What trading platform to choose?

Trading on crypto exchanges, the equity market, and Forex is hardly possible without a trading platform. In addition to trading, such software provides a vast array of tools for analysis.

MetaTrader 5 (MT5) is the most popular modern trading platform. Read more about how it works here: MetaTrader 5 for Dummies.

What are trading platforms for?

A trading platform is used for conducting trades. It also serves other useful functions:

- Information support to help you track quotes online

- Wide range of analysis tools to help you analyze the market:

- technical indicators

- time frames

- charts - Various means of trading:

- Multiple order execution modes

- One-click trading directly from the chart

- Automatic trading settings

- Copytrading (you can copy orders of experienced traders) - Account management (you can open as many demo/live accounts as you wish)

- Demo account to master your trading skills

- Strategy testing (some trading platforms offer you an opportunity to develop and test new strategies using previous quotes)

- Trade history (you can analyze the efficiency of your trading activity)

- Latest financial and business news

A trading platform features it all for your convenience. Thus, you no longer need to look through multiple websites to stay updated.

What to consider when choosing platform?

Each and every trader tries to find a platform for comfortable trading. So, it should meet all their needs and be user-friendly.

Let’s find out what features to pay attention to when choosing trading software.

- Reliability. Having a stable trading platform is key. Trading software must operate reliably and without errors when carrying out transactions as well as to keep your funds safe.

- Functionality. Having access to all necessary tools, including tracking quotes, sending orders, monitoring transactions, charts, etc., is a must.

- Exchange access. Direct trading requires direct access to the exchange. The fewer the intermediaries, the better.

However, one third party is still needed. This is a broker providing access to the trading platform and the exchange. Select one based on the following criteria:

- Choose a trusted broker with a good reputation. Many unfair companies want to cash in on newcomers and embezzle your funds.

- Commission size and software cost. Free of charge software may turn out to be illegal and have operating problems. No commission may indicate hidden fees charged by a company.

- Software quality. Licensed platforms give access directly to the exchange and execute transactions in a matter of seconds. Reliable software does not freeze and performs its functions perfectly.

Most popular types of trading platforms:

- The desktop version boasts the widest functionality. In order to install it on your PC, you need to download a special file first. Platforms are constantly updated and are compatible with almost all Windows versions.

- The web browser version does not require downloading and works directly through a browser. Although it has a higher speed of operation, its functionality is somewhat limited.

- A mobile app is available for iOS and Android. It has limited functionality and is not suitable for full-fledged trading. This version can be used together with the desktop one.

Trading platforms without investing. Options for beginners

Although receiving income from trading without investing may seem surreal, it is actually possible.

There are several ways of trading and making a profit through platforms without investing your own funds.

1. Demo trading as the safest way to learn how to trade

Demo trading means risking virtual funds only, so you do not have to worry about your own. Alas, you will not be able to earn money. The only thing you can get is invaluable trading experience.

With a demo account, you will develop the necessary trading skills and learn how to understand and analyze the market. If your broker offers such an opportunity, do not miss a chance to use it.

2. Affiliate program as a way to make a profit

You receive remuneration for each of your referrals. The terms and the size of a commission differ depending on the type of affiliate partnership:

- Online partnership: you receive a commission from each transaction of a referred trader

- CPA partnership: you get a bonus for each new referral

- Representation: the most advanced level of partnership with bonuses calculated on an individual basis

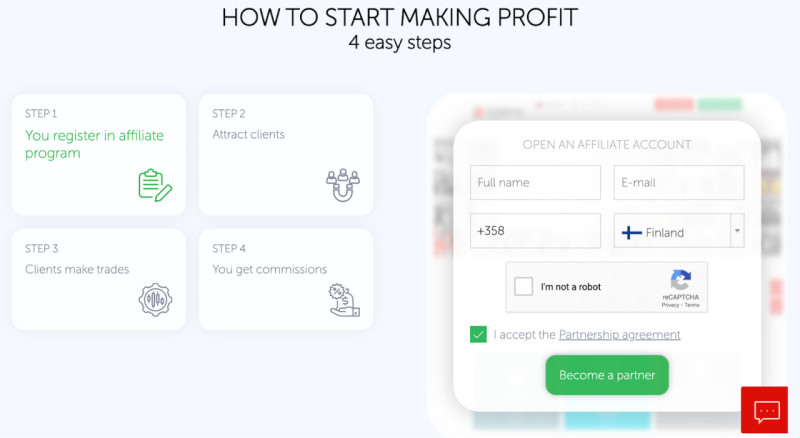

How to register for an affiliate program:

- Register

- Get a personal referral link

- Share your link on social networks, forums, and websites to attract new clients

For additional income, you can cooperate with several brokers.

