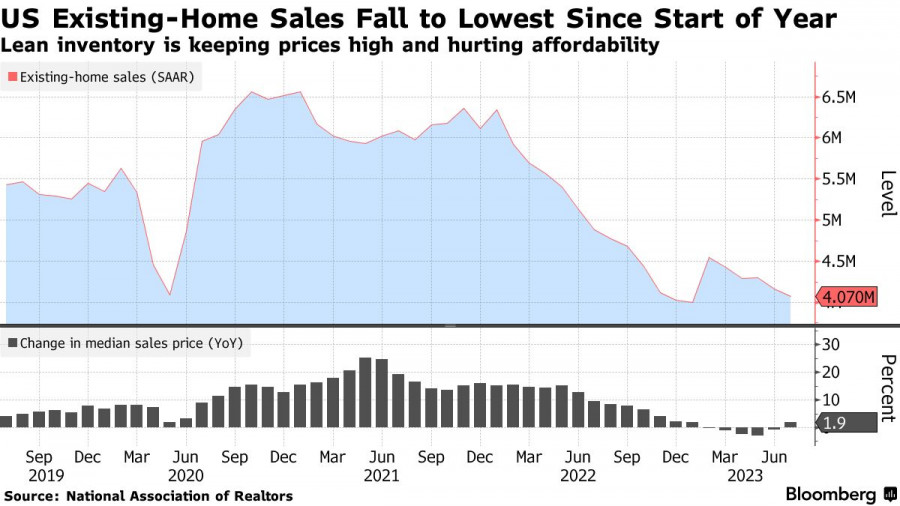

US existing home sales dropped in July to their lowest level since the beginning of the year. This decline is attributed to a shortage of available properties and higher borrowing costs. I have mentioned that issues in the real estate market are an indicator of an impending recession in the economy. While many US policymakers, including those from the Federal Reserve, are hoping for a softer landing, the data suggests the opposite. We are also expecting PMI index reports, which play a part in forecasting future economic scenarios.

According to the National Association of Realtors (NAR), the number of closed deals decreased by 2.2% from the previous month, amounting to 4.07 million on an annual basis. This number was lower than almost all economists' estimates. Sales dropped by more than 18% compared to the previous year, even without adjustments.

The report suggests homeowners hold off on selling their properties. This is because mortgage rates have more than doubled in recent years, affecting property prices. Not long ago, the average 30-year fixed mortgage rate exceeded 7%, the highest in over two decades. This indicates that demand might continue to decrease.

The combination of a limited number of existing homes and increased borrowing costs are forcing potential buyers to consider new houses. Meanwhile, others are completely backing out of deals. The NAR report highlights that current sales activity is determined by two factors: existing home availability and mortgage rates. Unfortunately, both factors are unfavorable for buyers.

The number of homes listed for sale increased from the previous month to 1.11 million. However, this is the lowest July figure since 1999. At the current sales pace, it would take 3.3 months to sell all the listed properties. Realtors state that a timeframe under five months indicates significant market problems. The average sale price for a home on the secondary market rose by 1.9% compared to last year, reaching $406,700. The NAR report revealed that 74% of sold homes were on the market for less than a month. In July, houses stayed on the market for an average of 20 days, compared to 18 days in the previous month.

While the above-mentioned report has not influenced the currency market, signs of a recession in the US continue to emerge. This is negative for the US dollar and its future, especially with the anticipated interest rate hikes that are currently supporting the dollar's value.

Regarding today's technical picture for EUR/USD, the pressure on the euro has returned. To regain control, buyers should keep the price above 1.0870. This would pave the way to 1.0910. From there, the price may climb to 1.0950. However, it would be quite difficult without support from major traders. If the pair drops, I expect significant actions from major buyers only around 1.0840. If they fail to be active, it would be wise to wait for a low of 1.0800 or consider long positions from 1.0770.

Meanwhile, the pound sterling continues trading within the channel. The pound sterling will rise only after bulls gain control over the 1.2770 level. Regaining this range will boost hopes for recovery to 1.2800, after which we can talk about a surge to around 1.2840. If the pair falls, bears will attempt to take control over 1.2720. If they succeed, a breakout of this range will hurt bulls' positions and push GBP/USD to a low of 1.2680, with the potential to drop further to 1.2650.