MetaTrader 5 is a universal platform for trading currencies, stocks, commodities, and cryptocurrencies.

You can find more information about MT5 in the article “MetaTrader 5 for dummies”.

Let’s take bitcoin as an example and see how to trade cryptocurrencies

Buy or sell bitcoin? MetaTrader 5 can help

Currency and energy markets largely depend on daily developments worldwide.

The fact that cryptocurrencies do not rely on such a factor is their main advantage. Moreover, digital assets do not have state or central regulation.

The most popular virtual currencies are bitcoin (BTC), ether (ETH), and ripple (XRP). Bitcoin enjoys the greatest demand among them all. The coin appeared in the market first.

BTC trading can be carried out through crypto exchanges, funds, and CFDs.

To trade the coin directly, you must be registered on the exchange and have a digital wallet. However, there are still certain risks of being hacked.

A CFD broker offers intermediate and safe trading, that is, positions are opened based on price forecasts.

Another option would be trading BTC against currencies. For example, US Dollar/Bitcoin (USD/BTC).

It is important that you understand the fact that crypto trading poses certain risks of losing funds.

When entering the market, use technical and fundamental analysis tools. They are available on the MetaTrader platform.

What crypto trading app to choose?

Using modern mobile apps, you can trade anytime, anywhere.

Nowadays, there are enough such apps available for Android and iOS.

Choose an app based on the following requirements:

- Speed. Prices in the crypto market can change in a matter of seconds. Therefore, the app should react to price changes immediately and display the current exchange rates.

- Usability. Users value simple and user-friendly apps. Nobody needs complex functionality.

- Consistency. Users also prize reliability as well as download and data display speed.

- Variety of assets. Having access to a wide range of trading instruments is important.

Here is the list of most popular crypto trading apps:

- Binance: more than 200 crypto assets, suitability for both beginners and savvy traders, effective user data protection

- Coinbase: despite having a smaller number of assets than Binance, the app offers its users better protection of personal data and provides access to training materials for beginners.

- WazirX: one of the most dynamic apps with access to the main digital currencies, instant transaction execution, and a high level of protection of user data and assets.

- Betconix: a stable and high-speed multilingual app with access to the most popular cryptocurrencies, dynamic charts, and other trading tools.

- EXMO: the app saves trading history and tracks past price fluctuations. It has a live chat for users to communicate. The app runs in Russian and English only, which is its main disadvantage. At the same time, it has strong technical support.

Best platform for crypto trading

The following criteria should be considered when choosing a platform for crypto trading:

- Popularity. The more users trust the platform, the better.

- Regulation. Licensing by a state regulatory body shows the exchange’s serious intentions.

- Reputation. It's better to know about scandals, information leaks, or hacker attacks in advance

- High trading volumes

- User-friendly interface

- Extended operation period

- Trader identity verification

- Mobile app available

- Impeccable technical support

- Wide range of trading instruments

- Commissions on deposits/withdrawals

Platforms also have options other than trading cryptocurrencies.

Staking is a way of passively increasing income by storing coins on the exchange. Trading platforms also provide landing and saving possibilities.

Tokenized stock trading is now available on some exchanges. Such stocks include Apple, Tesla, Facebook, etc.

Here is the list of trading platforms proven to be the best in the market:

- Binance: one of the most popular platforms with a user-friendly interface and a great number of options, including staking, as well as spot, futures, currency trading, and so on.

- Currency.com: a trading platform licensed in Belarus with over 1,500 trading assets and low commissions. Deposits/withdrawals are available with bank cards. It is considered one of the best platforms in the CIS.

- OKEx: a platform for spot and futures trading, with internal transfers and comprehensive account protection.

- AVAtrade: a platform licensed by six regulatory bodies at once, with a turnover of more than $60 billion dollars, a wide choice of crypto assets, and privileges for EU residents.

- Capital: a platform with a vast array of CFDs and no commissions for cryptocurrency trades. It is regulated by the CySEC and the FCA. The platform is suitable for beginner traders with small capital.

Best indicators for cryptocurrency trading

Understanding developments in the market is the key to success in trading crypto. For such purposes, traders turn to technical and fundamental analyses.

Fundamental and technical indicators correlate with each other, though they have different effects on the market.

News can have an impact on fundamental indicators. Technical indicators reflect the correlation between the demand and price of cryptocurrencies.

Factors for crypto analysis are universal. They are based on mathematical methods for calculating readings on all trading floors. The input is either the value of an asset or the trading volume.

There are several crypto market features:

- high volatility: prices can change in a matter of seconds

- price gap patterns

Not all indicators are suitable for analyzing crypto.

