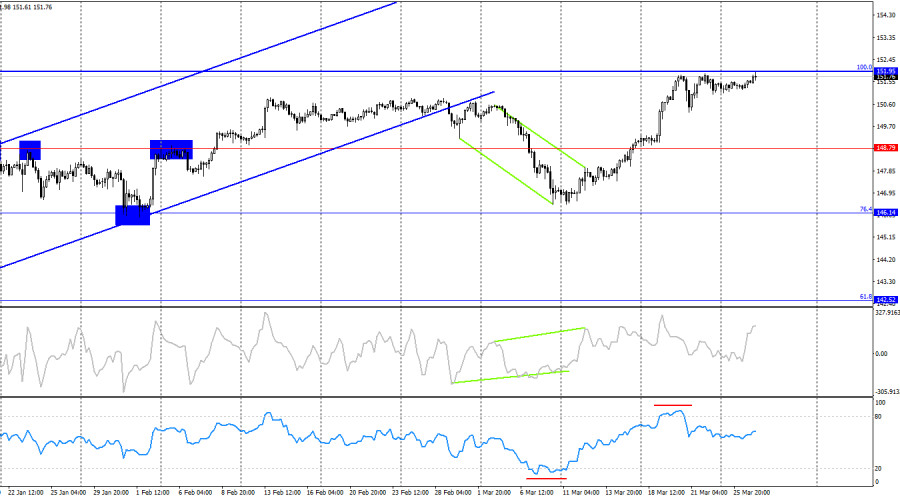

On the hourly chart, the USD/JPY pair resumed its upward movement toward the corrective level of 127.2%-152.10 on Tuesday. A rebound of the pair's rate from this level will favor the US dollar and some decline towards the support zone of 150.79-150.91. However, such a decline will cause consolidation below the ascending trend corridor. In this case, traders' sentiment will change to "bearish," and a stronger rise in the Japanese currency can be expected. Consolidating quotes above the level of 152.10 will increase the probability of further growth toward the next Fibonacci level of 161.8%-153.63.

The wave situation fully supports the bulls lately. Exactly three waves were formed downwards (one being corrective), so a new "bullish" trend is forming. The new upward wave easily broke the peak of the previous wave, so I have no reason to speak of the completion of the "bullish" trend. For signs of its completion to appear, a new downward wave is required, breaking the low of March 11, which will be difficult to achieve. Alternatively, the next upward wave should not break the last peak, which has yet to form, as the current wave is incomplete.

On Tuesday, the information background was almost absent in Japan and the US. The only report on durable goods orders in the US turned out to be better than forecast, which triggered a new bullish attack. However, it was also announced that Masato Kanda, Japan's chief currency official, plans to instruct the Bank of Japan to conduct currency interventions in response to the sharp weakening of the Japanese yen. Interventions will be aimed at strengthening the exchange rate. Thus, in the near future, the bears may go on the offensive. Kanda believes that the yen's weakness does not reflect the real picture of fundamental factors and negatively affects the Japanese economy.

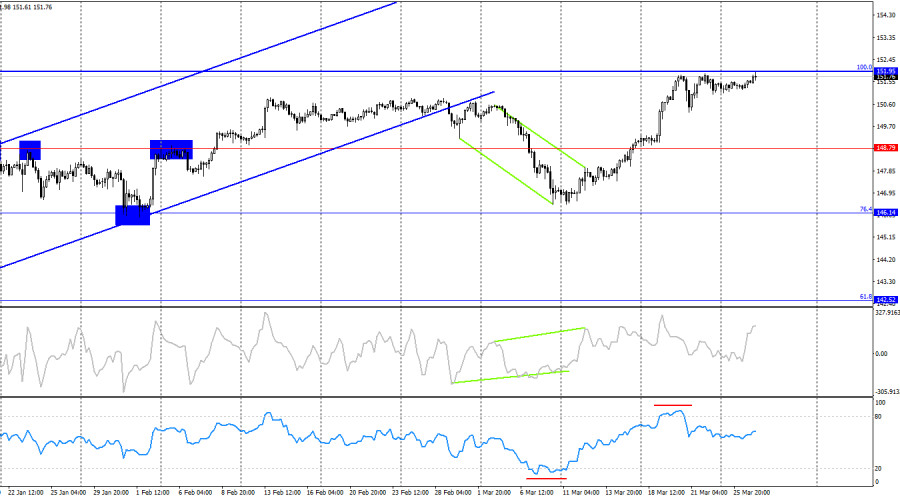

On the 4-hour chart, the pair has risen to the corrective level of 100.0%-151.95. A rebound of the pair from this level will favor the Japanese yen and some decline towards 148.79. Consolidating the pair's rate above the level of 151.95 will increase the probability of further growth towards the next Fibonacci level of 127.2%-158.66. After statements made by Japanese bankers and politicians, further growth of the pair has been called into question. There are currently no emerging divergences with any indicators.

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category for the last reporting week has become even more "bearish" than before. The number of long contracts held by speculators increased by 11351 units, while the number of short contracts increased by 25041. The overall sentiment of major players remains "bearish," and the advantage of sellers is huge. There is an almost threefold gap between the number of long and short contracts: 66 thousand versus 182 thousand.

The yen still has excellent prospects for further decline. Still, the strong gap between long and short contracts may also indicate the proximity of completing the "bearish" trend in the Japanese currency. In other words, bullish speculators may start to retreat from the market. On the 4-hour chart, we already see an important break in the "bullish" trend, but the dollar can continue to rise in the short term.

News Calendar for the US and Japan:

On Wednesday, Japan and the US calendars contain a few interesting entries. The influence of the information background on market sentiment for the rest of the day will be absent.

Forecast for USD/JPY and Trader Advice:

Today, sales of the yen can be considered on a rebound from 151.95 on the 4-hour chart with a target of 150.90 or a close below the ascending trend corridor on the hourly chart with a target of 149.86. Purchases were possible on a close above the level of 148.55 on the hourly chart and a close above 148.79 on the 4-hour chart with targets of 149.66, 150.89, and 151.95. All targets have been reached. New purchases are possible at a close above 151.95 with a target of 153.63.