There is a slight pullback on the world markets from the panic sales last Friday. Stock indexes rose, which does not indicate an increase in optimism at all. German inflation increased to 6% in November from 4.6% in October, which is significantly higher than the forecast. At the same time, ECB representatives issued massive warnings against the early cancellation of monetary policy, but at the same time, they still express confidence that in the next inflation will return to 2%.

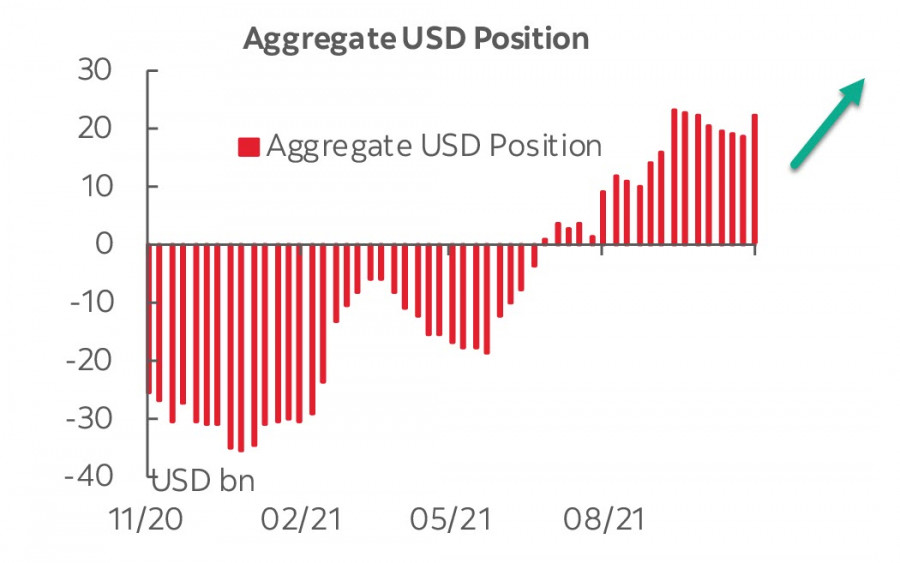

On Monday, the late CFTC report finally came out. It is very easy to interpret it – all major currencies have lost against the US dollar, which means that players are waiting for the US dollar to grow faster against both commodity currencies and defensive ones. The cumulative long position on USD increased by 3.8 billion during the reporting week and reached 22.3 billion, almost reaching the October high.

It should also be noted that there has been a reduction in demand for oil for the third week in a row. Gold has lost 6.1 billion over the past week, which is also sign of the expected strengthening of the US dollar. If we put aside fantasies, technical charts, and arguments about the state of the world economy, and focus only on an impartial analysis of the actions of major players, then it can be concluded that players are betting on the US dollar, and this trend is gaining impulse.

The panic about Omicron will most likely not last long, because even with a higher contagion, it is less dangerous than delta. This gives a chance that the wave of sales is close to completion.

NZD/USD

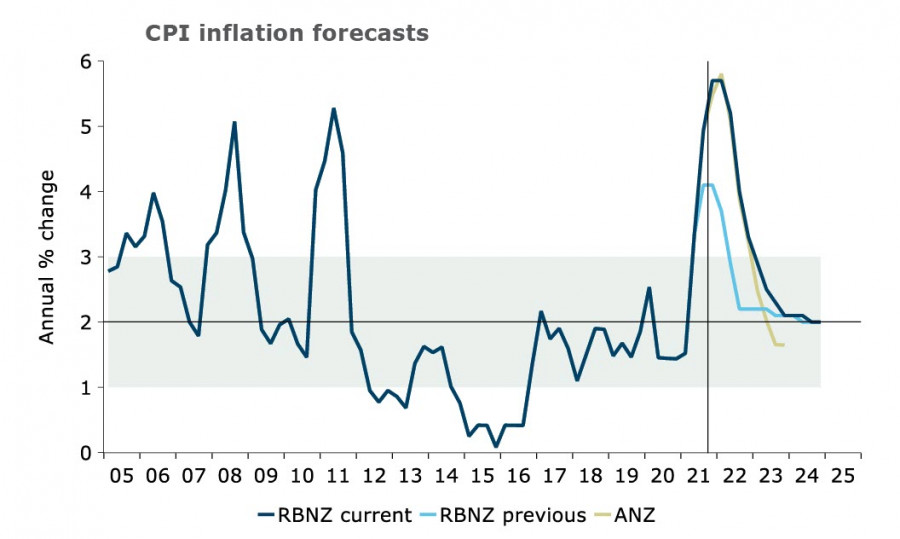

As expected, the RBNZ raised the rate for the second time by 0.25%, to 0.75%. This increase was already taken into account in prices and did not have a noticeable effect on quotes. The tone of the accompanying document is assessed as balanced. It is assumed that the gradual increase in the rate will continue until it reaches at least 2%.

These steps are necessary since inflation currently stands at 4.9%, which is significantly higher than the target range of 1-3%. If inflation continues to rise to 6% by the beginning of 2022, then the RBNZ will curb inflation through an increase in the rate.

The New Zealand dollar would have good prospects to rise, if not for a new lockdown and general panic regarding the next version of COVID-19. Apparently, the end of the global crisis is postponed again, which makes the prospects for commodity currencies, including the NZD, noticeably weaker.

