Ripple (XRP) is a cryptocurrency of the Ripple start-up, which currently occupies a place of honor at the top of the most capitalized digital coins. On the Internet, you can easily find a variety of offers to sell and buy this asset and any other cryptocurrency. The list of them today is impressive. However, one should always keep in mind that many of the existing methods can be simply unprofitable.

In addition, not all cryptocurrency exchanges have the functionality that allows you to buy XRP for Russian rubles. So that you do not spend a lot of time searching for suitable options for all occasions, we have done it for you. In this article, you will learn about the most popular ways to buy the digital asset, Ripple.

History of Ripple's creation and development

The path of the Ripple project can be called thorny, as it is developing against the background of litigation with the SEC (the United States Securities and Exchange Commission). These proceedings have been going on for several years, and, most likely, they will not end soon.

Interestingly, this difficult situation has not prevented the company from entering the top 100 ranking of the world's largest crypto data provider, CoinMarketCap, and even reaching a capitalization of several billion dollars.

Ripple (XRP) is both a digital coin and a payment system that is based on blockchain. This cryptocurrency resembles bitcoin by many criteria, although it does not compete with it. At least, this is what its developers assure us.

Ripple operates on distributed ledger technology, thanks to which users are able to make transactions between countries much faster and, most importantly, more reliably.

Ripple is a payment system with instant transactions, which usually take 3 seconds, and even the lowest commission.

The idea of creating such a system was proposed by Ryan Fuger. He developed it back in 2004, and even then, he gave it a name - RipplePay. Fuger dreamed of creating a decentralized system that would allow users to exchange assets directly, bypassing banks.

In 2012, Chris Larsen and Jed McCaleb joined Fuger. Together, they managed to create a new payment system based on blockchain technology that would enable the fastest and cheapest transfers of money between people and companies from anywhere in the world.

However, this project was documented only in 2013, when it received its official name, Ripple Labs. The Ripple payment system is considered the main development of this company.

Then, the first version of the Ripple protocol (XRP) was launched. It gave people the opportunity to make transfers of funds in any currency.

In 2014, Ripple already cooperated with major banks, such as Santander and UBS, which began to use the Ripple payment system for international transfers.

In 2015, Ripple launched a new version of the protocol, after which the payment system was used to exchange not only currencies but also any assets.

Ripple has developed so much that today it is one of the most innovative projects in the field of financial technology. This system makes life easier for millions of people and companies around the world, as it enables them to make fast, cheap, and, most importantly, secure transfers of assets around the globe.

However, before wondering how to buy Ripple, it is worth considering several issues that could cast a gloomy light on the entire story. Thus, Ripple has been developing for several years amid the ongoing litigation with the SEC. It is still unknown how the situation will end. However, there is no doubt that it will have a strong impact on both the project and the entire cryptocurrency industry.

The court case between Ripple and the SEC began in December 2020. Then, the US Securities and Exchange Commission filed a lawsuit against Ripple. The reason was that XRP (i.e., the company's native token) was sold as a security without registration with the SEC.

The complaint alleges that Ripple raised funds, beginning in 2013, through selling digital assets known as XRP in an unregistered securities offering to investors. Ripple allegedly raised over $1.3 billion in 2013 and $600 million in 2017.

The company began to deny all of the allegations made against it. Ripple began to claim that the XRP cryptocurrency was not a security in any way but solely a digital currency, just like Bitcoin and Ethereum.

According to the company's executives, the SEC has no reason to make demands or try to regulate it in any way.

Ripple said that the SEC itself provoked such a situation, as it did not warn about its positions on the XRP cryptocurrency for several years, although the company had been actively selling it all this time.

The legal battle lasted throughout 2021. In March 2021, the company managed to win the first phase of the litigation. The court decided that the digital currency XRP was indeed not a security. However, the SEC appealed, and the court resumed trial.

The litigation is still in process, and no assumptions can be made about the court's decision. This situation shows that any cryptocurrency has a good chance of falling under SEC regulation.

Key project investors

Although Ripple's legal proceedings continue to this day, the community around this project is growing. Almost all fans of cryptocurrencies are divided into two large groups.

Some are confident that the Ripple cryptocurrency will eventually be recognized as a security, and the company itself and the payment system will be regulated by the US government. If this really happens, the future prospects of the XRP token and the project itself will be gloomy as there will be decentralization. It is clear that this category of people is in no hurry to accumulate XRP tokens.

