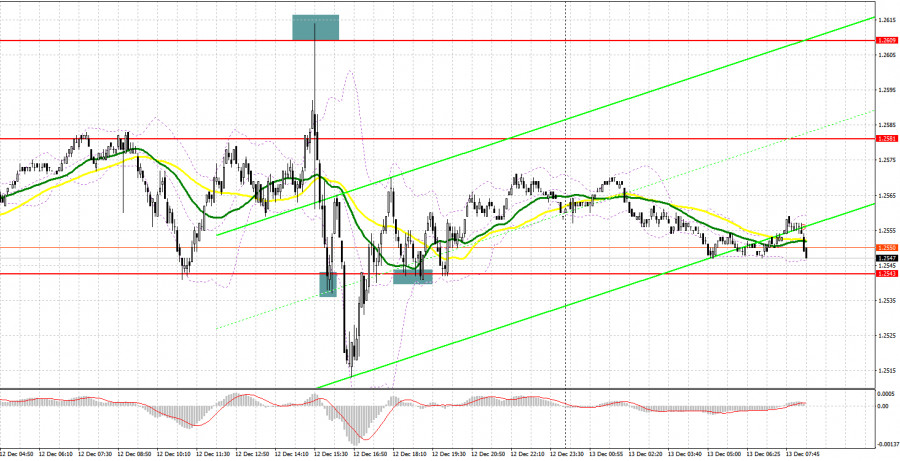

Yesterday, the pair formed several entry signals. Let's have a look at what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.2574 as a possible entry point. A breakout and retest of 1.2574 after the UK labor market data produced a sell signal, which sent the pair down by 25 pips. In the afternoon, selling from 1.2609 after a sharp spurt could not be caught, since it was quite fast. But buying at 1.2543 on a false breakout brought another 20 pips.

For long positions on GBP/USD:

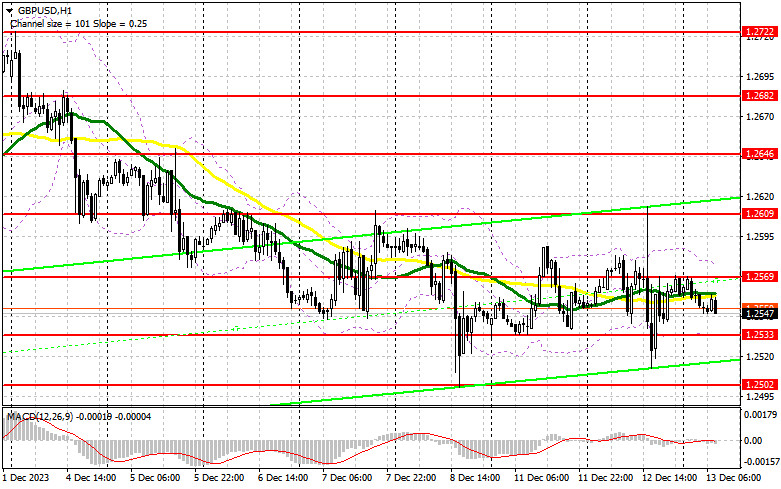

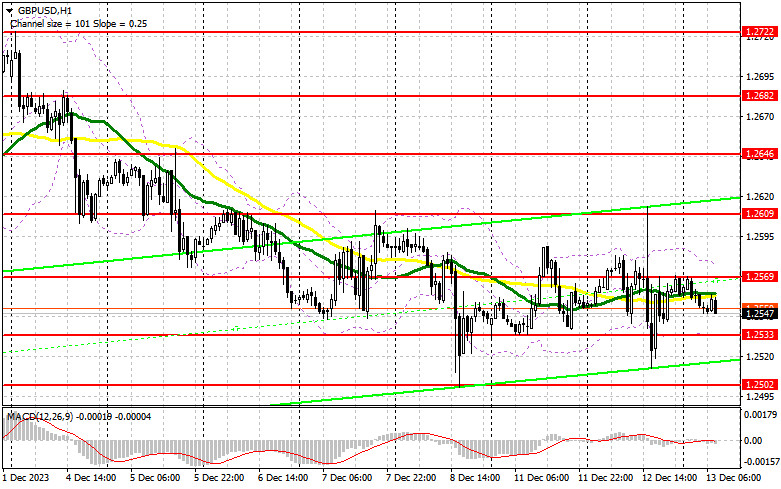

Yesterday's US inflation data, where on the one hand prices increased compared to last month, but on the other hand they fell annually, did not clarify the picture for traders. It is obvious that today the Federal Reserve will prefer to be cautious, but we will talk about that later. On Wednesday, UK data on GDP, industrial production, and balance of trade may garner investor interest. If the data disappoints, and most likely it will, the pressure on the pound will return. In this case, I will act on a false breakout near the new support at 1.2533, established yesterday. This will strengthen recovery chances, creating a buy signal to reach the nearest resistance at 1.2569. This is also in line with the bearish moving averages. A breakthrough and consolidation above this range will strengthen the demand for the pound and open the way to 1.2609. The furthest target will be the 1.2646 area, where I plan to take profits. If the pair falls and there is no buying activity at 1.2533, nothing terrible will happen for the bulls, as the market widely expects the Fed to take a soft position. In this case, only a false breakout near the next support at 1.2502, which is the lower band of the sideways channel, will signal opening long positions. I plan to buy GBP/USD immediately on a rebound from 1.2478, aiming for an intraday correction of 30-35 pips.