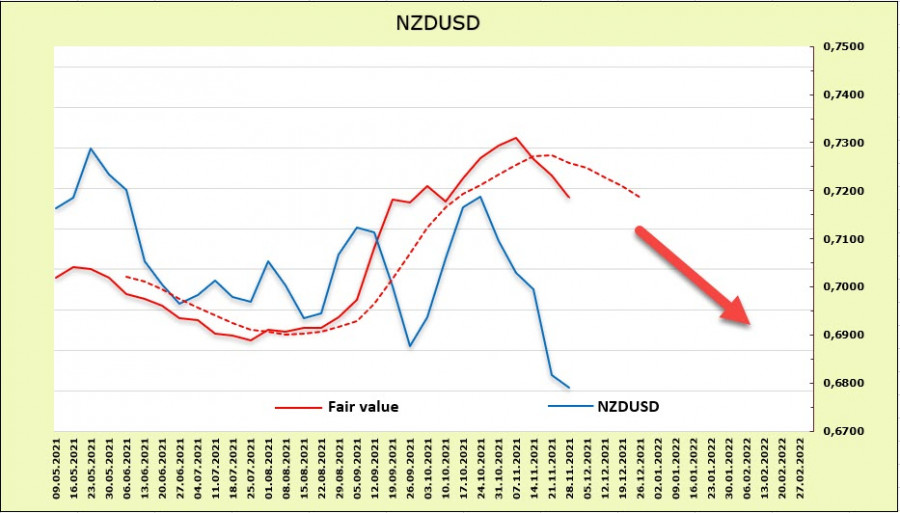

According to the CFTC report, the New Zealand dollar is the only one that managed to maintain a long position against the US dollar (+0.969 billion). The calculated price is still significantly higher than the spot price, but it has also confidently turned downward, unable to resist the market dominant.

As assumed in the previous review, the NZD declined and reached the support level of 0.68. The target shifted to the lower border of the descending channel, which runs approximately at 0.6660/90. There are very few reasons to expect a bullish reversal.

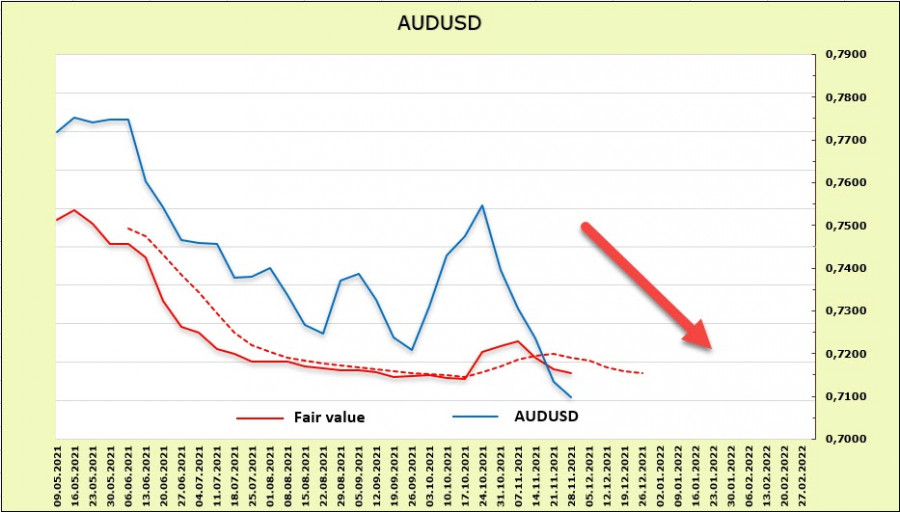

AUD/USD

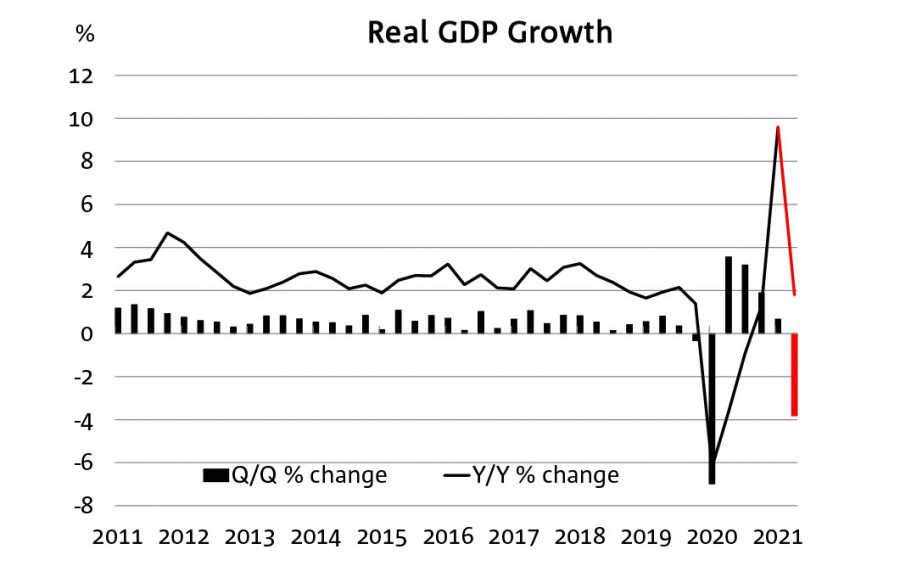

The Australian dollar is under strong pressure from several sides at once, these are both external factors (reduced demand for risk) and internal. NAB Bank expects Australia's GDP to fall by 3.8% in Q3 (-1.8% yoy) due to offensive restrictions in a number of states and a decline in investment activity.

Forecasts for a strong recovery in Q4 are also based on rather fleeting grounds, such as the expected opening of international borders. As it becomes clear, the latter is hardly possible – now everyone is afraid not of Delta strain, but of Omicron.

The Australian dollar has lost another 107 million. The net-short position rose to -4.573 billion, the bearish advantage is confident, and the estimated price is below the long-term average.

The AUD reached the support level of 0.7109. Technically, it has not yet consolidated below the support. A slight upward rebound is possible, but a test of support at 0.7053 is more likely and then immediately to 0.6990.