If you think that long–term trading is only for pensioners, you are deeply mistaken. Although this type of trading does not presuppose hustle and bustle, it has some advantages. Traders have to think over the situation and take the right decision.

In this article, we will find out all the peculiarities of long-term trading, its main features, as well pros and cons.

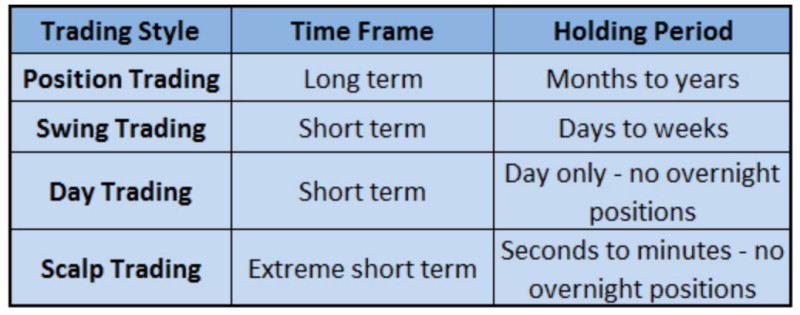

You can also read the article “Types of trading” to get more information on various types of trading and their peculiarities.

Long-term trading

Long-term trading is more like investing. There is no room for speculation on short-term changes in the value of the asset.

Trades are kept open for a longer period, usually from several months to several years. For these purposes, it is necessary to invest only that part of the capital that is really free.

Long-term trading is suitable for those who are not ready to spend days and nights at a computer monitor, tracking every change in quotes.

This type of trading could be considered an additional passive income. However, traders should work to make the strategy bring an income.

Firstly, quite a large amount of money is required for investment. Therefore, to begin with, investors should figure out where and how to earn funds in order to invest them.

Secondly, they need some experience in trading in the markets as well as basic knowledge about the formation of an asset trend and factors that can influence it.

Thirdly, one of the most important points is the compilation of an investment portfolio, that is, the selection of assets for investing funds.

The most important rule is not to put all the eggs in one basket. It means that traders should distribute the available capital among several assets.

It is recommended to add instruments with different risk levels and liquidity degrees to the portfolio. Traders should understand that the higher the potential return is, the higher the risks are.

There are specialists who help traders to compile investment portfolios depending on the readiness to risk and other wishes of the investor.

How to choose assets for investment

We have already mentioned that funds in long-term trading are invested for a sufficiently long period. Traders should understand that they are "frozen" and cannot be used during this time.

That is why it is especially important to take a responsible approach to the selection of assets for investment. It is necessary to find underestimated companies that have high growth potential.

In this case, the invested funds can give a decent income after a while. Conversely, if the asset is chosen incorrectly, the money will not bring profit. What is more, investors will be unable to withdraw the whole sum for many years.

There is a certain algorithm that can be used to select assets for investment. In long-term trading, fundamental analysis, not technical analysis, plays a primary role.

A trader should pay the closest attention to the financial performance of the company as a whole instead of short-term fluctuations in the value of the asset.

Curiously, shares of young, promising companies that have not been listed on the stock exchange are traded outside the exchanges. This could be considered both advantage and disadvantage.

The main advantage is that all the terms of the contract could be negotiated individually. Also, the over-the-counter market offers a much larger selection of assets than the stock exchange.

However, it can be quite difficult to find information about a company. If a company is not traded on the stock exchange, it has no strict obligations to publish annual and quarterly reports and so on.

Step-by-step instructions for selecting asset

To pick the right asset for long-term trading or investment, it is necessary to take the following steps:

1. Determine the real value of an asset. The fact is that securities may be undervalued, or, on the contrary, overvalued. In order to find out the real price, you need to search for financial information about the company. Next, it is necessary to calculate several indicators using this information:

• Coefficients determining the financial position (current ratio, quick ratio, debt to equity ratio);

• Performance/efficiency assessment (return on equity, return on capital raised);

• Value estimation (the ratio of prices to earnings).

2. Create a file with the obtained information and figures for each company. You can also create a summary table with all the companies that are considered an object for investment. This will be especially good if the companies belong to one field.

3. Analyze the received data. It is necessary to compare the performance of each company with the performance of the industry as a whole.

- If a company performs better or worse than its competitors, you need to pay attention to the figures described in the first paragraph to get confirmation that the company is undervalued.

- It is necessary to assess changes in the financial situation and the value of the company over the past few years to find whether these indicators are deteriorating or improving.

- Depending on the assessments of the financial situation, it is necessary to classify companies according to the risk level: high, medium, and low.

- Another analysis option is to look at the growth potential of companies and sort them by this feature.

4. Select 2-3 assets for investment from the list. It is possible and necessary to invest in more than one asset. It is better to distribute the available amount of money between several instruments. In this way, risks will be diversified. If one asset does not bring profit, an income from other assets could compensate for these losses.

Pros and cons of long-term trading

Like any other type of trading, the long-term one has advantages and disadvantages. Let us focus on them.

Advantages of long-term trading:

• Potentially high profitability in the long term. Positions stay open for several months, which allows traders to maximize the possible profit from the asset.

