Trading is a constantly evolving process. If you want to learn more about types of trading, we also have an article on this topic.

Meanwhile, this particular article focuses on low-frequency trading (LFT) and its advantages over high-frequency trading.

About LFT

Each and every trader wants to make the maximum profit from their activities regardless of the asset they trade.

Profits, in turn, depend on the effectiveness of trading strategies traders use. They guide them in the process of trading and answer the following questions:

- When to open trades

- What instruments to trade to achieve your goals

- When to close trades

- What is the potential profit/risk ratio

- How long to keep an unfinished position open and how frequently to conduct them

The last point is about trading frequency. This is a very important nuance, although some traders, especially beginners, do not pay enough attention to it.

As a result, trading does not bring the desired profit and contradicts the psychology of the trader.

Based on frequency, trading can be of the following types:

- High-Frequency Trading

- Low-Frequency Trading

They differ in the number of trades per period and intervals between opening and closing positions.

HFT is about opening numerous trades in seconds and even fractions of a second if trading robots are used. Meanwhile, unfinished trades are usually not transferred to the next day or trading session.

LFT implies opening a limited number of positions and usually in the daily time frame. In this case, trades are usually held open for more than a day.

In addition, LFT is also about carrying trades within a few hours.

Simply put, with high-frequency trading, traders can make tens, hundreds, and even thousands of transactions per day, whereas with low-frequency trading, they often do one trade or in some cases, non at all.

The choice of strategy - HFT or LFT - is based on the following factors:

- The psychology and temperament of a trader. Thus, HFT will be unacceptable for a melancholic person as well as it might be the best option for a choleric person;

- Trading experience. High-frequency trading requires quick reaction and efficiency in decision-making, which is not always common for beginners;

- Timing of receiving a profit. The less the trading frequency, the longer you have to wait for a profit to come.

If you use HFT, you can expand your account balance within seconds or minutes. At the same time, you risk losing money in a blink of an eye.

With LFT, you open and close positions less often. It takes hours, days, and even weeks to earn money; - Technical capabilities and time traders spend trading. HFT requires traders to be constantly involved in the process (if they do not use trading robots). Meanwhile, with LFT, traders spend less time trading.

When it comes to equipment, HFT is a more expensive process and involves the use of advanced and powerful equipment, whereas LFT is more accessible and versatile.

Low-Frequency Algorithmic Trading

Trading can be carried out not only by people but also by robots.

Algorithmic trading is getting increasingly popular these days. Strategies significantly simplify the trading process. Meanwhile, by using robots, traders can allow themselves to have more free time and be less involved in the process.

Experts in the field of computer technology and trading develop these algorithms, and robots do the work.

They open and close positions based on built-in algorithms.

Thus, there can be both high-frequency and low-frequency trading strategies. That is, sometimes LFT can be considered algorithmic trading.

With HFT, robots can make trades lasting less than a second, and their number can exceed tens of thousands during a trading day. With low-frequency trading, there is one position opened per day or per session.

The number of trades is prioritized in HFT, which is achieved through powerful equipment, technological solutions, and high-speed access to stock exchanges.

Unfortunately, not all private investors can use HFT algorithms due to their high financial cost.

Meanwhile, LFT focuses on the quality of trades. Here the logic of trading is what is the most important.

By and large, any trader can create and run an LFT algorithm. Although it does not require large financial expenses, a trader must have a deeper knowledge of computer technology and trading.

At the same time, high-frequency algorithms are about relative constancy. As long as they bring a profit, they do not need to be modified. Meanwhile, low-frequency algorithms are constantly adjusted by users.

Choosing between LFT and HFT

Let's dwell on some important nuances in order to distinguish between these two concepts.

Traditionally, high-frequency trading implies using robots. These are specially designed programs that take care of opening and closing trades and do not require traders to be involved in this process.

HFT is commonly used by big companies and hedge funds. This option is less popular with private investors as it requires powerful equipment, technical capabilities, and huge financial costs to develop and update the program.

Anyway, this regards traditional HFT. At the same time, scalping, which is also available to individual players, is often referred to as high-frequency trading.

Here traders can open tens or even hundreds of positions per day/session on short-term charts without using robots. Of course, they can’t do that within seconds and milliseconds as robots do.

Nevertheless, this option is still regarded as high-frequency trading.

HFT supporters often tend to believe that HFT increases their chance of yielding a higher profit. However, practice shows that there is no correlation between the time spent on trading and the result.

Here the skills and experience of traders are what is most important, not the number of trades. In addition, non-stop monitoring of markets is exhausting and can badly affect trading results.

Therefore, HFT has the following drawbacks:

- overestimated capabilities and potential. Even if HFT brings profit, a lack of knowledge and skills can lead to undesirable losses;

- unjustified profit/risk ratio. Oftentimes, the desire to make a quick profit is so high that traders ignore the principles of risk management;

- trading turns into gambling in an attempt to recoup losses or increase profits;

- trading feels exhausting as it requires constant monitoring of the market in order not to miss the right entry and exit points.

