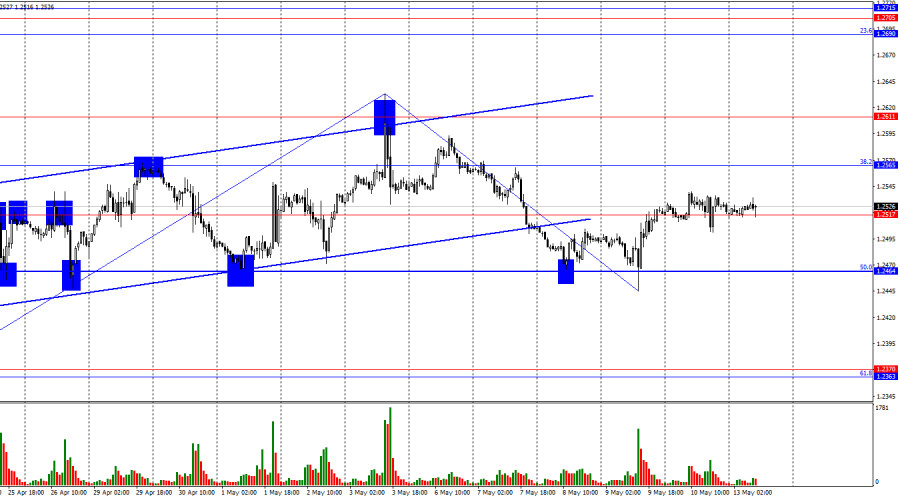

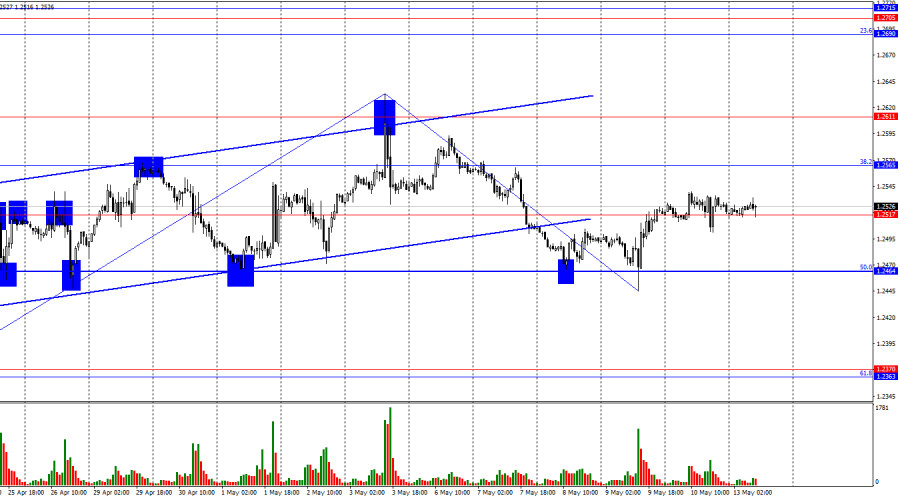

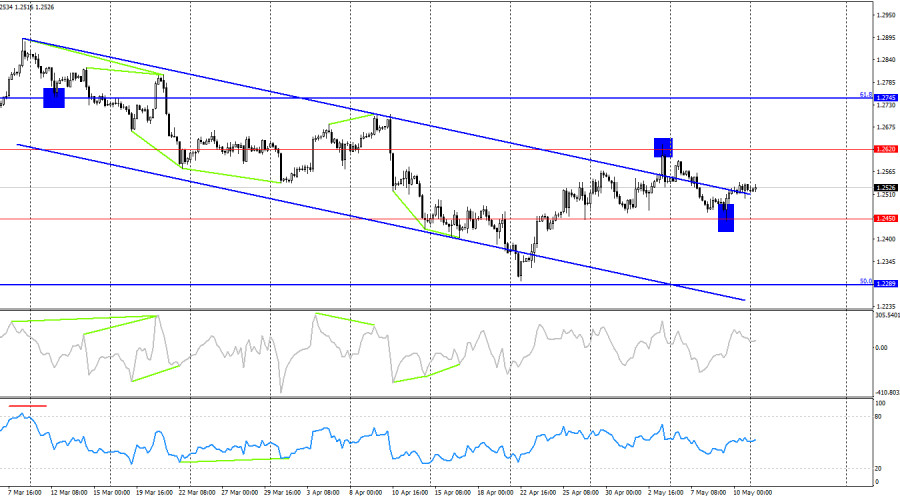

On the hourly chart, the GBP/USD pair traded horizontally on Friday, above 1.2517. Thus, the upward process may continue towards the next corrective level of 38.2%-1.2565. If the pair's rate consolidates below the level of 1.2517, it will favor the US dollar and initiate a new decline towards the Fibonacci level of 50.0%-1.2464.

