To make non-cash transactions, you need a bank account. To trade on Forex, you also have to open an account. This is described in detail in the article "How to open a standard, cent or demo account on Forex".

We will explain the meaning of forex micro account, how to use this type of account and what category of traders it suits best.

Do you fancy discovering how to start trading on Forex with only $1 on your account? This article provides information on this aspect.

What is forex micro account?

If you have already analyzed the trading conditions of different brokerage companies, you may have noticed that the minimum deposit to start trading is not the same. Thus, in some cases, this amount is a few US dollars or any other currency, and sometimes it totals hundreds of currency units.

The difference is considerable. However, this is the key point of such company policies. At the same time, large initial capital can automatically be used as a criterion to eliminate potential traders who are not eager or do not have enough money to trade in huge sums.

In most cases, we refer to beginners and inexperienced forex market players, who want to make money, but do not have a solid initial capital.

A forex micro account is designed to make trading available to a great number of traders. Let’s explain its meaning. Although judging by the name, it is clear that we refer to something small-scale than a standard forex account. The point is that forex trading can be carried out in different ways. For example, the most common way is opening trades for 100,000 currency units: US dollars, euros and etc. This means a standard lot in forex trading. In case of a micro account, a trader can trade with a lot that is 100 times smaller. If we convert it to money units, it is 1,000 currency units, i.e. 0.01 of a standard lot. |

Therefore, the trading volume as well as the pip value is different. Notably, a pip shows how much a currency exchange rate has changed.

In the first case, the pip value is 10 currency units, in the second case it is 0.1 unit. As for the US dollar, it is $10 and 10 cents respectively.

Let’s discuss how it works. Assume that traders plan to invest into EUR/USD, the most popular currency pair on Forex.

As far as a standard lot is concerned, a 50 pips price movement will result in $500 of profit and loss. It mainly depends on the type of position and the direction of the price movement. If traders trade in micro lots, the profit or loss will be equal to $5, i.e. a 100 times less.

It's significant to realize that there is also a forex mini account, when the standard lot is reduced by 10 times. Moreover, some brokers offer traders even smaller nano accounts that allow trading with 100 currency units.

Thus, a micro account occupies an intermediate position between mini- and nano accounts. They have different minimum trading volumes, different pip value, and consequently profits and losses also differ considerably.

Forex lot sizes

| Account type | Trading volume, currency units | Correlation with market lot | Pip value, $ |

| Standard | 100 ,000 | 1 | 10 |

| Mini | 10,000 | 0.1 | 1 |

| Micro | 1,000 | 0.01 | 0.1 |

| Nano | 100 | 0.001 | 0.01 |

However, nano accounts are not very common, very few brokers offer this option to traders. Therefore, to grasp the essence of a micro account, we compared it to standard and mini accounts.

EUR/USD transaction results for a price movement of 100 pips

| Account type | Standard | Mini | Micro |

| Trading volume | 100 ,000 | 10,000 | 1 ,000 |

| Pip value, $ | 10 | 1 | 0.1 |

| Profits or losses, $ | 1 ,000 | 100 | 10 |

Therefore, a forex micro account allows beginners to reduce trading risks significantly. However, profits will also be less substantial in this case.

However, the point is not only trading results. We have already discussed above the availability of trading to market players with modest capital.

In this case, micro accounts increase their chances to enter the forex market and generate profits as the mimimum deposit amount does not exceed $10-50. Moreover, the use of leverage makes trading even more accessible, as traders need to invest less of their own money.

Thus, a micro account implies trading not in a full lot, but its fractional part. As a rule, this part is the smallest: only a few brokerage companies offer traders nano accounts.

Pros and cons of forex micro account

Many specialists share the same view that forex micro account is the best option for beginners who do not have enough experience in trading. To avoid risking a large amount of money, they can hone their skills on small trades.

However, this way of trading is also suitable for experienced treaders who want to add something new to their activity, to experiment with trading strategies or assets.

Moreover, this option can be beneficial to all categories of market players as it gives traders more control over positions.

Advantages of forex micro account:

- it improves trading skills;

- it allows traders to put a trading strategy into practice and assess it;

- it reduces risks when opening trades;

- it has low spreads;

- it provides traders with access to the market even if they have below $10 on a micro account;

- trading conditions are similar to those on a forex standard account;

- it has lower or no commissions;

- it helps to evaluate broker’s performance.