3. Participating in various contests held by your broker with cash as the main prize

True, these are non-withdrawable funds. However, they can be credited to your account, and you can use them for further trading.

The most popular brokerage firms hold contests on a regular basis: every week or every month. Both demo accounts and cent accounts can take part in these contests.

4. No deposit bonus or welcome bonus. Some brokers reward their clients with a bonus when a trading account is registered.

Thus, you open a live account, and the broker deposits some amount of funds into your account so that you can start trading.

Meanwhile, some brokerage firms require their clients to replenish their accounts with a small amount to receive a welcome bonus.

Bonus funds are non-withdrawable, but you can use them for trading.

If you are required to top up your account before receiving a bonus, make sure the company is honest and reliable as some unfair brokers simply want to embezzle your funds.

MetaTrader 4 for beginners

Although there is an updated and advanced MetaTrader 5 platform, many traders still use MetaTrader 4 (MT4).

Today, MT4 is the most popular software with access to trading stocks, commodities, CFDs, and futures.

The platform also features numerous technical analysis tools, including built-in indicators and charts.

You can trade pending orders and orders with instant execution through MT4 as well. Pending orders are executed when the price reaches the specified limit.

Expert Advisors, robots trading on your behalf, are also available.

For automated trading, you need to map out an efficient strategy, which is important given that all decisions will be made by a robot.

Advantages of MetaTrader 4

- User-friendly interface: even beginner traders will get the hang of it easily

- Multilingual software: the platform runs in almost all languages of the world

- Advanced capabilities in plotting charts, which is especially useful when analyzing the market

- Expert Advisor

- Modern means of communication between the client and the broker make solving problems easier and faster.

- Platform uses up a little of your computer's resources. The computer does not freeze, all operations are performed quickly

- All account information is available with one click of a button

- Heightened security of user data

- Vast choice of trading instruments

- Customized settings to suit your tastes and needs.

Are there platforms other than MetaTrader?

Of course, there are numerous alternatives to MetaTrader, including:

- Ninja Trader. This trading software provides you with opportunities to build cluster charts for analysis. With their help, you can determine market trends more accurately. There are two versions of this trading software: Lite and Pro. Demo trading is also available. The platform has a wider range of analysis tools than MetaTrader 4 and MetaTrader 5.

- Libertex. This trading platform developed by Forex Club offers a vast array of assets for trading. You can trade both on your own and using PAMM accounts.

- cTrader is a platform with its own system of indicators and advisors. This software also has an option of automated trading with cBot and is designed for experienced traders. cTrader is considered one of the best trading platforms.

- Zulu-Trade is commonly used for passive trading by means of investing in managing traders. This software allows users to monitor trades of successful traders. Users note it has not very user-friendly interface.

- SB-Pro is a platform more suitable for analysis. Just like Ninja Trader, it provides opportunities to build cluster charts. In terms of quantity and functionality, it is in no way inferior to more expensive analogs.

- Quantum AI is a platform designed for automated trading. Developers promise up to 60% income on a daily basis.

- Fusion is a platform for stock trading. It has an option of basket trade. You can use this platform even with an average Internet speed and PC specifications.

Some of the platforms are developed by certain brokers. To use them, you need to register an account with them.

Final thoughts

Now, you know what are the main criteria for choosing a trading platform. It should be as user-friendly as possible for you to use.

An efficient trading platform with a vast array of features can elevate your trading activity.

Trading software is used not just for trading. With its help, you will be able to analyze the market, stay updated, receive passive income, and much more.

Read more:

Back to articles

Back to articles