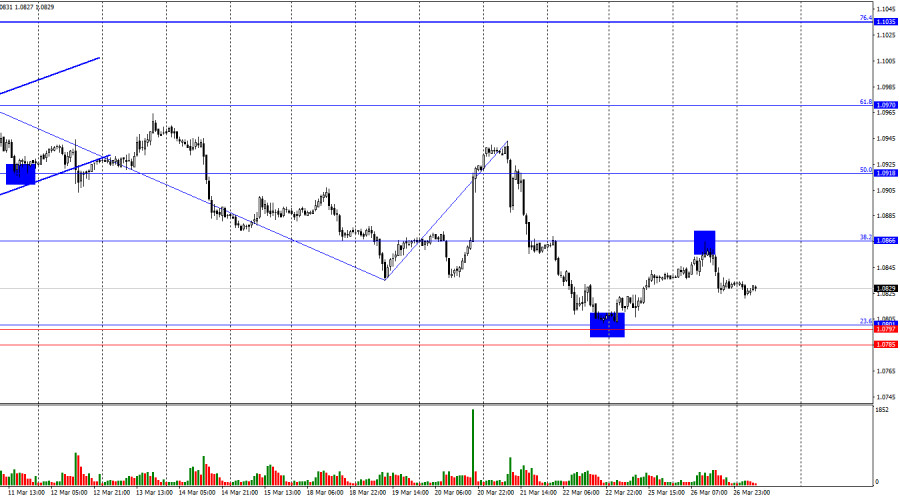

The EUR/USD pair executed a rebound from the corrective level of 38.2%-1.0866 on Tuesday, a reversal in favor of the US dollar, and started a new decline toward the support zone of 1.0797–1.0801. A rebound of quotes from this zone will again favor the euro and some growth towards the level of 1.0866. Consolidating the pair's rate below the zone will increase the probability of further decline toward the next corrective level of 0.0%-1.0696.

The wave situation remains quite clear. The last completed upward wave failed to break the peak of the previous wave (from March 8), and the next downward wave broke the low of the previous wave (from March 19). Thus, we are currently dealing with a "bearish" trend, and there is no sign of its completion. For such a sign to appear, the new upward wave must break the current last peak (from March 21). Until this moment, I expect the quotes to continue to fall.

The information background on Tuesday needed to be stronger, but some data still became known. The report on durable goods orders in the US aroused the greatest interest among traders. It became known that after a disastrous January when order volume decreased by 6.9% m/m, a recovery period followed - plus 1.4%, which is even slightly above forecasts. Orders for durable goods, excluding transportation and defense, also showed positive dynamics. Thus, in the second half of the day, the bears got the opportunity to launch a new offensive, which happened. The majority of indicators and types of analysis indicate further growth of the US currency. I remind you that after the Fed meeting on March 20, the dollar's chances of success sharply increased as the regulator showed no intention to soften the monetary policy stance in the coming months.

On the 4-hour chart, the pair reversed in favor of the US currency and started a new decline towards the Fibonacci level of 38.2%-1.0765. Consolidation above 1.0862 will favor the EU currency and increase the probability of further growth toward the next corrective level of 61.8%-1.0959. However, I do not expect such a development of events, as consolidation below the ascending trend corridor indicates the completion of the "bullish" trend.

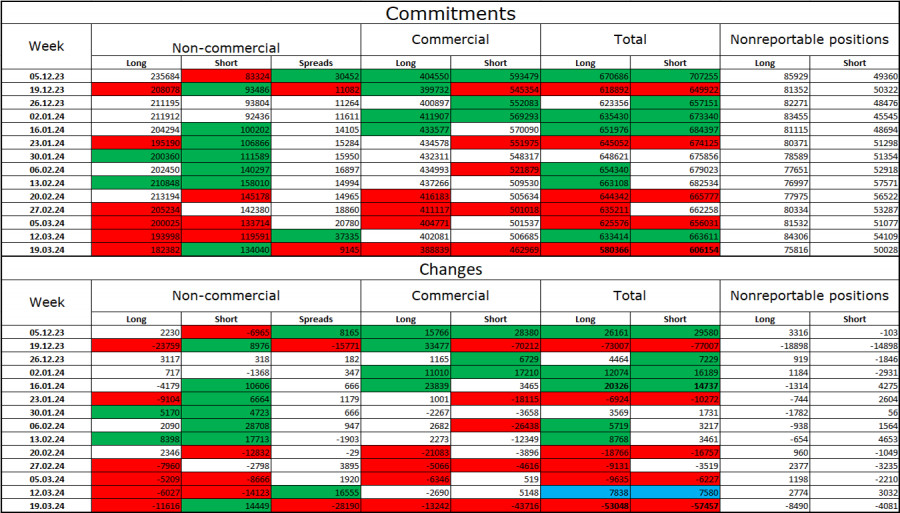

Commitments of Traders (COT) Report:

During the last reporting week, speculators closed 11616 long contracts and opened 14449 short contracts. The sentiment of the "Non-commercial" group remains "bullish" but continues to weaken. The total number of Long contracts held by speculators now stands at 182 thousand, while Short contracts amount to 134 thousand. The situation will continue to change in favor of bears. The second column shows that the number of Short positions has increased from 83 thousand to 134 thousand over the past 2.5 months. Long positions decreased from 235 thousand to 182 thousand during the same period. Bulls have dominated the market for too long, and now they need a strong information background to resume the "bullish" trend. In the near future, I do not see such a background.

News Calendar for the US and EU:

On March 27, the economic events calendar contains only some important entries. The influence of the information background on traders' sentiment today will be absent.

Forecast for EUR/USD and Trader Advice:

Selling the pair was possible on a rebound from 1.0866 on the hourly chart, with targets at 1.0785–1.0801. These trades can be kept open now. New sales - consolidation below the zone of 1.0785–1.0801 with a target of 1.0696. Buying the pair was possible on a rebound from the zone of 1.0785–1.0801 on the hourly chart, with targets at 1.0866 and 1.0918. The first target has been reached. New purchases - on a new rebound from 1.0785–1.0801.