smaller. - Some brokers offer clients Mini accounts with modest functionality if compared to Standard ones, which affects traders’ trading capabilities.

- Prolonged use of a Mini account can evoke the feeling of uncertainty when opening larger trades.

Mini Forex account: how it works

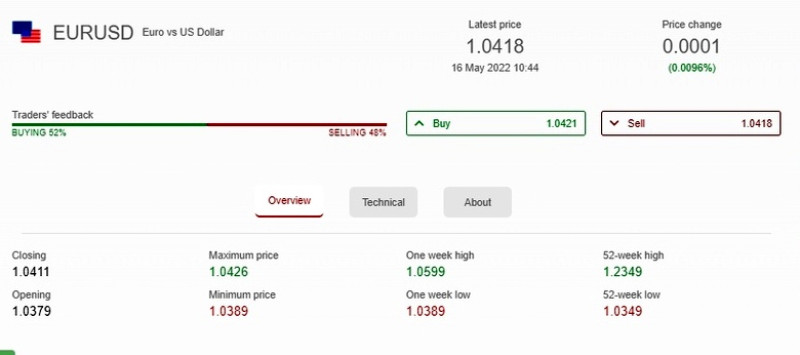

Forex is a marketplace where currency pairs are traded. Technically, traders from all over the world do not buy dollars, euros, and other currencies but only bet on their exchange rate.

For instance, a trader wants to invest in EUR/USD. Let’s say the pair trades at 1.0421.

This means that a trader needs 1.0421 USD to buy 1 EUR.

Forex is a marketplace where currency pairs are traded. Technically, traders from all over the world do not buy dollars, euros, and other currencies but only bet on their exchange rate.

For instance, a trader wants to invest in EUR/USD. Let’s say the pair trades at 1.0421.

This means that a trader needs 1.0421 USD to buy 1 EUR.

Let’s assume that a trader is aware of the latest news about the foreign exchange market. After conducting technical and fundamental analysis, the trader comes to a conclusion that the euro will strengthen versus the dollar. So, the trader opens a position to buy EUR.

If the forecast is accurate, the trader will gain 10 pips at the moment the trade is closed. In such a case, the profit will be:

- $100 if it is a Standard account

- $10 if it is a Mini account

- $1 if it is a Micro account

Oftentimes, the value of assets changes in the opposite direction, contrary to the trader's forecast. In such cases, we are talking about losses.

Thus, if the trade is closed after the euro falls by 10 pips against the dollar, the loss will total:

- $100 if it is a Standard account

- $10 if it is a Mini account

- $1 if it is a Micro account

This example shows the difference between different types of accounts in terms of potential profits and losses.

At the same time, it is important to remember that there is a difference in the deposit amount for each account type. Let’s find out how much money is needed to start trading.

Leverage for Mini Forex account

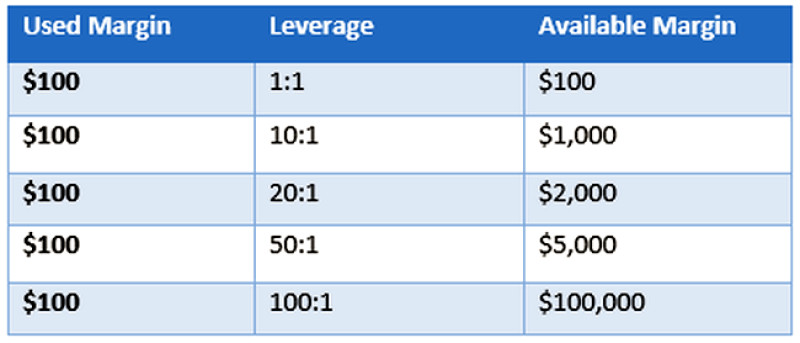

Leverage is a tool that expands traders’ possibilities. Thus, having $100 on a trading account, a trader can open a position of $10,000 by using the leverage of 1:100.

