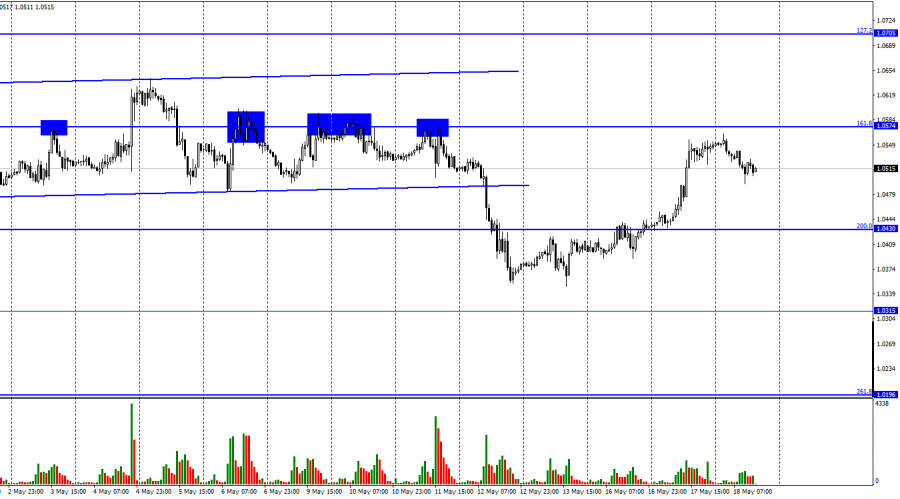

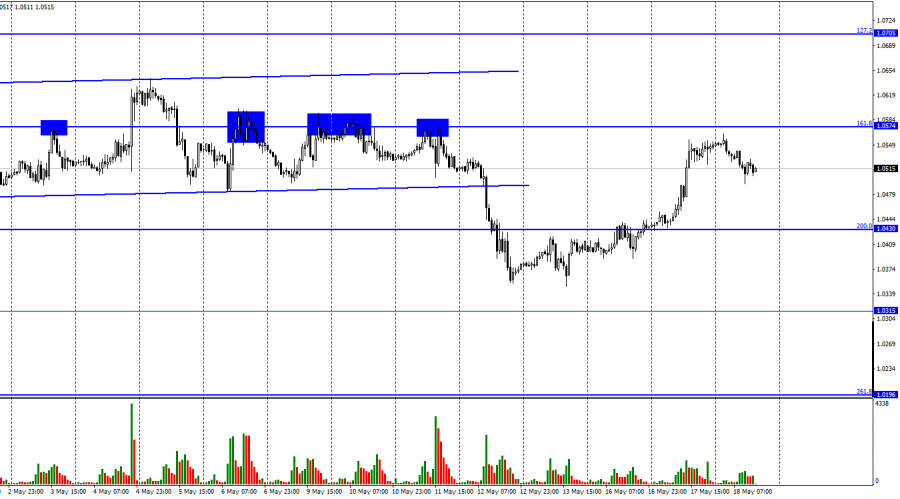

The EUR/USD pair performed a strong growth in the direction of the corrective level of 161.8% (1.0574) on Tuesday, and Wednesday - a reversal in favor of the US currency and began to fall in the direction of the Fibo level of 200.0% (1.0430). At the moment, the pair has not even worked out the level of 1.0574, from which the last stage of the fall of the euro currency began. Thus, no matter how much I would like to consider the movement of Monday and Tuesday as a new upward trend, I would not rush to conclusions yet. First of all, it is necessary to understand why yesterday we saw a strong growth of the euro at all. The GDP report in the first quarter was stronger than traders' expectations, but was it enough for the euro to grow so much? I think that now the ECB's position on monetary policy is much more important. And this position is rather vague and unstable. Let me remind you that it all started with the fact that Vice President Luis de Guindos said a few weeks ago that the rate could be raised in July.

After that, traders began to pay attention to all the speeches of Christine Lagarde, waiting for confirmation from her. But Lagarde, instead of saying "Yes, the rate will be raised in the summer," began to use various vague formulations, and now it is still unclear whether de Guindos expressed his position, which does not correspond to Lagarde's position at all, or Lagarde does not want to talk about the rate ahead of time and is preparing a surprise. Yesterday, it became known that the ECB president asked the bank's chief economist Philip Lane and member of the board of governors Isabelle Schnabel to make fewer public statements. That is, Lagarde is afraid of information leaks, but what kind? After all, the ECB rate is now much lower than the Fed rate, and even an increase of 0.25% will practically not change the situation. And what could be secret about the upcoming rate hike? Thus, if Lagarde confirms his willingness to raise the rate in the near future or traders believe it, then the euro will be able to continue growing.

