For the previous two weeks, the pound and the dollar have been trading within a price range with conditional boundaries set at 1.2270 and 1.2430. The pricing begins around the limits of this price range, showing a trajectory that resembles a wave. Given that the market is awaiting significant developments that will, at least in the long term, determine the fate of GBP/USD, such hesitation among traders is entirely natural.

The US currency will appreciate or depreciate in response to the Fed meeting in February. The Fed is now the subject of an excessive number of queries, and the window of opportunity has closed completely. Numerous analysts predict that the US regulator will exert pressure on the dollar by lowering the rate increase pace to 25 points and raising the possibility that the present cycle of tightening monetary policy will end sooner than expected. Another possibility is that Jerome Powell will take a hawkish stance and forecast that the rate will eventually reach its previously stated target of 5.1% and remain there for an extended period.

In any case, all dollar pairs may be expected to experience volatility, and the GBP/USD pair is not an exception in this case. The difficulty of the matter is that the Bank of England will announce its decision tomorrow, February 2, and that decision will determine the outcome of the February meeting. If these events resonate (the Fed will put pressure on the dollar, and the British regulator will support the pound), buyers of GBP/USD will be able to test the resistance level of 1.2550 (the upper line of the Bollinger Bands indicator on the daily chart). But it appears that the activity leading to the GBP/USD pair will only get more complex in light of the outcomes of the two central banks' meetings.

Leading economists were surveyed last week by Reuters journalists on the likely outcome of the British regulator's February meeting. The results of the survey were revealed last week. The majority (29 out of 42) concluded that the Central Bank will increase the interest rate by 50 basis points, or up to 4%. A 25-point scenario was predicted to be implemented by 13 experts at the same time. The majority of experts concurred that the Central Bank will raise the rate by 25 basis points, or to the level of 4.25%, at its upcoming meeting in March. When it comes to the end of the current cycle of increases, perspectives vary. While some experts predict that the Bank of England will stop raising interest rates at 4.25%, others predict that the Central Bank will raise them by another 25 basis points in May, taking the rate to 4.5%.

I believe that the market slightly underestimates the "dovish" scenario. Recall that two (out of nine) members of the Monetary Policy Committee voted against raising the rate in response to the outcomes of the previous meeting. They demanded its maintenance at a three percent level, saying that "this is more than enough" to bring inflation back to the desired level.

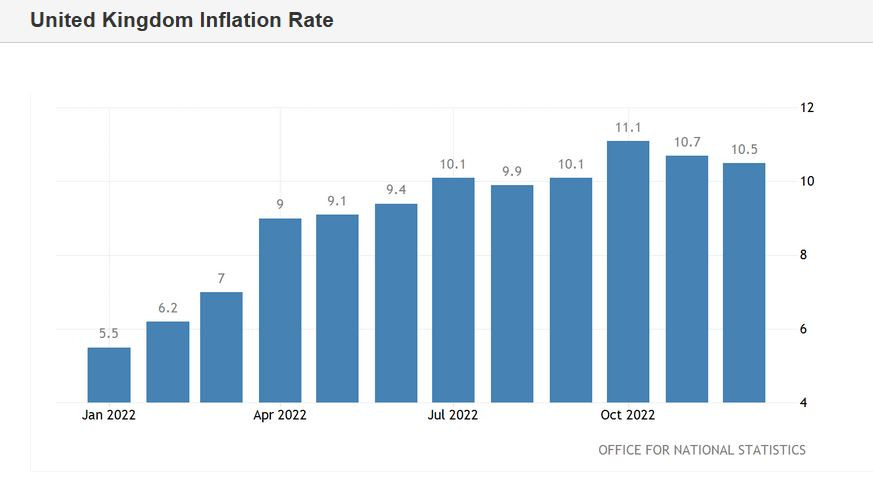

It is unlikely that the inflation reports released following the December meeting will challenge this assertion. Recall that the overall consumer price index was approximately 10.5%. Even though the index is still at an unacceptable level, it has been falling regularly for the past month. The core consumer price index, which was reported at the same level in November, stayed at 6.3% in December. However, the retail price index was in the danger zone. Forecasted growth was 13.9% (y/y), however, it happened to be 13.4%. There is a two-month downward trend in this instance as well.

The state of the labor market is likewise incredibly contradictory.

According to the most recent data, average earnings increased by 6.4% (with a growth estimate of 6.2%), and unemployment in the UK stayed at 3.7% (as in the previous reporting month). But this is only one aspect of the story. The growth rate of applications for unemployment benefits, which increased by 19 thousand, is on the other side. Since February 2021, this growth rate has been at its highest. This indicator has been increasing for the past two months.

The British PMI indicators also fell short of expectations. The aggregate purchasing managers' index, for instance, was 47.8 points (in December, the indicator rose to 49.0 points). As you are aware, an index value above 50 points denotes an increase in activity, while the one below suggests a decrease.

It is also important to note that the International Monetary Fund has revised its estimate of the UK's economic growth for 2023 downward, making it the only G7 nation to receive this treatment.

Frequent strikes in the UK and low consumer demand add to the negative picture.

Conclusions

If the split in the Bank of England remains (two or more members of the Committee vote against the rate hike) and the accompanying statement is mild, the pound will be under tremendous pressure - even if the fundamental 50-point scenario is implemented. We will see a negative rebound of GBP/USD, at least to the level of 1.2150 (the top limit of the Kumo cloud on D1) and most likely to the area of the 20th figure if the Central Bank unexpectedly slows down the pace of tightening the PEPP to 25 points already in February. Positive prospects for the pound, in general, seem improbable; the Bank of England meeting in February will not produce favorable outcomes for the British due to a mix of explicit and implicit fundamental factors.