• No need for daily monitoring of the market situation. Investors are rarely interested in momentary price fluctuations. The financial situation of the company as a whole and its development prospects are of higher importance. Therefore, fundamental analysis plays a key role.

• No need to learn the subtleties of technical analysis, study indicators, and graphical patterns. This matters only for short-term strategies.

• The possibility of receiving dividends. If investors put money in shares of a company, they may receive dividends. In addition to making a profit from shares, it is also possible to get additional passive income in the form of dividend payments. Notably, young and growing companies do not pay dividends. They prefer to invest all the raised funds in business development.

Disadvantages of long-term trading:

• Sufficiently high initial deposit. It is necessary to understand that long-term trading requires big sums of money. The invested funds cannot be withdrawn at any time. Long–term trading is one of the least liquid ways of trading.

• Considerable losses. Traders may lose a large sum if the investment object is chosen incorrectly. If you do not follow the rules of choosing an asset for investing and do not diversify the risks, you can lose significant sums. This problem is easily solved if you carefully pick instruments for long-term trading.

• Personal qualities. This type of trading is not suitable for impulsive people. Here it is necessary to be calm and patient enough not to close trades ahead of schedule. Traders should wait for the moment when the profit reaches its peak. They also need to be calm in order not to react to short-term fluctuations in the value of the asset.

• Age limits. It is too late to start long-term investing in retirement. You may not have time to get all the benefits from the invested funds. However, your children and grandchildren can benefit from your investments, which is also a good option.

Long-term Forex trading

In the previous sections, we talked about long-term trading in the context of investing. This implies, first of all, investing in securities, for example, stocks.

You can also consider this kind of trading in the context of Forex trading. However, it will have its own peculiarities. Let us look at them in detail.

Long-term trading could also be called positional. Traders open a certain position and hold it for quite a long time, from several weeks and months to several years.

At first sight, this type of trading is not difficult. You need to open a position, settle protective levels, and just profit from successful trades.

In fact, it is not that simple. In order to make a successful long-term trade, it is necessary to conduct a preliminary in-depth analysis of the market situation.

Long-term trends are very important for such trades. It is necessary to use all analytical tools for confirmation, including technical indicators and graphical patterns.

For long-term trading, traders apply big time frames (from daily and higher) since price fluctuations in short-term periods do not matter in the long term.

In addition, there is less market noise at higher time frames, and, therefore, fewer false signals.

Another important feature and at the same time disadvantage of this type of trading is that it is necessary to pay commissions, namely swaps, for transferring positions through the night.

Although the size of the swaps is small, a position that is open for several weeks may require a decent amount of money.

In this case, you need to be really sure that the expected profit will be sufficient to cover all the expenses.

That is why many traders prefer to open and close trades within one trading day, thus avoiding additional fees.

Comparison to mid-term trading

Positional and medium-term trading have some similarities but there is also a sufficient number of differences. Let us find out the similarities and differences.

The first similarity is that positions in both types of trading remain open for more than one day.

In case of long-term trading, positions stay open up to several years. For medium-term trading, this period varies from a few days to several weeks and months.

This means that choosing either trading style, traders have to pay for the transition of positions overnight. And this, in turn, requires additional spending.

At the same time, long-term traders have more freedom since they do not need to monitor changes in quotes daily. Meanwhile, for those who prefer mid-term trading, daily fluctuations are of vital importance.

The fact is that any important event occurring within the day may have a significant impact on the asset. Thus, it is necessary to close positions on time.

Both types of trading can be used as an additional source of income. Since they do not require constant presence at the computer, like intraday trading, they can be combined with the main work in the office, for example.

However, medium-term trading assumes a higher level of profit. An income may reach 75%. Long-term trading assumes a lower income of about 25% per annum.

Another similarity of both these styles is that traders have enough time to analyze the market situation and make a decision. Traders have no need to take knee-jerk decisions like scalpers, for example.

This, in turn, reduces stress and allows investors to avoid rash acts under the influence of emotions and momentary impulses.

Conclusion

This article is devoted to long-term trading and ways traders may use it. Most often, this type of trading is associated with investing.

However, it is important to understand that the invested funds cannot be withdrawn at any time. That is why it is so important to choose the right assets for investment so that they can really bring a significant profit in the future.

To do this, traders should create an investment portfolio that will contain assets with different levels of risk and degrees of liquidity. This will help them to diversify risks and make a profit.

Quite a big initial deposit is another disadvantage of this type of trading.

Nevertheless, long-term trading can be an additional source of income since it does not require constant presence at the computer. Daily fluctuations in the value of an asset are not essential for this type of trading.

Fundamental factors, such as releases of important political or economic news, as well as the financial position of the company, including its corporate reporting, are much more important here.

Long-term Forex trading also exists but it is not as popular as medium-term and short-term. The fact is that the potential profit from the last two types of trading is much higher (up to 100%) than the income from long-term trading (about 25%).

It is believed that the movement of the asset value over long time intervals is easier to predict. However, one should understand that traders do not open many long-term positions. That is why each of them is very important.

Recommendations

Quantitative Trading

LFT

Spoofing

Frontrunning

Positional trading

Medium-term trading

High-frequency trading

Back to articles

Back to articles