The euro and the pound sterling will likely return the market's favor after the release of US labor market data. Amid the ongoing sharp interest rate hike, It is unlikely that non-farm payrolls will grow significantly compared to July.

The long-expected US employment report could obviously make a third large interest rate hike more likely. However, it has likely already been priced in by market players after hawkish remarks by Fed chairman Jerome Powell, as well as data indicating strong consumer spending and high demand for labor.

Friday's data release is one of the last key reports Fed policymakers will receive before the policy meeting in mid-September. They face a difficult economic and inflationary puzzle. On the one hand, interest rate hikes are pushing the economy into a recession, as indicated by the inverted yield curve of 2-year and 10-year Treasury notes. On the other hand, if the issue of inflation is not addressed by the Fed, it could become entrenched, demanding much greater effort to bring under control in the future.

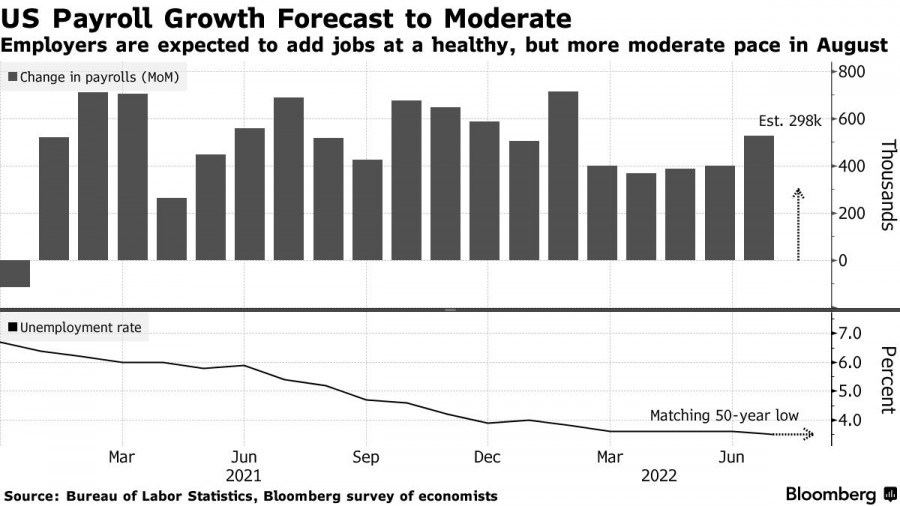

Economists expect a moderate non-farm payrolls increase by 298,000. The unemployment rate is predicted to remain at 3.5%, its lowest level in 50 years. Furthermore, a steady increase in wages is expected amid a continuing imbalance between supply and demand in the labor market.

If the data releases match these forecasts, it would be enough to encourage the Fed to increase interest rates by another 75 basis points to quell inflation, as part of its most aggressive rate hike cycle in a generation.

Nevertheless, any hint of a weaker employment increase in Friday's NFP report, coupled with a lower average hourly earnings rise, may help shift expectations toward a half-point rate hike. This would be a strong buy signal for risky assets, including EUR and GBP. However, Fed officials would also need to see results of CPI for August. Only then, a more precise outlook for interest rates could be made. If inflation decreases for the second month in a row in August, it would greatly benefit risky assets.

Last week, Fed chairman Jerome Powell stated that the central bank's decision at the end of August "will depend on the totality of the incoming data and the evolving outlook." The latest data published on Friday suggest that demand for labor continues to be healthy. Initial jobless claims fell to a 2-month low for a third week in a row, while a gauge of employment at factories rose to a five-month high.

Average hourly earning data will also be important. Economists expect the report will show a 0.4% increase in average hourly earnings from a month earlier and a 5.3% rise from August 2021. The annual increase would represent a slight uptick from the previous two months.

According to the latest data by ADP, which was released on Wednesday, the median annual pay for those who stayed in their jobs rose 7.6% in August from a year earlier. However, ADP payroll data indicated that employment in US companies increased by only 132,000 in the smallest since the start of last year.

On the technical side, the risk of a further sharp drop of EUR/USD remains high, as the pair is currently trading below parity. Bullish traders would have to push above 1.0000 for the pair to recover. If EUR/USD moves above 1.0050, it would open the way towards 1.0090 and 1.0130 further away, as buyers of risky asset would become increasingly confident. If EUR/USD fails to hold on to 0.9950, it would put an end to the upward correction and could potentially push the pair down towards 0.9905 and 0.9860.

The pound sterling is currently trading below 1.1600, which complicates matters for bulls. A major upward correction is unlikely, particularly if bears regain 1.1515. If bullish traders fail to keep GBP/USD in this range, the resulting sell-off could send the pair down towards 1.1470. A breakout below this level would open the way towards 1.1410, the low of 2020 which was hit at the height of the coronavirus pandemic. To begin an upward correction, GBP/USD would have to settle above 1.1560, which would open the way towards 1.1600 and 1.1650.