Disadvantages of forex micro account:

- orders are sometimes executed with delay;

- low profits compared to trading standard lots;

- risk of getting used to it.

Notably, micro accounts do not limit traders’ activity. They can trade as many micro lots as they want.

For example, it is possible to trade 100 micro lots at a time, which is equal to one market lot. However, why is the micro lot preferable in some cases?

The point is that this way of trading is more precise in terms of position sizing.

For instance, using a standard way of trading, traders open a position with 1 lot. If they use a micro account, they can trade from 1 to 100 micro lots.

In the first case, market players will either generate profits or lose all the money. However, in the second case, some trades may be profitable, while others can lead to losses.

Therefore, the position size is significant, as it affects potential risks. The lower they are, the better for traders.

Let’s give a clear example. Assume that a trader has $500 in his account and trades EUR/USD.

In the case of a standard lot, he uses a leverage of 1:200. A trader will lose $10 if the price changes by one pip.

Let’s suppose that the price moved in the opposite direction and went down by 10 pips. Such rapid fluctuations occur on the market quite often.

Consequently, the trader would lose 20% of his money, i.e. $100.

What is a possible scenario in the case of a micro account? With the same deposit amount of $500, he uses a smaller leverage, i.e. 1:2.

If the price rises by 10 pips, he will lose only $0.1, i.e. 100 times less compared to trading with a standard account. Moreover, the price of EUR/USD must rise by 1,000 pips to result in a loss of 20% of a deposit.

Thus, the more precisely the position size is defined, the more chances traders get and the lower are risks they can face when opening trades.

How to choose broker

Forex micro accounts are extremely popular with traders as they have more pros than cons. In fact, market players can use the same trading instruments as in the case of the standard account. Moreover, they have a smaller initial capital and reduce their risks significantly.

How to open a micro account? The situation is similar to the standard account. First, you should choose a brokerage company.

Notably, only few brokers offer traders a chance to trade with a micro account. However, the number of such brokers has increased lately.

Major points when choosing a brokerage company:

1. Legitimacy of financial services. It guarantees that all your personal data and funds will be effectively protected.

Brokers who work legally must have a license allowing them to provide brokerage services. In most cases, you can find it on the company's website.

For example, InstaForex is regulated by the Financial Services Commission of the British Virgin Islands;

2. Ways of carrying out financial transactions

To start trading on Forex, you need to transfer funds to a micro account.

If you generate profit and plan to spend it, first you should withdraw it.

Brokers offer traders different options, i.e. bank transfers, payment systems, credit cards, and etc. Take into account this aspect so that you have a chance to perform transactions;

3. Spread amount. In short, it is the difference between the bid and the ask prices of an asset. The smaller the spread, the more profits traders can generate.

Spreads can be fixed or floating. In the second case, it is significant that the difference between the bid and the ask price should be as slight as possible. This will allow assessing the spread amount more precisely.

For example, InstaForex broker offers traders forex micro accounts with no spreads or with spreads which do not exceed seven pips;

4. Commissions. It is logical that they should be as low as possible as every market player is interested in minimizing the trading costs.

For example, if a broker has set a commission of 0.5% and a trader opens a trade to buy EUR/USD with a volume of 5,000 units, the commission will be 25 euros.

At the same time, many brokers do not charge any commission if traders have a micro account. For example, InstaForex broker makes trading micro-lots available on Insta.Standard and Cent.Standard accounts with zero commission.

Other companies set commissions only for profitable trades;

5. List of assets. As for forex trading, brokers should ofeer traders a lot of currency pairs.

It is possible that another currency pair will catch your attention during trading and studying the market more thoroughly. In case the broker lacks it in his list, you will have to change the broker or trade the same asset;

6. Customer Service. It is optimal if it works 24 hours a day and provides various options for feedback.

It is significant to realize that not all brokerage companies advertise micro accounts on their websites. In most cases, they simply indicate fractional lots in the contract specifications.

For example, InstaForex broker offers its clients the opportunity to trade in forex micro account within Insta.Standard accounts. Therefore, traders can open positions with only $1-10 as a deposit.

This micro-trading strategy is also possible if you have cent accounts in InstaForex. In this case, you can open trades with the volume of 0.0001 of a standard lot, at which the price of one pip is only 0.1 cent.