This money is given to the trader by a broker and should be returned afterwards. In fact, traders do not get these funds credited into their accounts as it is instantly included in a trade. No commission is charged for the borrowing.

What is the purpose of leverage? As we know, trading volume affects the value of a pip.

With leverage, trading volumes get larger, which means the value of a pip also increases; hence potential profits and losses also grow.

Leverage is available for holders of Standard and Mini accounts.

For instance, a trader has $200 and he needs $10,000 to trade 1 mini lot. So, the trader can use the leverage of 1:50. All that needs to be done is to set the size of leverage in your profile settings.

Here are a few examples of how leverage can be used.

Trading results with different deposits and leverage

| Trader’s own funds, $ | Leverage | Trade size, mini lot | Pips value, $ | Profit/loss when price changes by 20 pips, $ |

| 50 | 1:200 | 1 | $1 | 20 |

| 500 | 1:20 | 1 | $1 | 20 |

In other words, leverage allows traders with various financial capabilities to trade in the market. Importantly, the size of leverage can be adjusted during the trading process.

As seen from the table, the smaller the deposit, the larger the size of leverage is needed to trade 1 mini lot. At the same time, it is important to remember that leverage can increase losses in case of an unprofitable trade.

Let’s assume that a trader has 10,000 units of a currency and opens a trade of 1 mini lot. In such a case, price movements by 50 pips can result in a profit/loss of $50.

If the trader uses the leverage of 1:2, the size of the trade will double. Likewise, the value of 1 pip will automatically double as well as a potential profit or loss.

How to open Mini Forex account

To enter the forex market, traders need the help of a brokerage firm. Due to a vast array of brokers in the market, it is important to choose the reliable one. The following criteria could help:

- Broker’s image, traders’ feedback

- Regulation and licensing

- Trading conditions: commission size, spreads, etc.

- Trading platform: popular МТ4 and МТ5, for example. It will be a plus if it is similar to the one you worked with during demo trading

- Support service: open hours, efficient response, multiple ways of staying in touch

- Trading instruments: the more currency pairs the better

- Bonuses, contests, and campaigns: although it is not the most important factor, clients like them. For instance, InstaForex traders receive a Welcome Bonus after account registration.

It is important to remember that not all brokers have a Mini account. Above all else, such accounts might have a different name, without Mini Forex in it.

In addition, not all brokers feature such information on their websites.

So, how can you find out whether a broker offers mini-lot trading? It is simple: you should see what is the minimum trade size a broker offers.

It is a Mini Forex account if it offers 0.1 of a standard lot.

For example, this option is available for InstaForex Standard accounts. If you trade with a mini lot with this broker, your deposit can be just $100.

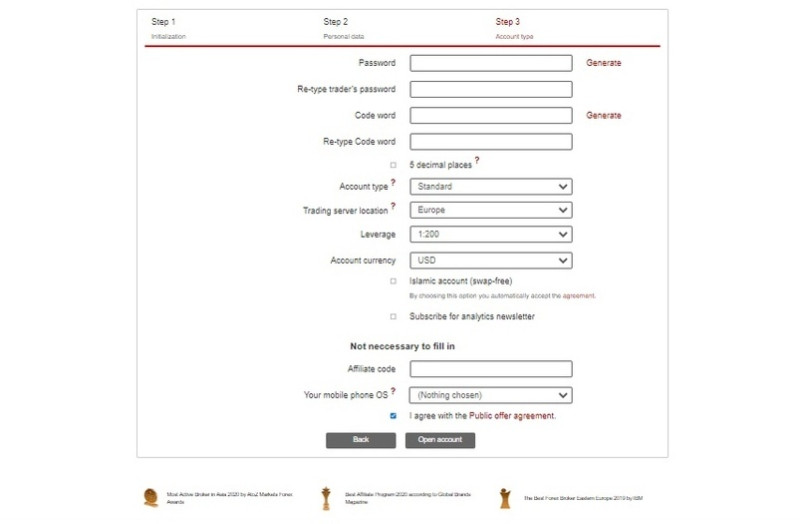

After you have picked a broker offering a Mini account, it is time to register a trading account. As a rule, the following steps should be taken to open one:

- filling out registration forms, entering personal and contact information

- confirming agreement with the Public Offer Agreement

- choosing the account type, the deposit currency, and leverage

- downloading and installing a trading platform

- launching a trading platform and linking a trading account to it

- making a deposit by any of the offered methods

It will take just 5-10 minutes of your time without replenishing your account. As soon as funds are credited to your Mini account, you can start trading.

