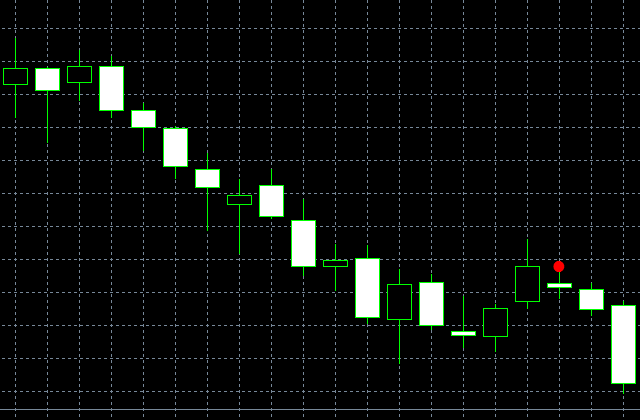

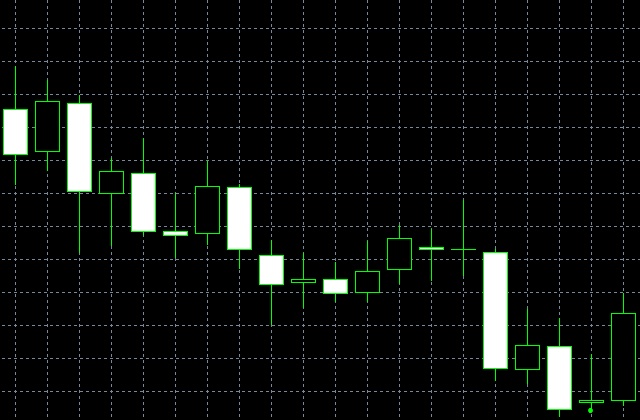

The Harami chart formation consists of a large candlestick body followed by a smaller body. It is the relative size of these two candlesticks that makes the Harami a significant reversal figure. Remember that the days when a Doji candle is formed (i.e., when the opening and closing prices are equal) occur when the market is sluggish, representing days of indecision. Therefore, smaller body days following longer body days also indicate market indecision. The more indecision and uncertainty there is, the bigger the likelihood of a trend reversal. At the moment when the body of the second day becomes a Doji, the chart figure is referred to as the Harami Cross, where the cross is the Doji. The Harami Cross is a more reliable reversal pattern than the regular Harami.

How to recognize this pattern?

- A long day occurs in a trending market.

- The second day is a Doji (the opening and closing prices are equal).

- The second-day Doji is fully within the range of the previous long day candlestick.

Possible scenarios and pattern psychology

The psychology behind the Harami Cross formation is similar to that of the regular Harami pattern. At first, a clearly visible market trend is in place. Then, all of a sudden, the market reverses within one trading day, without exceeding the candlestick range of the previous day.

One of the drawbacks is that the market closes at the same price as it opened. The trading volume of the Doji day also fades out, reflecting the complete indecision of market participants. Thus, this chart figure signals a strong potential trend reversal.

Pattern flexibility

The color of the long day candle should reflect the trend direction. The Doji may have opening and closing prices that diverge by 2 or 3 percent (only if there are no Dojis in the preceding data).

The bullish and bearish variations of the Harami Cross both come down to a single candlestick that supports their interpretation in most cases. The body of the reduced single-day candle may be considerably longer than what is allowed for the Paper Umbrella or Hammer formations.

Note that transformation confirms the nature of this pattern.

Related patterns

The Harami Cross may well be the beginning of a chart figure called Rising (or Falling) Three Methods, depending on the price action within the next several days. The Rising and Falling Three Methods formations are continuation patterns, which come in contradiction with the signal sent out by the Harami Cross.