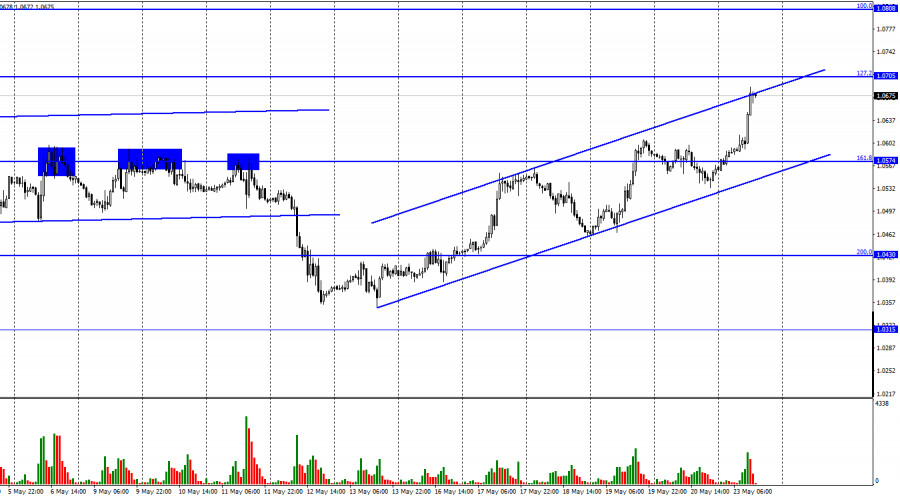

On Friday, the EUR/USD pair performed a slight drop inside the upward trend corridor, which continues to characterize the mood of traders as "bullish". However, today a reversal was made in favor of the euro currency and the growth process resumed in the direction of the corrective level of 127.2% (1.0705). The rebound of quotes from the upper limit of the corridor may work in favor of the US currency and a new fall in the direction of the Fibo level of 161.8% (1.0574). On Monday, the information background was practically absent for the euro and the dollar. There will be very little important news this week in general, but news tends to arise when no one is waiting for them. The European currency has been growing for more than a week, and today it showed growth even without statistics. Thus, I believe that the mood of traders is beginning to change to "bullish". Let me remind you that for many months the European currency has been doing nothing but falling.

However, now geopolitics no longer has such a strong negative impact on the euro. Probably because traders have already taken into account the conflict between Ukraine and Russia and its possible consequences for the European economy. I would also like to note that in recent weeks the ECB has begun to signal that it will also start raising the interest rate this summer. And this is a serious factor in favor of the euro since while the Fed was talking about tightening monetary policy and raising its rate, the dollar was steadily growing. Thus, the situation for the euro began to improve slowly. It should also be noted that the euro has fallen very much over the past year. Thus, the usual corrective growth can now begin. Christine Lagarde and Jerome Powell will speak tomorrow, and traders can make sure that both central banks are ready to raise the rate this year. But traders have already worked out all kinds of Fed rate hikes, and any new signal from the ECB can cause rapid growth of the euro.

On the 4-hour chart, the pair performed an increase to the corrective level of 100.0% (1.0638). The rebound of quotes from this level will allow traders to expect a reversal in favor of the dollar and a new fall in the direction of the Fibo level of 127.2% (1.0173). Consolidation above the level of 100.0% will work in favor of continued growth in the direction of the upper boundary of the downward trend corridor, which continues to characterize the mood of traders as "bearish". The growth on the 4-hour chart looks very small so far.

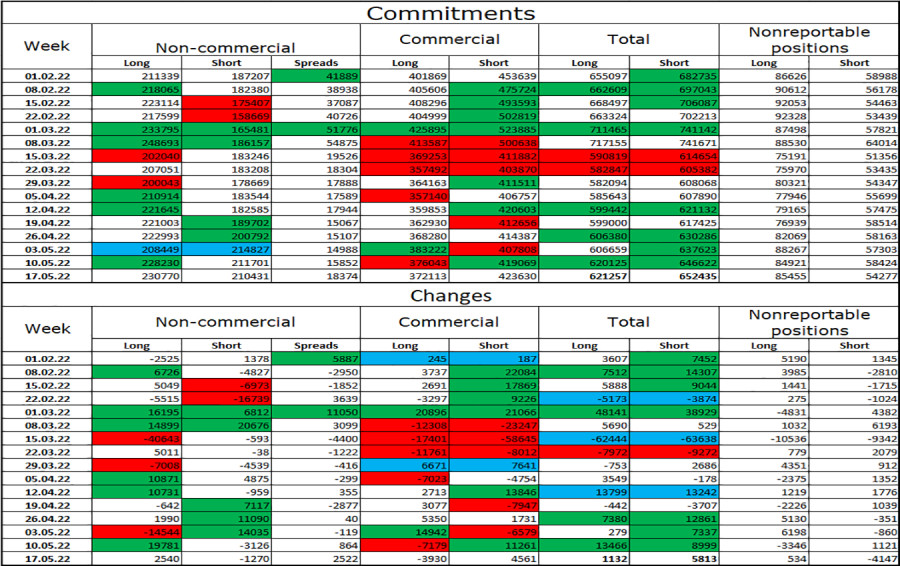

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 2,540 long contracts and closed 1,270 short contracts. This means that the bullish mood of the major players has intensified again. The total number of long contracts concentrated on their hands is now 230 thousand, and short contracts - 210 thousand. As you can see, the difference between these figures is small, and you can't even say that the European currency has only been falling in recent months. In recent months, the euro has mostly remained bullish, but this did not help the EU currency. Now the situation is about the same. The COT report continues to say that major players are buying euros, and the euro, meanwhile, is falling. Therefore, the expectations of COT reports and the reality now simply do not coincide.

News calendar for the USA and the European Union:

On May 23, the calendars of economic events in the European Union and the United States are empty. Thus, the background information for the rest of the day will not have any effect on the mood of traders.

EUR/USD forecast and recommendations to traders:

I recommend new sales of the pair if there is a rebound from the 1.0638 level on the 4-hour chart with the goal of the 1.0430 level. I recommended buying the euro currency when closing above the 1.0574 level with a target of 1.0705. This level is almost reached, so the deal can be closed.