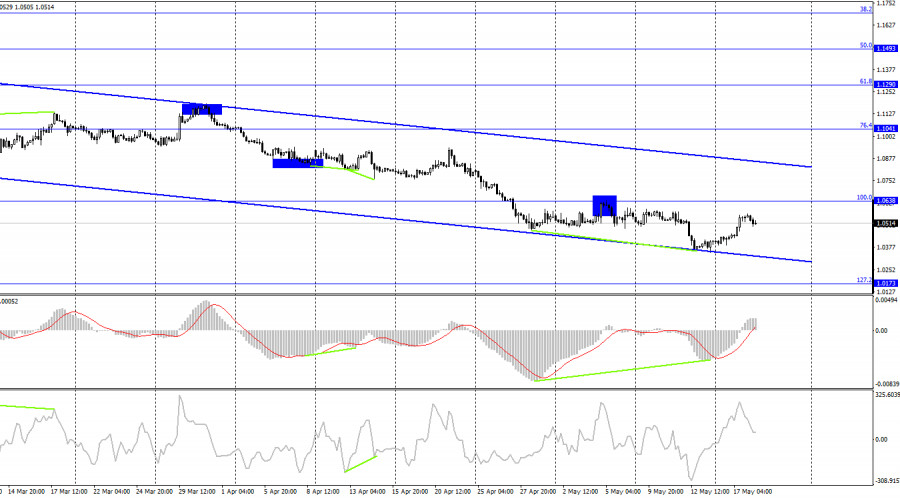

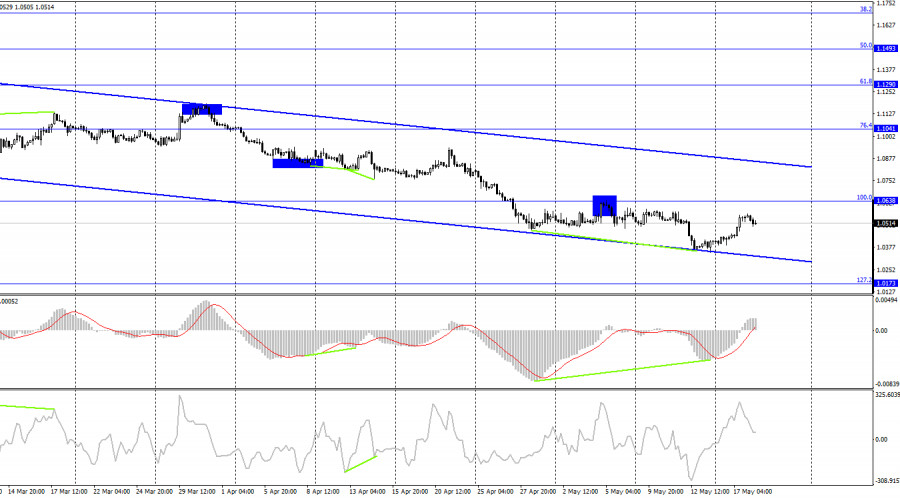

On the 4-hour chart, the pair performed a reversal in favor of the European currency after the formation of a "bullish" divergence at the MACD indicator. The process of growth has begun in the direction of the corrective level of 100.0% (1.0638), but this growth takes place inside the downward trend corridor, which still characterizes the current mood of traders as "bearish". A rebound from the level of 100.0% will work in favor of the US currency and the resumption of the fall in the direction of the Fibo level of 127.2% (1.0173).

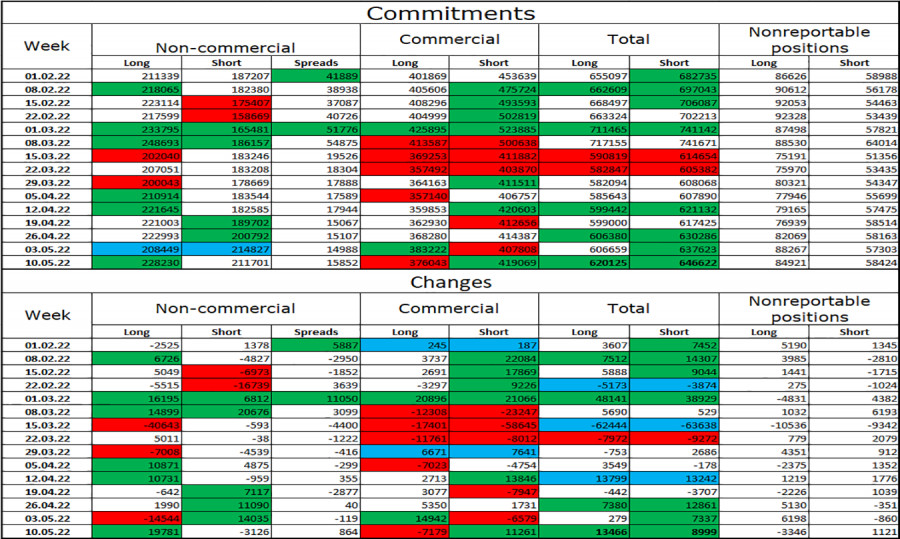

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 19,781 long contracts and closed 3,126 short contracts. This means that the bullish mood of the major players has intensified again. The total number of Long contracts concentrated on their hands is now 228 thousand, and short contracts - 211 thousand. As you can see, the difference between these figures is minimal and you can't even say that it is a big problem for the European currency to show an increase of 100 points in the market. In recent months, the euro has mostly remained bullish, while the currency itself has been falling, falling, and falling. Thus, now the situation is approximately the same. The COT report continues to say that major players are buying euros, and the euro, meanwhile, is falling. Therefore, the expectations of COT reports and the reality now simply do not coincide.

News calendar for the USA and the European Union:

EU - consumer price index (09:00 UTC).

On May 18, the calendars of economic events in the European Union and the United States are almost empty. The only report of the day has already been released, inflation in the EU in April was 7.4%. The background information for the rest of the day will not affect the mood of traders.

EUR/USD forecast and recommendations to traders:

I recommend new sales of the pair if there is a rebound from the 1.0574 level on the hourly chart with the goal of the 1.0430 level. Or in case of a rebound from the 1.0638 level on the 4-hour chart. I recommended buying the euro currency when closing above the 1.0430 level on the hourly chart with a target of 1.0574. These deals could have been closed today. New purchases at the close above 1.0574 with a target of 1.0705.