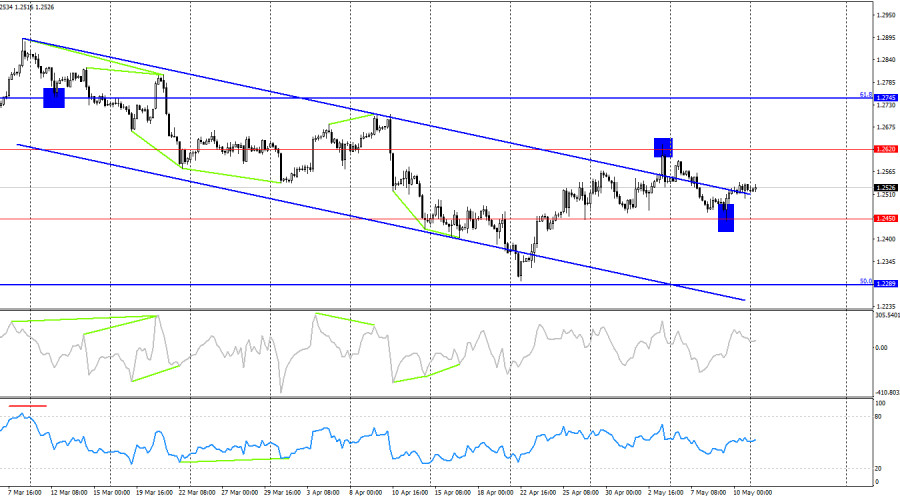

The wave situation remains unchanged. The last completed upward wave did not surpass the peak of the previous wave, and the new downward wave is still too weak to break the low from April 22nd. Thus, the trend for the GBP/USD pair remains "bearish," and there are no signs of its completion. The first sign of bulls turning aggressive could be a breakthrough of the peak from May 3rd. If it proves weak and fails to break the low from April 22nd, a new downward wave could also indicate a trend reversal. But for now, I cannot consider it 100% complete. Waves in recent months have been quite large, so it's necessary to reduce the scale of the hourly chart to understand the current trend.

Unlike the EU and the US, there were important publications in the UK on Friday. Unfortunately for the pound, they didn't interest traders. Otherwise, the British pound would have continued to rise. The report on economic growth in the first quarter showed a value of +0.6% quarter-on-quarter and +0.2% year-on-year. Traders expected much more modest indicators for the British economy. Also, the report on industrial production in March was released. Volumes grew by only 0.2%, but traders expected a decline of 0.5%. Thus, both reports were strong, but the British pound failed to continue its upward momentum. The lack of traders' willingness to buy the pound suggests a new downward wave (or the continuation of the old one) awaits us. Expecting a decline in the pound and the euro now is much more reasonable than expecting their rise as the Fed indefinitely delays the first rate hike.

On the 4-hour chart, the pair bounced off the level of 1.2620, which allows us to expect a decline in the British pound. However, the bounce from the level of 1.2450 enabled the quotes to experience a slight rise, bringing them back close to the channel's upper boundary. This line has already been breached, but it's still not time to bury the "bearish" trend. It's difficult to say why bull traders might continue to attack in the coming months, especially as the Bank of England is actively preparing for a rate cut while the Fed continues to wait for inflation to rise.

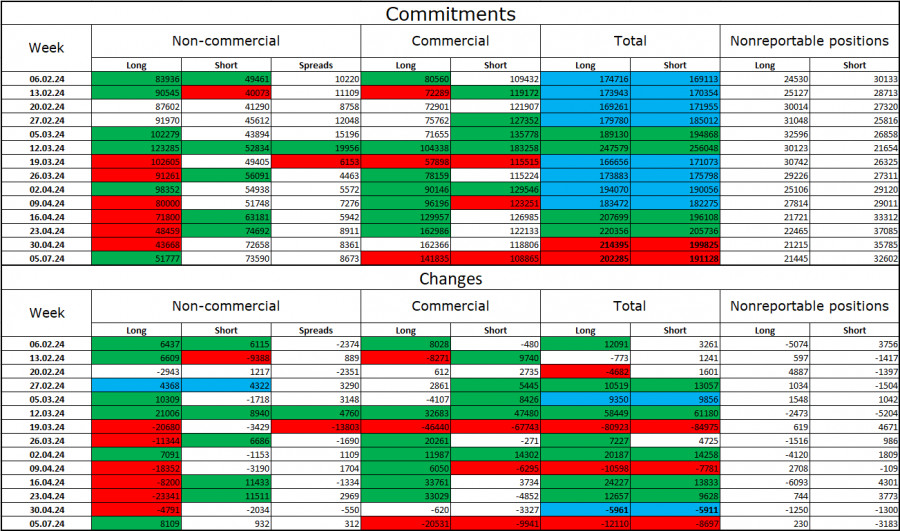

Commitments of Traders (COT) report:

The sentiment of the "Non-commercial" trader category has become less "bearish" over the past reporting week. The number of Long contracts held by speculators increased by 8109 units, while the number of Short contracts increased by 932. The overall sentiment of major players has changed, and now the bears are dictating their terms in the market. The gap between the long and short contracts is 22 thousand: 51 thousand versus 73 thousand.

The prospects for a decline remain for the British pound. Over the past three months, the number of Long contracts has decreased from 83 thousand to 51 thousand, while the number of Short contracts has increased from 49 thousand to 73 thousand. Over time, bulls will continue to liquidate Buy positions or increase Sell positions, as all possible factors for buying the British pound have already been exhausted. Bears have demonstrated their weakness and complete unwillingness to switch to offense in recent months, but I still expect the British pound to start a stronger decline.

News Calendar for the US and UK:

On Monday, the economic events calendar contains a few interesting entries. The influence of the news background on the market sentiment for the remainder of the day will be absent.

Forecast for GBP/USD and trader recommendations:

Sales of the British pound are possible upon closing below the level of 1.2517 or on a rebound from 1.2565 on the hourly chart with a target of 1.2464. Purchases could have been considered on a rebound from the level of 1.2464 on the hourly chart, with targets at 1.2517 and 1.2565. The first target has been hit, and I doubt the second will be reached.