Another camp of crypto-enthusiasts does not support this version. They suppose that Ripple will definitely win the court, after which the native token of the project will begin to actively grow in value. It is clear that this group will continue to buy the project's cryptocurrency.

In any case, only time will show who was right. Today, however, the list of the company’s investors is impressive.

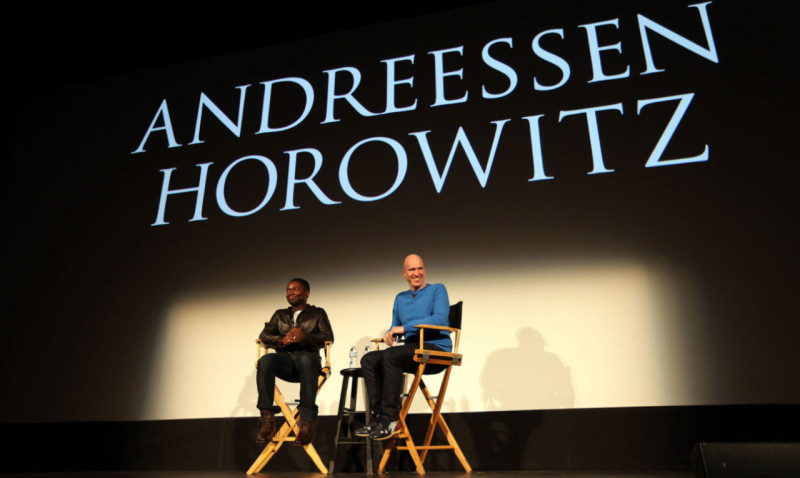

For example, Andreessen Horowitz is influential and one of the most successful venture funds in the United States. It invested a significant $25 million in the Ripple project in 2013. It also put its money in Airbnb, Facebook, and Instagram.

One more venture fund that supported Ripple at the start of its existence is Google Ventures. This fund was created by Google and is designed to invest exclusively in the most promising start-ups. Google Ventures invested an impressive amount of $10.5 million in Ripple.

A huge amount of money was invested in Ripple by the IDG Capital Partners venture fund. The fund, which puts money money in technology companies in China and the US, allocated $20 million in 2015.

The Santander InnoVentures Fund invested $4 million in Ripple in 2015.

The UK's Standard Chartered invested $5 million in the company in 2016. The bank then invested money in start-ups that dealt exclusively with blockchain projects and cryptocurrencies.

In addition to this authoritative list of the world's largest investment funds, Ripple has also received funds from such major financial institutions as Accenture, CME Group, SBI Holdings, and some others.

Apparently, the idea of the Ripple project turned out to be very attractive to the largest players in the financial sector, since they decided to invest millions of dollars in it.

XRP cryptocurrency

XRP is a native Ripple coin. It fulfills the classic functions of money to a greater extent than other digital coins.

- It is used as a crypto to exchange for other cryptocurrencies with fast transaction speeds and minimal costs.

- It is used as a means of payment. Assets can be bought and sold with XRP.

Such an active use of the digital coin as a means of payment suggests that it can be used as a means of savings.

Today, many organizations are looking to acquire the functionality of the XRP cryptocurrency, thus boosting the price of the token. In this light, many users are searching for ways to buy XRP.

Thus, the services of the Ripple platform are now used by many banks and investment organizations, including Bank of America and the largest financial and credit group, Santander.

The market capitalization of the Ripple coin today is expressed in billions of dollars. An impressive part of the assets belongs to the company Ripple Labs. It owns more than 60% of all existing tokens. This makes it possible to avoid an uncontrolled jump in the currency and its sharp depreciation.

You can purchase XRP on exchanges and trading platforms. To make a transfer, you need to enter the user's address and the destination tag that will be generated in the crypto wallet. It is possible to store coins and perform operations with XRP on many crypto wallets.

XRP is also a unit of account in the RippleNet interbank payment communication system. Actually, it is developed by the company Ripple. By the way, steaking for XRP is not carried out.

The price of Ripple coins for individual investors is determined by crypto exchanges in the process of trading.

Project’s tokenomics

Ripple has its own features that are related to tokenomics and the use of the XRP cryptocurrency.

The first feature is issuance. A considerable number of XRP tokens have been issued, namely 100 billion. For comparison, the number of issued bitcoins is just 21 million.

