The GBP/USD currency pair showed no interesting movements on Monday. As mentioned earlier, yesterday was a national holiday in the United States - Presidents' Day. Therefore, American markets were closed. However, we would not have expected significant price changes even without holidays. It's simple – the macroeconomic and fundamental events calendar was completely empty.

This factor of an empty calendar was expected to influence market sentiment, resulting in low-volatility movements and the absence of a clear trend for the GBP/USD currency pair. All would be fine if the pair had not been trading in this manner for two months. In other words, a "boring Monday" has become the approximately 50th boring day in a row for the British pound. Recall that the pair exited the sideways range of 1.2611-1.2787, and nothing changed. Currently, even the level of 1.2611 is ignored by traders, although previously, the price was above it for two months. The movements have no logic to discuss, as the pound remains overbought and unreasonably expensive. Despite the lack of "dovish" signals from the Bank of England, many other factors indicate the strength of the dollar and the weakness of the British pound.

However, the market continues to ignore all these factors stubbornly. The course of any instrument or pair depends solely on the actions or inaction of the market. If the market is not trading, even a one percent rate cut by the Bank of England in one meeting will not affect the pound's exchange rate.

Meanwhile, the British economy has slid into a recession. Following suit, the German economy has also entered a recession. The two largest economies in Europe are now in recession. If the European currency at least depreciates (which is logical), the pound does not react to this factor at all. What's next? How much does the UK's GDP need to lose for traders to start selling the pound? How many strong reports from the US do we need for the dollar to appreciate even slightly? These are all rhetorical questions.

In conclusion, on the 24-hour timeframe, the technical picture also fully supports the scenario of a decline in the currency pair. The price could not overcome the Fibonacci level of 61.8% (1.2763) for two months and finally bounced off it. The British currency's rise in the second half of 2023 has gained the status of a correction. The price may drop to the Senkou Span B line in the near future, which is quite close. Despite the almost complete absence of a pound decline, a slight downward trend is still present. Therefore, we expect movement only to the south despite the market's complete passivity.

In the 4-hour timeframe, the CCI indicator entered the oversold zone last week, but it does not indicate anything in the flat condition. Settling above the moving average line means nothing if the price predominantly moves sideways (speaking of a medium-term perspective, not intraday).

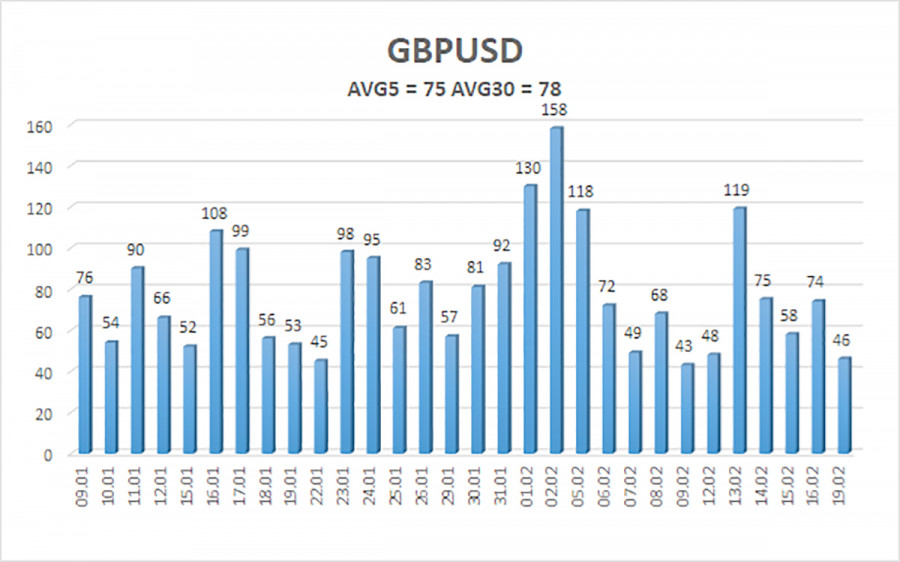

The average volatility of the GBP/USD pair for the last five trading days is 75 points. For the pound/dollar pair, this value is considered "average." Therefore, on Tuesday, February 20th, we expect movement within the range limited by the levels of 1.2517 and 1.2667. The senior linear regression channel is sideways, indicating the current sideways movement. The CCI indicator has entered the oversold zone, so we can expect another upward movement soon.

Nearest support levels:

S1 – 1.2573

S2 – 1.2543

S3 – 1.2512

Nearest resistance levels:

R1 – 1.2604

R2 – 1.2634

R3 – 1.2665

Trading recommendations:

The GBP/USD currency pair has left the side channel and may continue to form a new downtrend, which we have been talking about for a very long time. However, this moment is constantly postponed. The pair was able to go down more than 200 points, but that was the end of the fall in the pound sterling. We expect further southward movement to continue with targets of 1.2543 and 1.2512. It will be possible to consider long positions only if the price is above the moving average with targets of 1.2634 and 1.2665 and only if there is a favorable macroeconomic background. However, if a downtrend has really started now, it is obvious that purchases cannot be a priority.

Explanation of the illustrations:

Linear regression channels – help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold zone (below -250) or overbought zone (above +250) indicates an upcoming trend reversal in the opposite direction.