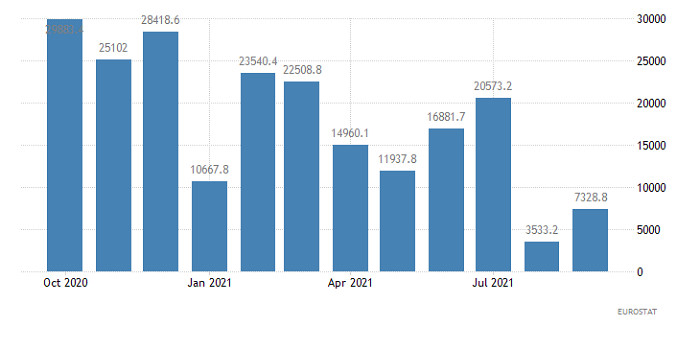

The Euro currency rapidly declined again after a short stagnation, although everything pointed to the need for a correction. There are no serious macroeconomic data published yesterday. Moreover, the data on the trade balance of the euro area were completely ignored. The trade surplus amounted to 7.3 billion euros with a forecast of 10.7 billion euros. At the same time, the previous data were revised downwards – from 4.8 billion euros to 3.5 billion euros. It is worth noting that the market has never been particularly interested in the size of the trade surplus or deficit especially when it comes to the Eurozone or the United States. Therefore, it is not surprising that the market simply stood still at the time of publication of these data. The sharp decline in the single European currency began much later, and the reason for it was the speech of Christine Lagarde.

The head of the European Central Bank has once again stated that the regulator will pursue an ultra-soft monetary policy for a long time, and an increase in interest rates should be expected no earlier than 2023. According to her, any tightening of monetary policy parameters is extremely undesirable in the conditions of economic recovery. In general, Christine Lagarde did not say anything new. All representatives of the European Central Bank have been talking about this for quite a long time.

The EU's inflation continues to grow steadily, and it can only be fought by tightening monetary policy, but the European regulator continues to sit idly by. Moreover, Christine Lagarde said that inflation will continue to rise and will remain at record high levels for a long time. So it is the inaction of the European Central Bank, despite the further increase in inflation, that is the only reason for the euro's further collapse.

Trade balance (Europe):

In turn, the pound was marking time all day yesterday as it doesn't care much about the European Central Bank's problems. There were also no macroeconomic data released in the UK or the United States. Thus, it is not surprising that the pound simply stood still yesterday. Moreover, the local correction took place at the end of last week.

The market will be more active today as labor market data are published in the United Kingdom, which may well lead to the growth of the pound. The point is that the unemployment rate should remain unchanged. If nothing changes, then there is no reason for any fuss. However, the pound is still clearly oversold, and even the stability of the unemployment rate, especially when it is so low, is reason enough to rise.

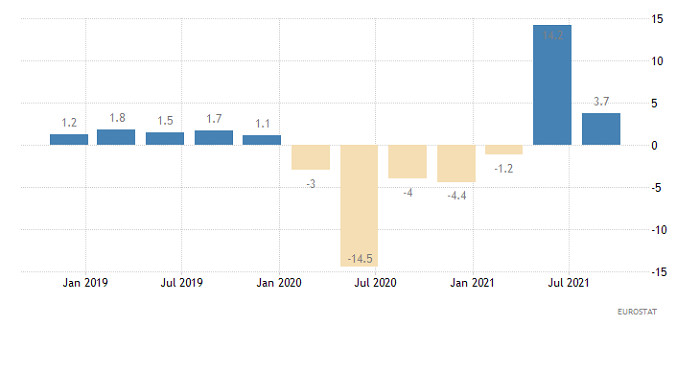

Unemployment rate (UK):

Today's European statistics will once again be ignored, although GDP data will be published. The fact is that we are talking about the second estimate of the rate of economic growth in the third quarter, which should confirm the first estimate, where there was a slowdown in the rate of GDP growth from 14.2% to 3.7%. So investors don't expect anything new.

GDP change (Europe):

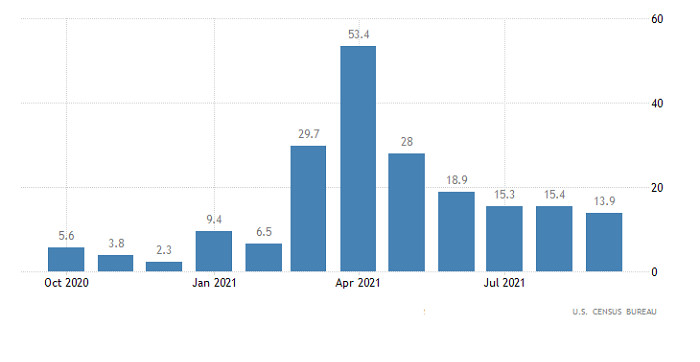

In any case, the US dollar is likely to rise again after the opening of the American trading session. The reason for this will be the retail sales data. Formally, things are not so good, since their growth rates may slow down from 13.9% to 12.0%, which indicates a decrease in consumer activity, which is the driving force of the US economy. However, the numbers themselves speak of the continuing influence of the low base effect. Consequently, the annual data is still not as informative, and it is better to look at the monthly data for now. Just on a monthly basis, sales should rise 1.2%. So nothing terrible happens.

On the contrary, consumer activity continues to grow even despite the sharp rise in inflation. Another thing is that the growth potential of the US dollar will be constrained by data on industrial production, the growth rate of which should slow down from 4.6% to 3.9%. But we are talking only about limiting the growth potential, and not about changing the direction of movement in the opposite direction.

Retail Sales (United States):

The EUR/USD pair continues to follow a downward scenario despite the high oversold level, breaking several important price levels on the way. Now, there is a slight stagnation-pullback in the market, but at the same time, the volume of short positions did not practically decline. It should be noted that keeping the price below the level of 1.1350 will indicate a signal to sell the euro.

The GBP/USD pair is in the range of 1.3400/1.3440 for more than 24 hours, which may signal the process of accumulation of trading forces. In this case, the most appropriate trading tactic is the method of breaking through one or another border of the established range.