The second feature is the token distribution scheme. 80 billion coins are divided between the founders—that is, between Ripple and its partners. The other 20 billion units are placed in a certain account. They are needed for the development of the project.

The third feature of the project's ecosystem is the XRP tokens themselves. They are used to exchange currencies, tokens, and tangible assets, and they can be transferred directly on the platform.

Ripple assures that when using XRP tokens, the cost of transfers will be reduced by 30% or even 60% compared to traditional payment methods.

Ripple is constantly working to expand its ecosystem. This is done despite the difficulties in the company, which have arisen due to litigation with the SEC. The company continues its active development thanks to cooperation with both large banking organizations and various financial institutions.

Advantages and disadvantages of Ripple

The Ripple project has its pros and cons. The undeniable advantage is fast and inexpensive international transfers. The Ripple payment system is organized in such a way that the transfer of money between different countries is very fast and rather cheap.

The second advantage is multi-currency wallets. Anyone can store several different currencies in one electronic wallet, which is very convenient for international payments.

The next positive feature of the system is the security of the network. This security is ensured by the Ripple consensus protocol, as it prevents the possibility of DDoS attacks.

In addition to all this, the Ripple payment system is supported by large financial institutions, as the company works closely with many large banks.

Today, more than 300 large financial organizations around the world use the Ripple network to improve their operations, including various state-owned banks and large corporations.

No other cryptocurrency can boast such a feature. Probably, that is why it has so many admirers and those who are confident in its cloudless future.

However, regardless of all these obvious advantages, Ripple also has many disadvantages.

Centralization is the first of them. The Ripple Labs company controls a huge number of XRP tokens, which causes doubts in the crypto community. In general, the main idea of the cryptocurrency world is to get away from centralization, any regulation, and control.

The limited decentralization of the payment system is undoubtedly discouraging. The project itself is not fully decentralized, which means it is not suitable for those users who are looking for a platform that guarantees complete anonymity and full control over their finances. Ripple certainly cannot boast of this.

Another disadvantage is, of course, the ongoing litigation. Ripple has many fans who believe in its growth in the future. However, due to the long process of investigation and verification, many people do not believe in this project and do not see its future.

It is clear that the long-term existence of the project and the successful conduct of business amid such a long trial are very doubtful. Although Ripple manages to stay afloat and show signs of some growth, it is impossible to predict how long it will be able to do so.

Where and how to buy Ripple?

Ripple is an alternative to existing interbank transaction systems, like SWIFT. Therefore, it is not surprising that its cryptocurrency is in such great demand, even despite the company's existing disagreements with the US Securities and Exchange Commission.

The crypto community is betting that Ripple Labs' disagreement with the SEC will be finally resolved. Amid the existing pressure from the Commission, the XRP cryptocurrency has so far failed to update the all-time high in the growth cycle amid bitcoin's halving in 2020.

If the conflict between the two parties is finally resolved, it will definitely be the starting point for the XRP price to soar. This anticipated growth, according to the beliefs of many analysts, should compensate for all previous failures.

Ripple is one of the most promising blockchain projects, and its token is definitely worth taking a closer look at. Notably, its price is currently quite low. As of January 16, 2024, the XRP/USD pair was trading at 0.57590.

Now let's find out where and how to buy Ripple.

First of all, you need to decide where to store digital coins. To save money, you need to think up and write down a personal password on any information carrier. A good solution is to duplicate this password on paper and keep it in a safe place.

This personal key is the owner's access to his/her assets, which are saved on electronic wallets.

Hardware wallets are the best way to keep cryptocurrencies safe. The Ledger Nano S, which has long supported XRP, is a good example of such a wallet.

Once the user decides where to store coins, it is necessary to decide where to buy XRP profitably. There are several ways to do this:

- crypto exchanges

- crypto exchange platforms

- cryptomats

- Telegram bots

- payment systems (AdvCash, Payeer, etc.).

The most suitable exchanges for buying XRP are ByBit and Binance. ByBit is favorable because it has a minimum deposit and low commissions. Binance is suitable for this purpose as it offers low Ripple withdrawal fees and does not limit its clients to the minimum deposit.

If we are talking about Russia, after the sanctions were imposed in 2022, the only way to purchase XRP on its territory is through P2P.

Today, there are many crypto exchanges with P2P platforms for Russian-speaking users. The most popular of them is the Bybit exchange. To buy XRP there, you need to register, pass verification, and, in fact, proceed to the purchase itself.

