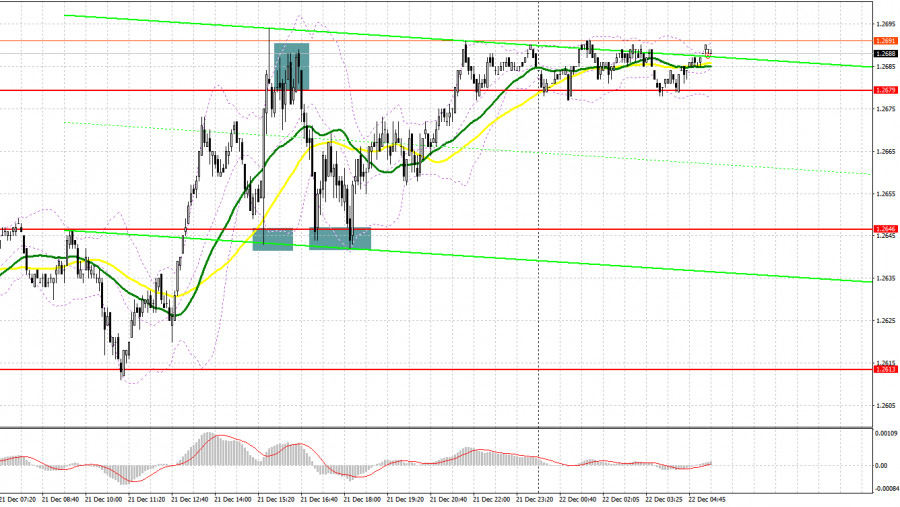

Yesterday, the pair formed several entry signals. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.2625 as a possible entry point. The pair fell to 1.2625, but I did not wait for a false breakout to form. In the afternoon, safeguarding the resistance at 1.2679 generated a sell signal, which sent the pair down by more than 35 pips. After a pretty good correction, the buyers emerged in the area of 1.2646, producing new buy signals in continuation of building the uptrend, and traders could earn about 30 pips of profit.

For long positions on GBP/USD:

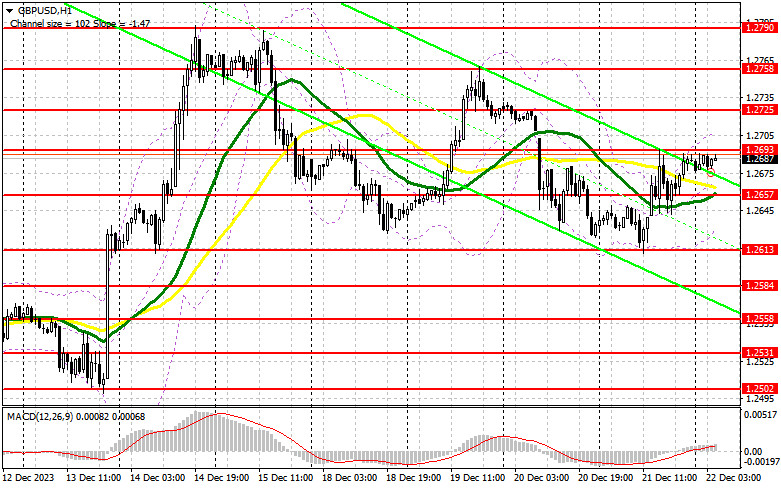

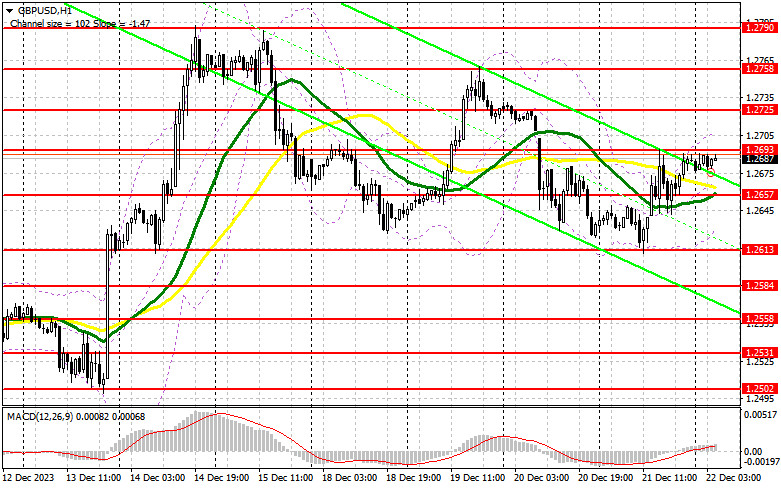

The final reading of the US Q3 GDP data showed a downward revision, and this exerted pressure on the dollar, giving bulls an advantage, as they recouped losses following the release of UK inflation data. Today, UK reports on retail sales and GDP will garner investor interest. Poor retail sales and a downwardly revised GDP data, indicating a likely recession in the UK, will create problems for the bulls, as gloomy data can push the pair to fall, which I plan to take advantage of. Forming a false breakout at 1.2657, which is in line with the moving averages, will create a buy signal, with the goal of pushing the pair up to the area of 1.2693, which the pair failed to surpass yesterday. A breakout and consolidation above this range will strengthen the demand for the pound and open the way to 1.2725. The farthest target will be the area of 1.2758, where I will take profits. If the pair falls and there is no buying activity at 1.2657, and this level is a kind of the middle of the sideways channel, only a false breakout near the next support at 1.2613 will signal opening long positions. I plan to buy GBP/USD immediately on a rebound from 1.2584, aiming for an intraday correction of 30-35 pips.

For short positions on GBP/USD:

Sellers will get a chance to start a corrective movement in case the UK releases a weak report. If the data turns out to be better than economists' forecasts, bears will have to defend the resistance at 1.2693. Forming a false breakout there after the release of UK data would be a good reason to open short positions with the goal of moving the price to the middle of the sideways channel at 1.2657, which is in line with the moving averages. A breakout and an upward retest of this range will deal a more serious blow to the bulls' positions, leading to the removal of stop orders and opening the way to 1.2613, where the buyers will be more active, as this level serves as the lower band of the channel. The furthest target will be 1.2584, where I will take profits. If GBP/USD rises and there is no activity at 1.2693 in the first half of the day, traders will continue to build a bullish market. In such a scenario, I would delay short positions until a false breakout at 1.2725. If there is no activity there either, I will sell GBP/USD immediately on a bounce right from 1.2758, considering a downward correction of 30-35 pips.

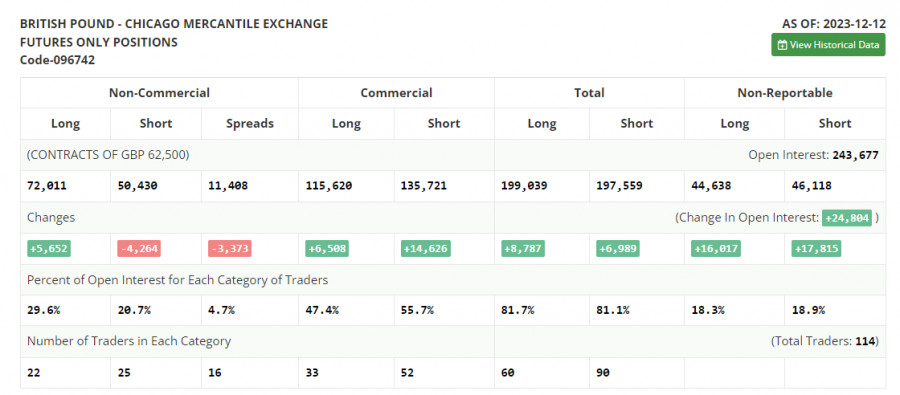

COT report:

The Commitment of Traders (COT) report for December 12 showed an increase in long positions and a decline in short ones. Obviously, there is still demand for the pound, as the Bank of England's recent decision to leave interest rates unchanged as it continues its fight to curb inflation, as well as statements by BoE Governor Andrew Bailey that rates will remain high for an extended period, has revitalized the pound. As a result, the British currency strengthened against the U.S. dollar. Another thing is how the UK economy, which has been struggling lately, will react to all this. A batch of UK and US inflation data will be released soon, and if prices rise, we can bet on the pair's further growth. The latest COT report indicates that non-commercial long positions rose by 5,652 to 72,011, while non-commercial short positions were down by 4,264 to 50,430. As a result, the spread between long and short positions decreased by 3,373.

Indicator signals:

Moving Averages

Trading just around the 30- and 50-day moving averages indicates sideways movement.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If GBP/USD falls, the indicator's lower border near 1.2645 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.