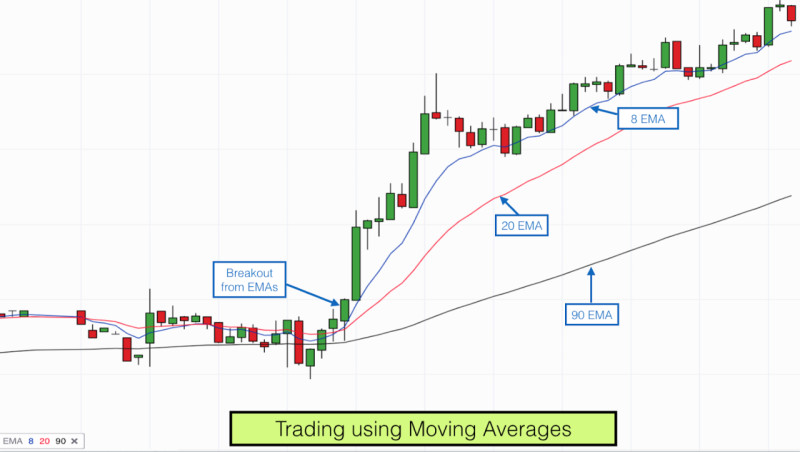

Support and resistance, Moving Averages, Oscillators, Ichimoku Cloud, and trading volumes help traders analyze the crypto market more effectively than other tools.

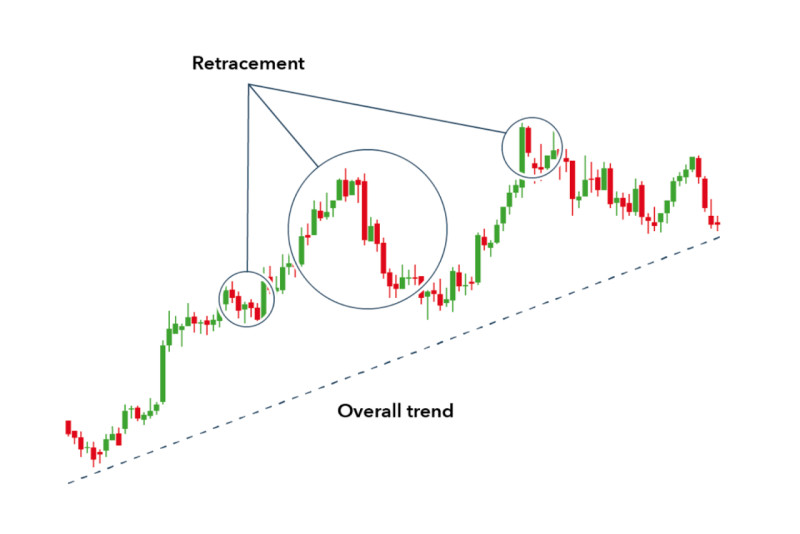

- Support and resistance (key levels) are basic tools all traders must know how to use. Support refers to a level that the price has difficulty falling below. Resistance reflects a level that the price has difficulty rising above.

- Moving Averages are perhaps the most commonly used indicators. They determine an average price of an asset over a specific period of time. To do this accurately, the strength of a trend should be taken into account. The indicator is also used to find support and resistance.

- Oscillators show price deviation from the average value. They help determine a trend when the price movement is unclear. Sometimes, however, they can make inaccurate signals. Therefore, they should be used in combination with the two above-mentioned indicators.

- Ichimoku Cloud is a moving-average-based indicator. Clouds – zones indicating an uptrend or a downtrend – are formed between the MAs on the chart.

- Trading volumes. The higher the indicator, the more actively an asset trades over a specific period of time. The indicator does not reflect a complete picture of the market. It must be compared with the chart to understand the situation better.

Not sure if crypto trading is right for you? Try demo crypto trading first

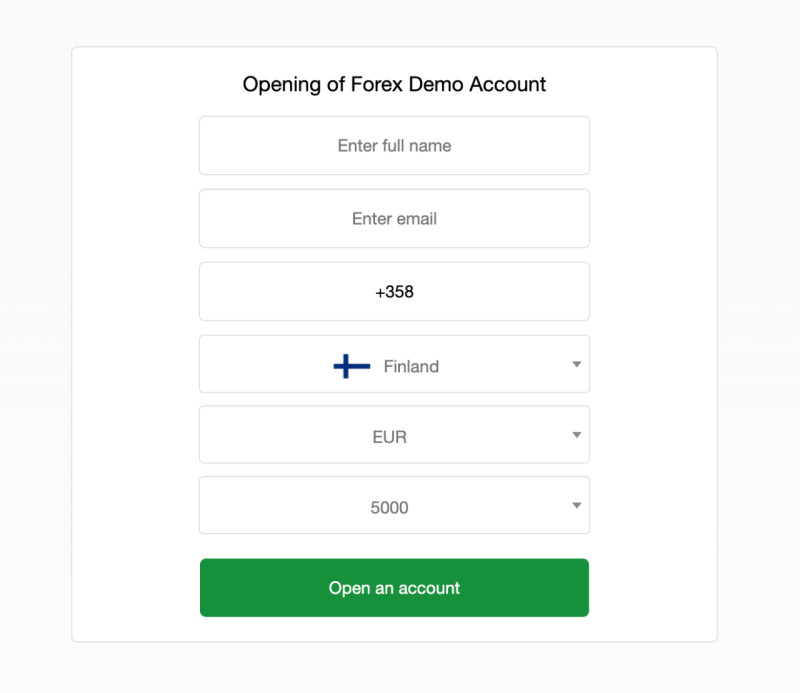

A demo account is a way of trading crypto without actually losing funds. Demo trading is practiced with virtual money. Therefore, your wallet is safe.