All in all, manual HFT may not meet traders’ expectations. Despite that, HFT is a commonly followed trading style anyway.

This is due to the fact that most traders focus on short-term profits. With an accurate forecast, a trader can yield a profit within several minutes.

In addition, even insignificant price changes may bring a profit, which is another benefit of HFT.

Now let’s talk about LFT.

For traders who choose this option, the number of trades does not matter. Rather, they open trades, which can be just a few in a whole month, guided by risk management rules.

This, in turn, increases their chance of generating a solid profit in the LFT process.

The daily time frame is commonly used for low-frequency trading.

The process of identifying trends and potential reversals is one of the crucial moments in trading. In this regard, the daily time frame is more reliable and informative than short-term intervals.

For example, a bullish trend on the M1 chart could be just a correction on the daily chart. Therefore, traders who open buy positions only in the M1 time frame will incur losses.

On the daily chart of EUR/USD below, you can see how the price changes after the formation of the Pennant pattern. This formation illustrates a further trend continuation. Thus, you can see on the chart how the bullish trend resumes after a correction.

Traders would yield a 500-pip profit during the LFT process if they used the coming buy signal and opened long positions in time.

Meanwhile, on the M30 chart, traders could miss such an opportunity due to visual reversals and corrections as determining the trend and identifying this pattern would be difficult.

Other benefits of LFT:

- There is no need to spend a lot of time at the computer to trade;

- There is a great chance to get a solid profit trading with the trend when the direction is identified accurately;

- Small psychological and trading load on the user;

- Risk management;

- No haste and risk of making irrational moves;

- Market noise filtering through the use of daily and higher timeframes;

- Accuracy of signals. Chart patterns, support, resistance, trend lines, and other tools are more reliable in higher time frames.

Still, it does not mean that one of the above trading types is better than the other. Both options have their pros and cons, their supporters and critics.

So, make sure you choose what is best for you based on your personal preferences and trading goals.

LFT strategies

To develop an LFT strategy, you should be an experienced trader.

You can use technical and fundamental analysis data, etc. Your strategy should become the basis of your trading.

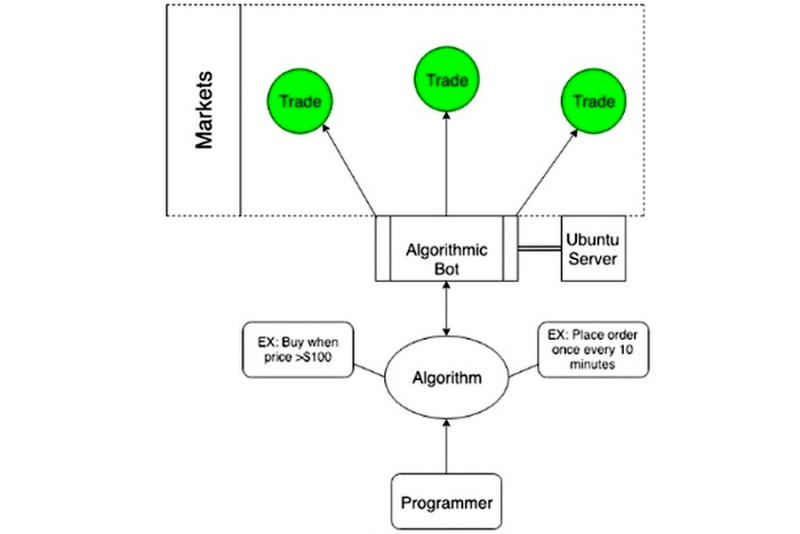

If you want to automate your strategy, you should build an algorithm. That is, you should create a program that will allow a trading robot to open and close positions. This is where programming skills come in handy.

Algorithms that take care of the most monotonous work in the process of low-frequency trading take a lot of time to develop and require certain knowledge.

So, a developer should know the main programming languages such as C++, Python, etc.

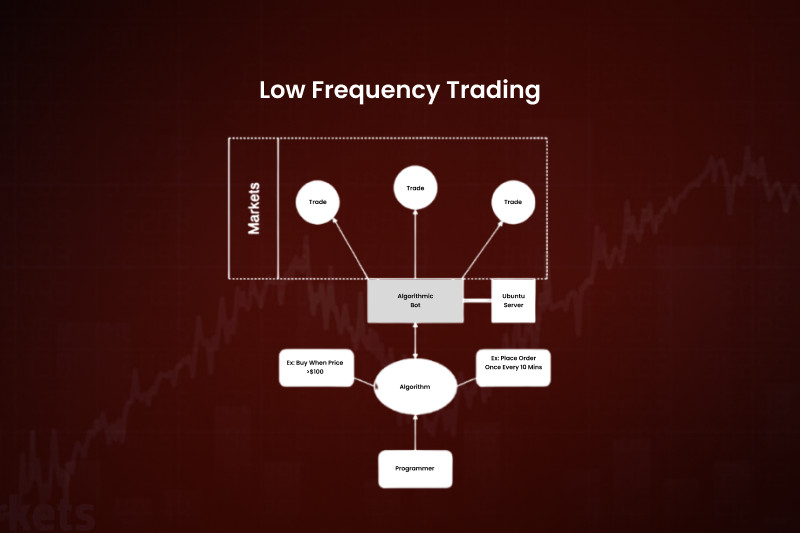

The diagram below shows the simplest LFT strategy. It involves placing an order every 10 minutes if the value of the selected asset drops below $100.