How is the purchase of digital coins on a crypto exchange carried out? First, you should register on the platform and create your trading account. To do this, the exchange usually asks for an email address, a phone number, and a password.

The next step is verification. KYC verification is always mandatory. It is impossible to access the services of the crypto exchange without it.

After the account registration has passed, the user needs to confirm his/her identity. To do this, it is necessary to:

- pass basic verification. The user must provide the exchange with an identity document and go through the facial recognition procedure.

- pass the extended verification. It is not mandatory but gives more trading opportunities. At this stage, the exchange, as a rule, requests additional documents that should confirm the exact address of the user's residence.

After verification, the user can top up an account with cryptocurrencies or fiat money (euros, dollars, rubles).

It is worth considering that when depositing funds in cryptocurrency, no commission fee will be charged. If the user decides to deposit fiat funds into the account, the exchange is likely to withhold a certain amount. However, the size of this commission will depend on the currency being deposited and the method of payment.

The next stage is buying the Ripple cryptocurrency on the exchange. In order to purchase XRP on the spot market, the user needs to select the "Trade" column in their personal account and then click "Spot." After that, on the trading platform, one should find the needed pair, for example, XRP/USDC.

In addition to the mentioned ByBit and Binance, you can pay attention to other crypto exchanges. The most popular of them are the following:

- Huobi

- BingX

- Gate.io

- OKX (but it should be taken into account that the exchange has completely disabled P2P trading in rubles).

- KuCoin

- MEXC

- Bitget

- Poloniex

- Bitfinex

The scheme of buying a digital coin through crypto exchanges may not seem the most convenient or the easiest to many people. For such users who want to buy XRP quickly and easily, there are crypto exchange platforms. Fortunately, they have much simpler registration requirements. Moreover, by using many of them, you can perform transactions anonymously.

However, it should be taken into account that such platforms have noticeably fewer trading tools, as they are designed for the simple exchange of coins. In addition, they are less secure than crypto exchanges and their P2P platforms.

To buy XRP, you can also use alternative options. For example, cryptomats, where you can buy cryptocurrency for rubles. However, they often charge customers an excessive commission. In addition, many cryptomats cannot withdraw a large amount of money, as they have limits on the amount of withdrawal.

XRP can also be purchased by hand. It is clear that this is the most unsafe way out of all of them. It should be used only if there are guarantees that the funds will not be lost.

Another alternative way to buy XRP is through Telegram bots. There are many crypto wallets and various automated bots in the social network, through which you can realize the exchange and purchase of crypto coins. For example, @Prostocash_bot or @Bot_60sec_bot.

The user just needs to write the name of the desired bot in the search bar and then launch it. So, the @Prostocash_bot will first offer the user an exchange and then ask them to select the desired cryptocurrency. It will ask you to select the currency to sell and, later, the one to buy.

In the same way, you can buy XRP coins for money from an e-wallet or bank card. Everything is simple enough. The main thing is not to fall for fraudulent bots. And for this purpose, it is necessary to use only those bots that have already gained high popularity among users and, therefore, have proved to be reliable.

Bots are good because they provide the user with complete anonymity, but their functionality is simple and intuitive.

There are also bots that can replace e-wallets, which is very convenient as you do not have to buy extra options but just use Telegram messenger.

These are not all the ways to buy Ripple. For example, you can also buy the coin through payment systems such as AdvCash and Payeer. If the user has a trading account in such a system, there is no need to register somewhere or search for a suitable exchanger.

Payeer is good as it has a built-in cryptocurrency exchange, through which you can directly exchange XRP tokens or exchange fiat currency for XRP.0

Payeer combines the functions of a payment system and an exchange, which allows users to transfer their funds into the desired currency very quickly. This payment system works with Russian banks.

Of all the ways to buy XRP cryptocurrency that exist today, crypto exchanges are the safest and perhaps the most reliable. As a rule, they have the most favorable exchange rate and the highest level of fund protection. You should choose an exchange that has already established itself in the market for such services.

Ripple and its cryptocurrency can boast a steady increase in popularity, which means that the XRP asset is a promising instrument for long-term investment. The high liquidity of this cryptocurrency makes it easy to exchange it for any other asset. Thanks to the sudden intraday rate hikes, investors can earn on price changes in a short period of time.

Back to articles

Back to articles