This is both an advantage and a disadvantage of a demo account. The good thing is that a trader can learn to trade without risking their own savings. The downside is that demo trading resembles a computer game. It is definitely not an online trading simulator.

Demo trading should be taken seriously as it can cause addiction to excessive and unjustified risks.

A demo account can be useful for both beginners and professionals. It can help test a new strategy or try out a new instrument.

Novice traders should begin with a demo account but take it as a live one. Moreover, it is important that they trade the exact amounts they have in live accounts.

On a demo account, you need to make mistakes in order to fully understand all possible risks and develop a certain trading algorithm that can later be used with real money.

When switching from a demo account to a live one, you should work with small amounts at first. This way, of course, you will not be able to earn much but will not lose much as well.

Your primary goal is to double your deposit. After reaching the goal, you can place higher bets.

How to start trading bitcoin?

Catch up on theory: read related materials and listen to recorded lectures or webinars. Experienced traders often develop their own trading courses.

Study the basics of fundamental and technical analysis. This will help you understand developments in the crypto market and foresee them.

Learn about various strategies of market behavior. For example, an averaging strategy involves dividing the total amount to be invested.

Here is what traders should and should not do:

- Control emotions and make cool-headed decision

- Be careful with buy/sell signals from Telegram and social networks

- Don't trade based on the news. If there is an event affecting bitcoin, most likely, it has already happened.

- Don't be greedy. If BTC is on the rise, it is better to sell some of the coins and place a stop-loss order. A stop-loss order is an order to sell bitcoins at a certain price.

- Don't use trust management. If you do, sign a notarized trust management contract.

- Don’t trade with your last or borrowed funds. It should be your money that you can afford to lose in case of failure.

- Never stop improving your skills. Record all your trades for later analysis.

- Admit losses and close trades you are unsure of.

How to choose the best trading strategy?

The right trading strategy will help minimize risks from crypto trading.

Markets are cyclical: a fall in price is followed by an increase, and so on. However, it is quite difficult to buy an asset at the lowest price.

A trading strategy is a way to find the most favorable moment to buy or sell an asset.

Averaging is the simplest and most commonly used strategy. Since it has already been discussed in this article, let's see other trading algorithms.

Scalping is the opposite of averaging. This strategy involves a large number of short-term trades and is suitable for experienced traders. Its main disadvantages are high risks and high commissions.

There is also the price level trading strategy, which is based on support and resistance. These are price zones where the price can either rise or fall. With this trading tactic, you can also focus on forecasts.

Trend trading is a strategy for beginners. Before employing this strategy, the price direction – upward or downward– should be determined. When the price moves steadily up, you buy, and when it falls, you sell.

The buy-and-hold strategy is more like an investment. Hodlers purchase crypto at a low price and wait for the price to rise.

There are even more trading strategies. Each trader can choose one based on their needs and trading skills.

5 steps to start trading crypto with MetaTrader 5

1. The first and most important step is to choose a reliable broker.

When picking a broker, pay attention to:

- regulation and license

- experience

- commissions and spreads

- leverage

- depositing and withdrawal options

- quality of technical support

2. Open a trading account

If a broker offers demo trading, take advantage of it and then switch to a live account.

3. Use a trading account

Download MetaTrader 5 and log in to your account. Select the size of leverage.

Pick a cryptocurrency and top up your account with the required amount of fiat money.

Use technical analysis tools when trading.

4. Open positions

After the analysis, check spreads for different types of crypto CFDs. Decide which position you want to open: long or short.

Do not forget about risk management. Use a stop-loss order if necessary.

Make sure that the account balance does not fall below the required margin. Otherwise, you will receive a margin call to replenish your account.

Use MetaTrader 5 Expert Advisors. You can also customize the search options for new offers.

5. Monitor trades

Follow the news that may affect the cryptocurrency value.

Trade various assets and develop your own trading strategies.

Final thoughts

This article covers how to trade BTC with MetaTrader 5.

It is important to test trading skills on a demo account before proceeding with a live one. It can help minimize the risks of losing funds.

Go through the theory and tools of technical and functional analysis. This will help choose a trading strategy or develop your own.

Work with a trusted broker. Choose reliable trading platforms based on the criteria disclosed in this article.

Remember that when you start trading crypto, you can both gain and lose a lot of money. However, if you are willing to take the risk, good luck!

Read more:

Back to articles

Back to articles