How to open micro account

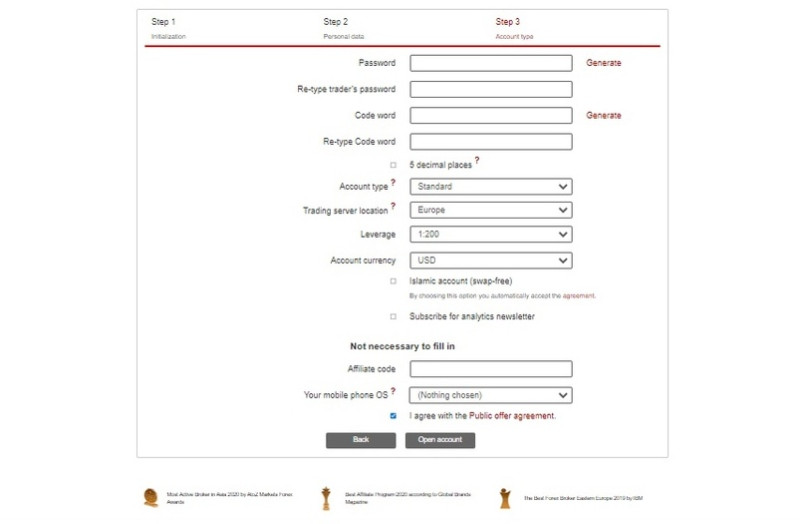

To open a micro account, it is enough to choose a brokerage company which provides such service and to have a device with Internet access. Besides, to start trading in a micro account, you need to deposit it.

The process of micro account registration is the same as in case of the standard account.

To start trading in micro account, you need to:

- Complete the registration. Traders should specify their personal data, e-mail address, and contact phone number,

- Read the public offer agreement and confirm your acceptance of its terms and conditions

- Choose the currency of account, leverage size, and account type;

- Download and launch the trading platform, connect to a micro account using the username and password received by e-mail

- Transfer money to your deposit by any of the available methods.

When you deposited your account, you can start trading. The trading process is similar to that of a standard account.

The same applies to the trading platform. It can be the popular and safe MetaTrader 4, MetaTrader 5 and etc. Traders’ preferences and the offers of the brokerage company play the key role in this choice.

The only difference is trading volume. As mentioned before, a forex micro account allows you to trade with 1,000 currency units, i.e. 0.01 of a standard market lot.

How to use micro account effectively

Therefore, it is easy to open a micro account and start trading in it. The major point is that you should get satisfaction of trading on Forex, and generate profits.

A forex micro account is particularly suitable for the following market participants:

- who do not have extensive trading experience;

- with limited finances;

- not willing to open large trades;

- followers of algorithmic trading;

- who plan to test a new strategy.

This way of trading can be used after or alongside with trading in a demo account. It is the best option for those traders who plan to trade with huge sums in the future, but have not yet prepared for it either financially or psychologically.

A forex micro account is considered the first step to enter a full-scale currency market. Moreover, the financial instruments in both cases are practically identical.

Micro lot trading is also available due to the possibility of using leverage, as in the case of a standard account. Consequently, the required initial capital can be even smaller and the trading volume can be larger.

Remember that even in case of a micro account, the use of leverage requires an effective risk management. It is provided by:

- placing stop-loss and take-profit orders. In the first case, the amount of losses is limited, in the second case, it is the same about the amount of profits;

- minimizing risks: they should not exceed 1-2% per trade. It is advisable to keep this figure within 5% of the deposit during a day.

- using a trading strategy with a clear algorithm for entering and exiting a position;

- reducing the trading volume in case of a series of unprofitable trades, and etc.

These basic rules will make trading more effective as well as protect traders from substantial losses. At least his trading plan will include possible risks and actions in case of unforeseen circumstances.

Conclusions

Therefore, trading in micro account allows traders to enter the forex market, assess their own trading skills without risking a large sum of money. Moreover, this way of trading significantly reduces trading costs.

The truth is that it is unlikely to generate huge profits from one trade. However, it is better to yield modest profits than to earn nothing.

Therefore, fractional lot trading is becoming more popular due to the advantages mentioned above. Moreover, this trading method is used by both beginners and professionals.

It is irrational to believe that trading in micro-lots is the sign of insecurity and limited trading experience. On the contrary, traders who trade in micro accounts strive for more remarkable success and achievements on Forex.

Read more:

Cent Account Forex: How to Open?

Forex Demo Account: How to Open?

Back to articles

Back to articles