As for deposit and withdrawal methods, they include wire transfers, bank cards, payment systems, and so on.

Before you register an account, make sure that a broker’s options are suitable for you. Otherwise, you simply will not be able to trade or use profits as you like.

How to trade

Trading with fractional lots is no different from trading with complete lots. In both cases, a buy/sell trade is opened based on the price forecast for the base currency in the pair.

When the forecast is accurate, a trader expands the capital, when it is not, the deposit is partially lost. The difference is in the trading volume and the size of profit/loss only.

Facts to remember when trading on a Mini account:

- The risk per trade should not exceed 2% of the deposit. This rule applies regardless of the account type and prevents the loss of all funds.

- Trading volumes should be increased gradually. Do not switch to a Standard account right after yielding a profit on a Mini one.

If you feel widely excited, open a trade in several mini lots. - Improve your trading skills on a demo account before switching to a Mini one. Occasionally, it can be useful to combine the two options.

- Use stop-loss and take-profit orders despite lower risks. This will help you understand the behavior of an asset and control your own deposit better.

- You can trade one or several mini-lots, depending on your goals, skills, and financial capabilities.

How Mini account differs from other account types

Let’s compare account types to see which one suits you the most:

- Trading volumes: it is smaller for Mini than for Standard but larger than for Micro and Nano.

The difference between each of them is 10 times. - Pip value. For USD, it totals:

- Standard lot – $10;

- Mini lot – $1;

- Micro lot – $0.1;

- Nano lot – $0.01; - Size of profits/losses: it is based on the value of each pip when the price of an asset changes.

When prices change according to the forecast, traders earn profits. Otherwise, when they go in the opposite direction, they incur losses.

- Initial deposit. Here is the table showing various deposit amounts for all the account types using the most common size of leverage – 1:100.

| Account type | Standard | Mini | Micro | Nano |

| Minimum deposit, $ | 1,000 | 100 | 10 | 1 |

- Trading costs. Many brokers have lower commissions for a Mini account than for a Standard one.

As a rule, commissions depend on trading volumes. Some brokers do not charge commissions for fractional trading at all.

- Trading experience. Savvy traders usually use a Standard account. Meanwhile, other account types are suitable for both beginners and professionals.

- Functionality. Some brokers limit functionality when it comes to fractional trading.

- Margin size, i.e. part of a deposit that is used as collateral with leverage trading. Margin can sometimes vary depending on the account type.

At first glance, it may seem impossible to remember all these factors and rules when trading, which requires patience and efficiency. In reality, they ensure its expediency and eventually, traders will stick to them without even noticing.

Final thoughts

A Mini account with all its benefits can help traders achieve success on Forex. Step by step, a player will be increasing the trade size, boosting profits, and mastering skills.

Nevertheless, it is important to comprehend that the possibilities of traders, in this case, are almost limitless. Oftentimes, they can have access to almost all instruments a broker can offer but with smaller investments and risks.

Owing to a Mini Forex account, players are psychologically prepared for trading big.

When a trader proceeds to full-scale trading, the risks of losing an entire deposit are higher. After all, it is always emotionally draining when you trade with actual money for the first time.

However, with a Mini account, the amount of money a trader can risk is purely symbolic. With time, having developed an efficient trading strategy, such a player can become a professional member of the FX community.

Read more:

Cent Account Forex: How to Open?

Forex Demo Account: How to Open?

Back to articles

Back to articles