You must test any strategy, including the LFT one, before you start using it.

First, you test its efficiency based on past performance.

Here you should get proof that your trading strategy will work and be profitable.

Testing ends with a final assessment of the strategy. The maximum drawdown value is most often used for that as it shows the strongest decline from peak to bottom on the account equity chart.

Remember that LFT strategies usually show a stronger drawdown than HFT ones.

The Sharpe ratio is another indicator that shows the effectiveness of your strategy. Simply put, it shows the profit/risk ratio.

After checking the efficiency of the strategy in real conditions and following risk management rules, the LFT algorithm can be used for trading.

The LFT process can be not only automated but also manual. In this case, there is no need for a special program. Traders open and close positions themselves.

Common myths about LFT

When it comes to LFT, certain misconceptions among newcomers make them take the wrong steps. To avoid misunderstandings and disappointments in the trading process, let's discuss some of these misconceptions in detail.

1. The more complex the LFT strategy, the higher the chance of making a profit. In fact, the correlation between the complexity of trading strategies and trading results has no proof.

There are multiple examples where traders succeed with the simplest algorithms, and vice versa, fail with complex ones. Therefore, make sure you choose an LFT strategy that works for you. Never be guided solely by the level of its complexity;

2. Frequency affects the effectiveness of trading and the amount of profit. Practice shows that you can get the same profit by opening hundreds of positions or just one trade per day.

You should stick to your strategy and never chase the quantity of trades. For example, if an LFT trader makes three trades per week and they are profitable, increasing the number of positions will make sense.

However, if you get mixed results from your strategy, adjusting it would be wiser than increasing the frequency of trading.

3. LFT is an option only for beginners who do not know their trading capabilities and do not have enough experience to trade more often. Actually, many professionals choose low-frequency trading as a tool for making a profit.

4. LFT strategies with a guaranteed profit are expensive and are unavailable in the public domain. In fact, strategies that guarantee profit simply do not exist.

No strategy, even developed by highly qualified experts, promises profit. In addition, algorithms may lose their effectiveness with time.

First, there will be losses anyway. The main thing is that profits offset them. Secondly, any strategy needs to be modified and adjusted to changing market conditions;

5. It is impossible to make a solid profit with LFT. That is a wrong belief because the frequency of trading does not affect the size of the profit.

It depends on the effectiveness of the strategy and trading volumes, rather than on their number for a certain period.

Knowing these aspects will help secure the trading process and avoid mistakes, which can lead to losses in some cases.

Who chooses LFT

Low-frequency trading can be both algorithmic and manual. In the first case, the process is automated with trading robots doing most of the work.

In the second case, when implementing the LFT strategy, traders open and close positions themselves.

The types of traders engaged in low-frequency trading are the following:

1. Users who do not have enough time for high-frequency trading. In this case, it is also about manual trading (scalping), rather than algorithmic one.

For example, a trader has a full-time job and can’t open and close many trades during the day or constantly monitor the market.

So, LFT is the best solution for busy users;

2. Traders who feel distressed when they open numerous positions. Constant emotional pressure badly affects the effectiveness of trading, not allowing traders to focus on the process and analyze the market;

Traders who focus on yielding quick profits rather than the quality of trading. LFT is the best option for conscious users who weigh their every trading decision.

When it comes to experience, experts have different opinions on this matter. Some of them argue that experience is not an important factor when choosing the frequency of trading.

Others believe that LFT is the most suitable option to start with as it offers the optimal ratio of profit and risk and does not require an immediate response.

Final thoughts

Oftentimes, inexperienced traders get too excited when watching constant changes in the value of selected assets. After all, there is nothing easier than opening a position in the hope of making a profit when prices go up or down.

In fact, it is typical not only for beginners. Professionals overestimating their capabilities sometimes open multiple positions, forgetting about the basics of risk management.

All traders without exception must remember that quantity does not guarantee quality. Simply put, numerous trades do not promise the maximum profit.

When it comes to LFT, traders can not only save time spent on trading but also be mindful of each position and trade with no haste. Sometimes, the best trade is the one that was never carried.

The trader who opens trades just for the sake of opening them is bound to losses.

Back to articles

Back to articles