For short positions on GBP/USD:

Sellers have the chance to build a downtrend - especially after weak UK data, expected in the first half of the day. In case the market positively reacts to the data, sellers will have to defend and form a false breakout near resistance at 1.2569, which is in line with the moving averages. This will create a sell signal, which will give bears a chance to move the price down to the intermediate support at 1.2533. A breakout and a retest from below will deal a more serious blow to the bulls' positions, leading to the removal of stop orders and opening the way to the lower band of the channel at 1.2502. The next target would be the 1.2478 area, where I will take profits. If GBP/USD rises and there is no activity at 1.2569, I will postpone sales until the price performs a false breakout at 1.2609, where the big players emerged on Tuesday. If there is no activity there either, I recommend opening short positions on GBP/USD from 1.2646, anticipating a 30-35 pip downward rebound within the day.

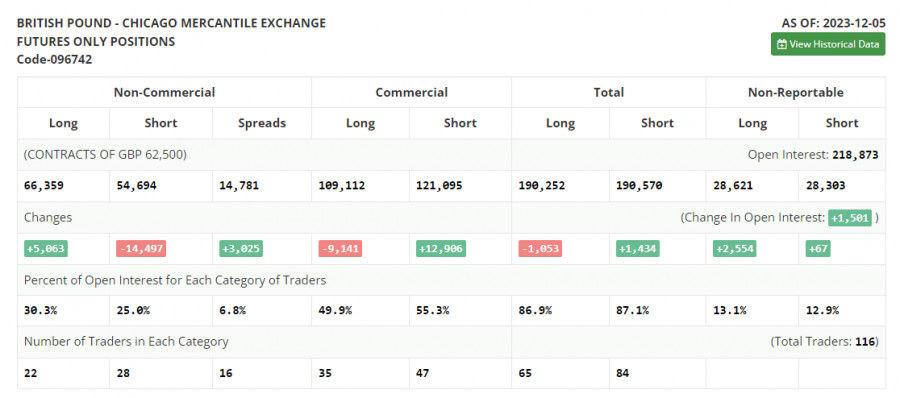

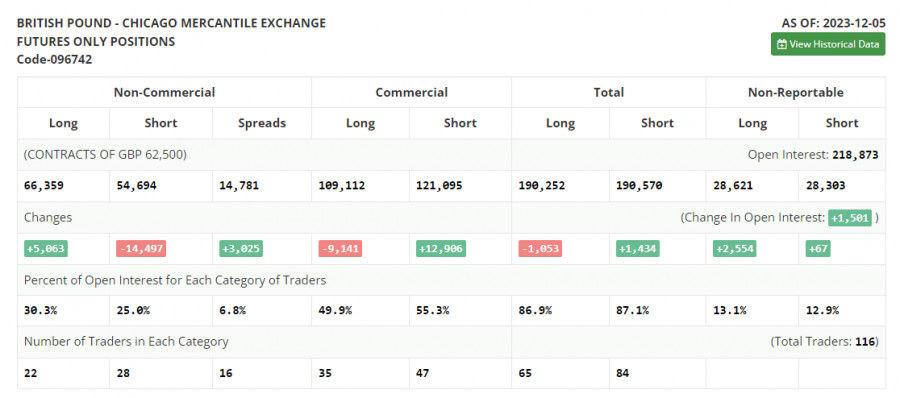

COT report:

The Commitments of Traders (COT) report for December 5 showed a sharp increase in long positions and a decline in short ones. The pound is still in demand, as Bank of England Governor Andrew Bailey and other BoE policymakers mentioned that the interest rates will need to be kept at the current level, if not raise them. This led traders to believe that they can buy the pair on every good downward move. The Federal Reserve and the BoE meetings will be held this week, which will be decisive. The soft tone of the US central bank will weaken the dollar's positions. If the situation is reversed, and if the Fed says it needs to wait longer to decide when to cut interest rates, and the Bank of England starts worrying about the prospects for economic growth, then it is inevitable that the pound will fall. The latest COT report indicates that non-commercial long positions rose by 5,063 to 66,359, while non-commercial short positions were down by 14,497 to 54,694. As a result, the spread between long and short positions increased by 3,025.

Indicator signals:

Moving Averages

Trading below the 30- and 50-day moving averages indicates a possible decline in the pair.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the 1D chart.

Bollinger Bands

If GBP/USD declines, the indicator's lower border near 1.2533 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.